Optmization of Treasury

This book is dedicated to companies and students that wish to know about how to optimize treasury and Cash-Management.

This book is dedicated to companies and students that wish to know about how to optimize treasury and Cash-Management.

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

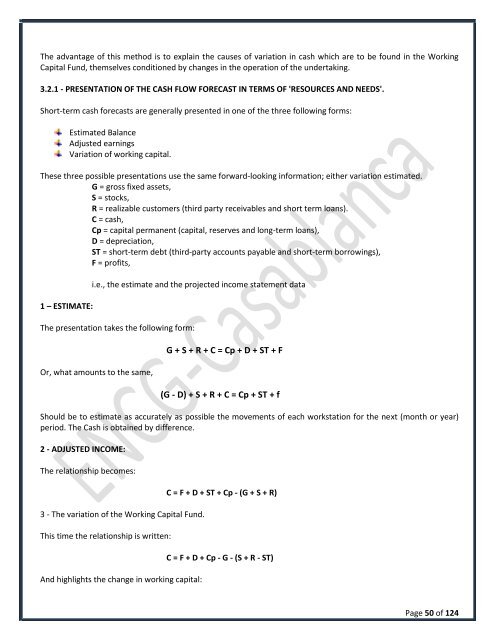

The advantage <strong>of</strong> this method is to explain the causes <strong>of</strong> variation in cash which are to be found in the Working<br />

Capital Fund, themselves conditioned by changes in the operation <strong>of</strong> the undertaking.<br />

3.2.1 - PRESENTATION OF THE CASH FLOW FORECAST IN TERMS OF 'RESOURCES AND NEEDS'.<br />

Short-term cash forecasts are generally presented in one <strong>of</strong> the three following forms:<br />

Estimated Balance<br />

Adjusted earnings<br />

Variation <strong>of</strong> working capital.<br />

These three possible presentations use the same forward-looking information; either variation estimated.<br />

G = gross fixed assets,<br />

S = stocks,<br />

R = realizable customers (third party receivables and short term loans).<br />

C = cash,<br />

Cp = capital permanent (capital, reserves and long-term loans),<br />

D = depreciation,<br />

ST = short-term debt (third-party accounts payable and short-term borrowings),<br />

F = pr<strong>of</strong>its,<br />

1 – ESTIMATE:<br />

i.e., the estimate and the projected income statement data<br />

The presentation takes the following form:<br />

Or, what amounts to the same,<br />

G + S + R + C = Cp + D + ST + F<br />

(G - D) + S + R + C = Cp + ST + f<br />

Should be to estimate as accurately as possible the movements <strong>of</strong> each workstation for the next (month or year)<br />

period. The Cash is obtained by difference.<br />

2 - ADJUSTED INCOME:<br />

The relationship becomes:<br />

3 - The variation <strong>of</strong> the Working Capital Fund.<br />

This time the relationship is written:<br />

And highlights the change in working capital:<br />

C = F + D + ST + Cp - (G + S + R)<br />

C = F + D + Cp - G - (S + R - ST)<br />

Page 50 <strong>of</strong> 124