technologies

mic6301ZqIz

mic6301ZqIz

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

2016<br />

21 st ANNUAL REPORT<br />

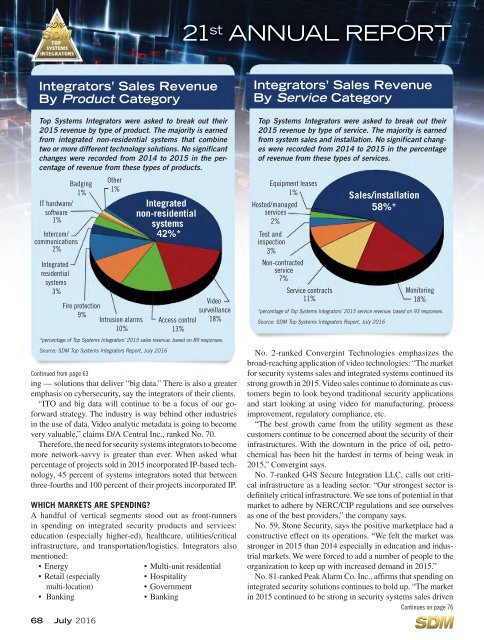

Integrators’ Sales Revenue<br />

By Product Category<br />

Top Systems Integrators were asked to break out their<br />

2015 revenue by type of product. The majority is earned<br />

from integrated non-residential systems that combine<br />

two or more different technology solutions. No significant<br />

changes were recorded from 2014 to 2015 in the percentage<br />

of revenue from these types of products.<br />

Badging<br />

1%<br />

IT hardware/<br />

software<br />

1%<br />

Intercom/<br />

communications<br />

2%<br />

Integrated<br />

residential<br />

systems<br />

3%<br />

Continued from page 63<br />

ing — solutions that deliver “big data.” There is also a greater<br />

emphasis on cybersecurity, say the integrators of their clients.<br />

“ITO and big data will continue to be a focus of our goforward<br />

strategy. The industry is way behind other industries<br />

in the use of data. Video analytic metadata is going to become<br />

very valuable,” claims D/A Central Inc., ranked No. 70.<br />

Therefore, the need for security systems integrators to become<br />

more network-savvy is greater than ever. When asked what<br />

percentage of projects sold in 2015 incorporated IP-based technology,<br />

45 percent of systems integrators noted that between<br />

three-fourths and 100 percent of their projects incorporated IP.<br />

WHICH MARKETS ARE SPENDING?<br />

A handful of vertical segments stood out as front-runners<br />

in spending on integrated security products and services:<br />

education (especially higher-ed), healthcare, utilities/critical<br />

infrastructure, and transportation/logistics. Integrators also<br />

mentioned:<br />

• Energy<br />

• Retail (especially<br />

multi-location)<br />

• Banking<br />

68 July 2016<br />

Other<br />

1%<br />

Fire protection<br />

9%<br />

Intrusion alarms<br />

10%<br />

Integrated<br />

non-residential<br />

systems<br />

42%*<br />

Video<br />

surveillance<br />

18%<br />

Access control<br />

13%<br />

*percentage of Top Systems Integrators’ 2015 sales revenue; based on 89 responses.<br />

Source: SDM Top Systems Integrators Report, July 2016<br />

• Multi-unit residential<br />

• Hospitality<br />

• Government<br />

• Banking<br />

Integrators’ Sales Revenue<br />

By Service Category<br />

Top Systems Integrators were asked to break out their<br />

2015 revenue by type of service. The majority is earned<br />

from system sales and installation. No significant changes<br />

were recorded from 2014 to 2015 in the percentage<br />

of revenue from these types of services.<br />

Equipment leases<br />

1%<br />

Sales/installation<br />

58%*<br />

Hosted/managed<br />

services<br />

2%<br />

Test and<br />

inspection<br />

3%<br />

Non-contracted<br />

service<br />

7%<br />

Service contracts<br />

11%<br />

*percentage of Top Systems Integrators’ 2015 service revenue; based on 93 responses.<br />

Source: SDM Top Systems Integrators Report, July 2016<br />

Monitoring<br />

18%<br />

No. 2-ranked Convergint Technologies emphasizes the<br />

broad-reaching application of video <strong>technologies</strong>: “The market<br />

for security systems sales and integrated systems continued its<br />

strong growth in 2015. Video sales continue to dominate as customers<br />

begin to look beyond traditional security applications<br />

and start looking at using video for manufacturing, process<br />

improvement, regulatory compliance, etc.<br />

“The best growth came from the utility segment as these<br />

customers continue to be concerned about the security of their<br />

infrastructures. With the downturn in the price of oil, petrochemical<br />

has been hit the hardest in terms of being weak in<br />

2015,” Convergint says.<br />

No. 7-ranked G4S Secure Integration LLC, calls out critical<br />

infrastructure as a leading sector. “Our strongest sector is<br />

definitely critical infrastructure. We see tons of potential in that<br />

market to adhere by NERC/CIP regulations and see ourselves<br />

as one of the best providers,” the company says.<br />

No. 59, Stone Security, says the positive marketplace had a<br />

constructive effect on its operations. “We felt the market was<br />

stronger in 2015 than 2014 especially in education and industrial<br />

markets. We were forced to add a number of people to the<br />

organization to keep up with increased demand in 2015.”<br />

No. 81-ranked Peak Alarm Co. Inc., affirms that spending on<br />

integrated security solutions continues to hold up. “The market<br />

in 2015 continued to be strong in security systems sales driven<br />

Continues on page 76