- Page 2:

Abbreviations and acronyms AFC Aver

- Page 6:

Fundamentals of Power System Econom

- Page 10:

For Penny and Philippe For Dragana,

- Page 14:

viii CONTENTS 2.4.3 Future contract

- Page 18:

x CONTENTS 7.3.2 Capacity payments

- Page 22:

xii PREFACE The typical reader we h

- Page 26:

2 1 INTRODUCTION public utilities w

- Page 30:

4 1 INTRODUCTION Large consumers, o

- Page 34:

6 1 INTRODUCTION Genco Genco Disco

- Page 38:

8 1 INTRODUCTION objectives. When t

- Page 42:

2 Basic Concepts from Economics 2.1

- Page 46:

2.2 FUNDAMENTALS OF MARKETS 13 Pric

- Page 50:

2.2 FUNDAMENTALS OF MARKETS 15 For

- Page 54:

2.2 FUNDAMENTALS OF MARKETS 17 and

- Page 58:

2.2 FUNDAMENTALS OF MARKETS 19 Pric

- Page 62:

2.2 FUNDAMENTALS OF MARKETS 21 p 2

- Page 66:

2.2 FUNDAMENTALS OF MARKETS 23 p 2

- Page 70:

2.3 CONCEPTS FROM THE THEORY OF THE

- Page 74:

2.3 CONCEPTS FROM THE THEORY OF THE

- Page 78:

2.3 CONCEPTS FROM THE THEORY OF THE

- Page 82:

2.3 CONCEPTS FROM THE THEORY OF THE

- Page 86:

2.4 TYPES OF MARKETS 33 factors hav

- Page 90:

2.4 TYPES OF MARKETS 35 McDonald is

- Page 94:

2.4 TYPES OF MARKETS 37 commodities

- Page 98:

2.5 MARKETS WITH IMPERFECT COMPETIT

- Page 102:

2.5 MARKETS WITH IMPERFECT COMPETIT

- Page 106:

2.5 MARKETS WITH IMPERFECT COMPETIT

- Page 110:

2.7 PROBLEMS 45 2.7 Problems 2.1 A

- Page 114:

2.7 PROBLEMS 47 b. Repeat these cal

- Page 118:

50 3 MARKETS FOR ELECTRICAL ENERGY

- Page 122:

52 3 MARKETS FOR ELECTRICAL ENERGY

- Page 126:

54 3 MARKETS FOR ELECTRICAL ENERGY

- Page 130:

56 3 MARKETS FOR ELECTRICAL ENERGY

- Page 134:

58 3 MARKETS FOR ELECTRICAL ENERGY

- Page 138:

60 3 MARKETS FOR ELECTRICAL ENERGY

- Page 142:

62 3 MARKETS FOR ELECTRICAL ENERGY

- Page 146:

64 3 MARKETS FOR ELECTRICAL ENERGY

- Page 150:

66 3 MARKETS FOR ELECTRICAL ENERGY

- Page 154:

68 3 MARKETS FOR ELECTRICAL ENERGY

- Page 158:

70 3 MARKETS FOR ELECTRICAL ENERGY

- Page 162:

72 3 MARKETS FOR ELECTRICAL ENERGY

- Page 166:

74 4 PARTICIPATING IN MARKETS FOR E

- Page 170:

76 4 PARTICIPATING IN MARKETS FOR E

- Page 174:

78 4 PARTICIPATING IN MARKETS FOR E

- Page 178:

80 4 PARTICIPATING IN MARKETS FOR E

- Page 182:

82 4 PARTICIPATING IN MARKETS FOR E

- Page 186:

84 4 PARTICIPATING IN MARKETS FOR E

- Page 190:

86 4 PARTICIPATING IN MARKETS FOR E

- Page 194:

88 4 PARTICIPATING IN MARKETS FOR E

- Page 198:

90 4 PARTICIPATING IN MARKETS FOR E

- Page 202:

92 4 PARTICIPATING IN MARKETS FOR E

- Page 206:

94 4 PARTICIPATING IN MARKETS FOR E

- Page 210:

96 4 PARTICIPATING IN MARKETS FOR E

- Page 214:

98 4 PARTICIPATING IN MARKETS FOR E

- Page 218:

100 4 PARTICIPATING IN MARKETS FOR

- Page 222:

102 4 PARTICIPATING IN MARKETS FOR

- Page 226:

104 4 PARTICIPATING IN MARKETS FOR

- Page 230:

106 5 SYSTEM SECURITY AND ANCILLARY

- Page 234:

108 5 SYSTEM SECURITY AND ANCILLARY

- Page 238:

110 5 SYSTEM SECURITY AND ANCILLARY

- Page 242:

112 5 SYSTEM SECURITY AND ANCILLARY

- Page 246:

114 5 SYSTEM SECURITY AND ANCILLARY

- Page 250:

116 5 SYSTEM SECURITY AND ANCILLARY

- Page 254:

118 5 SYSTEM SECURITY AND ANCILLARY

- Page 258:

120 5 SYSTEM SECURITY AND ANCILLARY

- Page 262:

122 5 SYSTEM SECURITY AND ANCILLARY

- Page 266:

124 5 SYSTEM SECURITY AND ANCILLARY

- Page 270:

126 5 SYSTEM SECURITY AND ANCILLARY

- Page 274:

128 5 SYSTEM SECURITY AND ANCILLARY

- Page 278:

130 5 SYSTEM SECURITY AND ANCILLARY

- Page 282:

132 5 SYSTEM SECURITY AND ANCILLARY

- Page 286:

134 5 SYSTEM SECURITY AND ANCILLARY

- Page 290:

136 5 SYSTEM SECURITY AND ANCILLARY

- Page 294:

138 5 SYSTEM SECURITY AND ANCILLARY

- Page 298:

6 Transmission Networks and Electri

- Page 302:

6.2 DECENTRALIZED TRADING OVER A TR

- Page 306:

6.2 DECENTRALIZED TRADING OVER A TR

- Page 310:

6.2 DECENTRALIZED TRADING OVER A TR

- Page 314:

6.3 CENTRALIZED TRADING OVER A TRAN

- Page 318:

6.3 CENTRALIZED TRADING OVER A TRAN

- Page 322:

6.3 CENTRALIZED TRADING OVER A TRAN

- Page 326:

6.3 CENTRALIZED TRADING OVER A TRAN

- Page 330:

6.3 CENTRALIZED TRADING OVER A TRAN

- Page 334:

6.3 CENTRALIZED TRADING OVER A TRAN

- Page 338:

6.3 CENTRALIZED TRADING OVER A TRAN

- Page 342:

6.3 CENTRALIZED TRADING OVER A TRAN

- Page 346:

6.3 CENTRALIZED TRADING OVER A TRAN

- Page 350:

6.3 CENTRALIZED TRADING OVER A TRAN

- Page 354:

6.3 CENTRALIZED TRADING OVER A TRAN

- Page 358:

6.3 CENTRALIZED TRADING OVER A TRAN

- Page 362:

6.3 CENTRALIZED TRADING OVER A TRAN

- Page 366:

6.3 CENTRALIZED TRADING OVER A TRAN

- Page 370:

6.3 CENTRALIZED TRADING OVER A TRAN

- Page 374:

6.3 CENTRALIZED TRADING OVER A TRAN

- Page 378:

6.3 CENTRALIZED TRADING OVER A TRAN

- Page 382:

6.3 CENTRALIZED TRADING OVER A TRAN

- Page 386: 6.3 CENTRALIZED TRADING OVER A TRAN

- Page 390: 6.3 CENTRALIZED TRADING OVER A TRAN

- Page 394: 6.3 CENTRALIZED TRADING OVER A TRAN

- Page 398: 6.3 CENTRALIZED TRADING OVER A TRAN

- Page 402: 6.3 CENTRALIZED TRADING OVER A TRAN

- Page 406: 6.3 CENTRALIZED TRADING OVER A TRAN

- Page 410: 6.3 CENTRALIZED TRADING OVER A TRAN

- Page 414: 6.3 CENTRALIZED TRADING OVER A TRAN

- Page 418: 6.5 PROBLEMS 201 6.5 Problems 6.1 C

- Page 422: 6.5 PROBLEMS 203 B 400 MW 1 40 MW C

- Page 426: 7 Investing in Generation 7.1 Intro

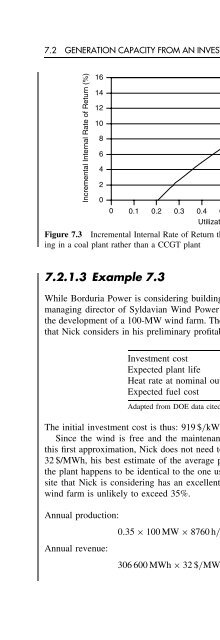

- Page 430: 7.2 GENERATION CAPACITY FROM AN INV

- Page 434: 7.2 GENERATION CAPACITY FROM AN INV

- Page 440: 212 7 INVESTING IN GENERATION Nick

- Page 444: 214 7 INVESTING IN GENERATION sione

- Page 448: 216 7 INVESTING IN GENERATION River

- Page 452: 218 7 INVESTING IN GENERATION capac

- Page 456: 220 7 INVESTING IN GENERATION vulne

- Page 460: 222 7 INVESTING IN GENERATION durin

- Page 464: 224 7 INVESTING IN GENERATION Schwe

- Page 468: 226 7 INVESTING IN GENERATION of it

- Page 472: 228 8 INVESTING IN TRANSMISSION Mor

- Page 476: 230 8 INVESTING IN TRANSMISSION pos

- Page 480: 232 8 INVESTING IN TRANSMISSION 8.3

- Page 484: 234 8 INVESTING IN TRANSMISSION 20

- Page 488:

236 8 INVESTING IN TRANSMISSION 8.4

- Page 492:

238 8 INVESTING IN TRANSMISSION con

- Page 496:

240 8 INVESTING IN TRANSMISSION 8.4

- Page 500:

242 8 INVESTING IN TRANSMISSION 0 3

- Page 504:

244 8 INVESTING IN TRANSMISSION Tab

- Page 508:

246 8 INVESTING IN TRANSMISSION For

- Page 512:

248 8 INVESTING IN TRANSMISSION Dur

- Page 516:

250 8 INVESTING IN TRANSMISSION Tab

- Page 520:

252 8 INVESTING IN TRANSMISSION Tab

- Page 524:

254 8 INVESTING IN TRANSMISSION P A

- Page 528:

256 8 INVESTING IN TRANSMISSION Dur

- Page 532:

258 8 INVESTING IN TRANSMISSION A 0

- Page 536:

260 8 INVESTING IN TRANSMISSION are

- Page 540:

262 8 INVESTING IN TRANSMISSION Cap

- Page 544:

264 8 INVESTING IN TRANSMISSION Plo

- Page 548:

266 APPENDIX: ANSWERS TO SELECTED P

- Page 552:

268 APPENDIX: ANSWERS TO SELECTED P

- Page 556:

270 APPENDIX: ANSWERS TO SELECTED P

- Page 560:

272 APPENDIX: ANSWERS TO SELECTED P

- Page 564:

274 APPENDIX: ANSWERS TO SELECTED P

- Page 568:

278 INDEX Commitment Unit See Unit,

- Page 572:

280 INDEX Imbalance See Balance Inc

- Page 576:

282 INDEX Price (continued) Market

- Page 580:

284 INDEX Unit Commitment 58, 85 Th