course

ey-africa-attractiveness-program-2016-staying-the-course

ey-africa-attractiveness-program-2016-staying-the-course

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

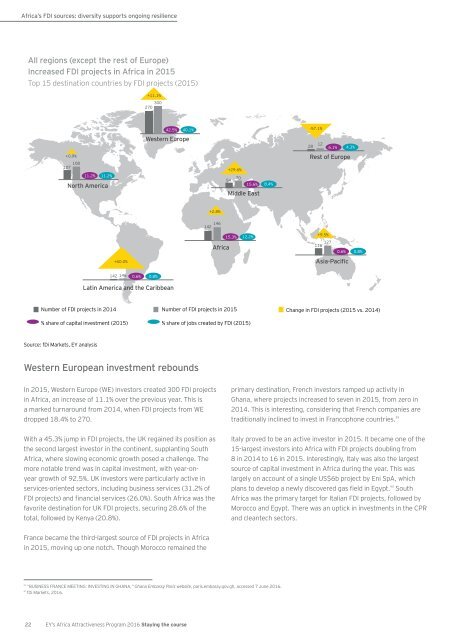

Top 15 destination countries by FDI projects (2015)<br />

+11.1%<br />

300<br />

270<br />

42.5% 40.1%<br />

-57.1%<br />

<br />

28 12 6.1% 4.3%<br />

+0.9%<br />

107 108<br />

11.2% 11.2%<br />

+29.6%<br />

<br />

North America<br />

54 70 15.6% 8.4%<br />

<br />

+2.8%<br />

142 146 15.3% 12.2%<br />

+9.5%<br />

Africa<br />

116 127 0.6% 0.8%<br />

+60.0%<br />

<br />

142 146 0.6% 0.8%<br />

Latin America and the Caribbean<br />

Number of FDI projects in 2014<br />

% share of capital investment (2015)<br />

Number of FDI projects in 2015<br />

% share of jobs created by FDI (2015)<br />

Change in FDI projects (2015 vs. 2014)<br />

Source: fDi Markets, EY analysis<br />

<br />

In 2015, Western Europe (WE) investors created 300 FDI projects<br />

in Africa, an increase of 11.1% over the previous year. This is<br />

a marked turnaround from 2014, when FDI projects from WE<br />

dropped 18.4% to 270.<br />

With a 45.3% jump in FDI projects, the UK regained its position as<br />

the second largest investor in the continent, supplanting South<br />

Africa, where slowing economic growth posed a challenge. The<br />

more notable trend was in capital investment, with year-onyear<br />

growth of 92.5%. UK investors were particularly active in<br />

services-oriented sectors, including business services (31.2% of<br />

<br />

favorite destination for UK FDI projects, securing 28.6% of the<br />

total, followed by Kenya (20.8%).<br />

primary destination, French investors ramped up activity in<br />

Ghana, where projects increased to seven in 2015, from zero in<br />

2014. This is interesting, considering that French companies are<br />

traditionally inclined to invest in Francophone countries. 39<br />

Italy proved to be an active investor in 2015. It became one of the<br />

15-largest investors into Africa with FDI projects doubling from<br />

8 in 2014 to 16 in 2015. Interestingly, Italy was also the largest<br />

source of capital investment in Africa during the year. This was<br />

largely on account of a single US$6b project by Eni SpA, which<br />

40 South<br />

Africa was the primary target for Italian FDI projects, followed by<br />

Morocco and Egypt. There was an uptick in investments in the CPR<br />

and cleantech sectors.<br />

France became the third-largest source of FDI projects in Africa<br />

in 2015, moving up one notch. Though Morocco remained the<br />

” Ghana Embassy Paris website, paris.embassy.gov.gh, accessed 7 June 2016.<br />

fDi Markets, 2016.<br />

39<br />

40<br />

22 EY’s Africa Attractiveness Program 2016 Staying the <strong>course</strong>