June 2016

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Money matters<br />

Advertorial<br />

If you run a small business and<br />

wonder whether you should be VAT<br />

registered, Alan Patient can help<br />

In my last article I covered<br />

some of the basics of starting<br />

up in business. This time I will<br />

try to clarify VAT issues.<br />

In particular, the question<br />

I'm often asked is “is VAT<br />

registration necessary?” Well, if<br />

your annual turnover is below<br />

£83,000, VAT registration is not<br />

necessary, although voluntary<br />

registration is possible below<br />

that figure. This would enable<br />

you to recover the VAT you pay<br />

on many of your overheads,<br />

such as equipment and<br />

stationery costs, for example.<br />

However, you must weigh<br />

up the benefits of voluntary<br />

registration – if most of your<br />

clients are likely to be members<br />

of the public, you will effectively<br />

be adding 20% to the cost<br />

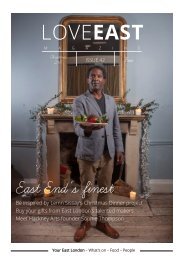

Some of the team: Chris James, Svitlana<br />

Matviychuk and Alan Patient (right)<br />

of your services – and your<br />

competitors will then be able to<br />

undercut you without too many<br />

problems.<br />

If you do become VAT registered<br />

it is usually worthwhile applying<br />

to use the VAT flat-rate scheme.<br />

This means that you charge<br />

and collect VAT at the standard<br />

rate of 20% and pay it to the<br />

Government at a lower rate –<br />

typically 13% – so in this case<br />

you make a “profit” on VAT –<br />

and all thanks to the Chancellor.<br />

Another tip: I would strongly<br />

advise opening up a separate<br />

bank account for the business.<br />

You will then see clearly<br />

the business income and<br />

expenditure without it being<br />

mixed up with supermarket<br />

bills and the like. Also you<br />

really need to be able to<br />

reconcile your bank account,<br />

at first probably to your<br />

business spreadsheets and<br />

possibly later to a cloud-based<br />

software package.<br />

There is a lot to get to grips with<br />

when you start up in business,<br />

but always remember – Alan<br />

Sugar and Richard Branson<br />

would have scratched their<br />

heads in confusion at first –<br />

and they certainly did all right.<br />

If you want to talk in more<br />

detail about this or any other<br />

accountancy matter, please<br />

do come to see us. Our first<br />

consultation is free.<br />

Next month<br />

How to use social media to drive<br />

your business forward.<br />

Alan Patient & Co<br />

9 The Shrubberies<br />

George Lane<br />

South Woodford<br />

E18 1BD<br />

020 8532 9843<br />

alanpatient.com<br />

LOVEEAST JUNE <strong>2016</strong> 37