Optmization of Treasury

This book is dedicated to companies and students that wish to know about how to optimize treasury and Cash-Management.

This book is dedicated to companies and students that wish to know about how to optimize treasury and Cash-Management.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

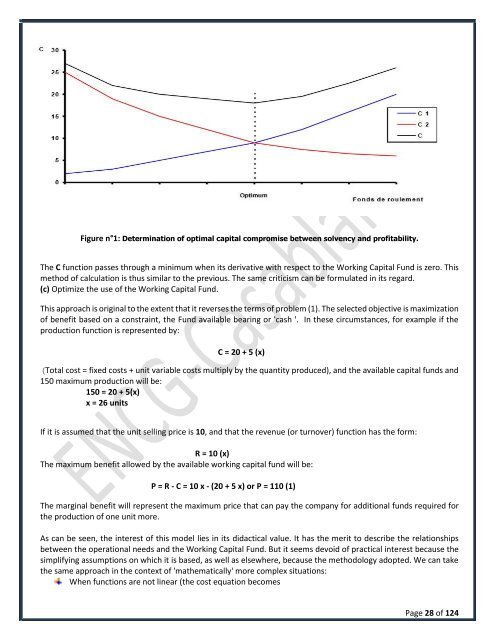

Figure n°1: Determination <strong>of</strong> optimal capital compromise between solvency and pr<strong>of</strong>itability.<br />

The C function passes through a minimum when its derivative with respect to the Working Capital Fund is zero. This<br />

method <strong>of</strong> calculation is thus similar to the previous. The same criticism can be formulated in its regard.<br />

(c) Optimize the use <strong>of</strong> the Working Capital Fund.<br />

This approach is original to the extent that it reverses the terms <strong>of</strong> problem (1). The selected objective is maximization<br />

<strong>of</strong> benefit based on a constraint, the Fund available bearing or 'cash '. In these circumstances, for example if the<br />

production function is represented by:<br />

C = 20 + 5 (x)<br />

(Total cost = fixed costs + unit variable costs multiply by the quantity produced), and the available capital funds and<br />

150 maximum production will be:<br />

150 = 20 + 5(x)<br />

x = 26 units<br />

If it is assumed that the unit selling price is 10, and that the revenue (or turnover) function has the form:<br />

R = 10 (x)<br />

The maximum benefit allowed by the available working capital fund will be:<br />

P = R - C = 10 x - (20 + 5 x) or P = 110 (1)<br />

The marginal benefit will represent the maximum price that can pay the company for additional funds required for<br />

the production <strong>of</strong> one unit more.<br />

As can be seen, the interest <strong>of</strong> this model lies in its didactical value. It has the merit to describe the relationships<br />

between the operational needs and the Working Capital Fund. But it seems devoid <strong>of</strong> practical interest because the<br />

simplifying assumptions on which it is based, as well as elsewhere, because the methodology adopted. We can take<br />

the same approach in the context <strong>of</strong> 'mathematically' more complex situations:<br />

When functions are not linear (the cost equation becomes<br />

Page 28 <strong>of</strong> 124