- Page 2: Abbreviations and acronyms AFC Aver

- Page 6: Fundamentals of Power System Econom

- Page 10: For Penny and Philippe For Dragana,

- Page 14: viii CONTENTS 2.4.3 Future contract

- Page 18: x CONTENTS 7.3.2 Capacity payments

- Page 22: xii PREFACE The typical reader we h

- Page 26: 2 1 INTRODUCTION public utilities w

- Page 30: 4 1 INTRODUCTION Large consumers, o

- Page 34: 6 1 INTRODUCTION Genco Genco Disco

- Page 38: 8 1 INTRODUCTION objectives. When t

- Page 42: 2 Basic Concepts from Economics 2.1

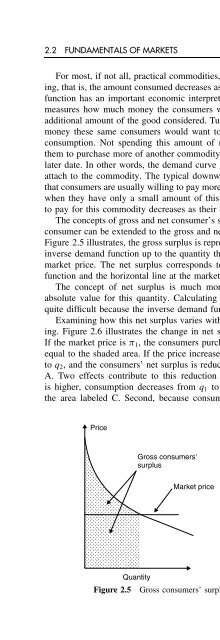

- Page 46: 2.2 FUNDAMENTALS OF MARKETS 13 Pric

- Page 52: 16 2 BASIC CONCEPTS FROM ECONOMICS

- Page 56: 18 2 BASIC CONCEPTS FROM ECONOMICS

- Page 60: 20 2 BASIC CONCEPTS FROM ECONOMICS

- Page 64: 22 2 BASIC CONCEPTS FROM ECONOMICS

- Page 68: 24 2 BASIC CONCEPTS FROM ECONOMICS

- Page 72: 26 2 BASIC CONCEPTS FROM ECONOMICS

- Page 76: 28 2 BASIC CONCEPTS FROM ECONOMICS

- Page 80: 30 2 BASIC CONCEPTS FROM ECONOMICS

- Page 84: 32 2 BASIC CONCEPTS FROM ECONOMICS

- Page 88: 34 2 BASIC CONCEPTS FROM ECONOMICS

- Page 92: 36 2 BASIC CONCEPTS FROM ECONOMICS

- Page 96: 38 2 BASIC CONCEPTS FROM ECONOMICS

- Page 100:

40 2 BASIC CONCEPTS FROM ECONOMICS

- Page 104:

42 2 BASIC CONCEPTS FROM ECONOMICS

- Page 108:

44 2 BASIC CONCEPTS FROM ECONOMICS

- Page 112:

46 2 BASIC CONCEPTS FROM ECONOMICS

- Page 116:

3 Markets for Electrical Energy 3.1

- Page 120:

3.3 THE NEED FOR A MANAGED SPOT MAR

- Page 124:

3.4 OPEN ELECTRICAL ENERGY MARKETS

- Page 128:

3.4 OPEN ELECTRICAL ENERGY MARKETS

- Page 132:

3.4 OPEN ELECTRICAL ENERGY MARKETS

- Page 136:

3.5 THE MANAGED SPOT MARKET 59 pool

- Page 140:

3.5 THE MANAGED SPOT MARKET 61 incr

- Page 144:

3.5 THE MANAGED SPOT MARKET 63 The

- Page 148:

3.6 THE SETTLEMENT PROCESS 65 syste

- Page 152:

3.8 PROBLEMS 67 OFGEM, http://www.o

- Page 156:

3.8 PROBLEMS 69 25/2/16 Magenta Sel

- Page 160:

3.8 PROBLEMS 71 3.6 A company calle

- Page 164:

4 Participating in Markets for Elec

- Page 168:

4.2 THE CONSUMER’S PERSPECTIVE 75

- Page 172:

4.2 THE CONSUMER’S PERSPECTIVE 77

- Page 176:

4.3 THE PRODUCER’S PERSPECTIVE 79

- Page 180:

4.3 THE PRODUCER’S PERSPECTIVE 81

- Page 184:

4.3 THE PRODUCER’S PERSPECTIVE 83

- Page 188:

4.3 THE PRODUCER’S PERSPECTIVE 85

- Page 192:

4.3 THE PRODUCER’S PERSPECTIVE 87

- Page 196:

4.3 THE PRODUCER’S PERSPECTIVE 89

- Page 200:

4.3 THE PRODUCER’S PERSPECTIVE 91

- Page 204:

4.3 THE PRODUCER’S PERSPECTIVE 93

- Page 208:

4.3 THE PRODUCER’S PERSPECTIVE 95

- Page 212:

4.3 THE PRODUCER’S PERSPECTIVE 97

- Page 216:

4.5 THE HYBRID PARTICIPANT’S PERS

- Page 220:

4.6 FURTHER READING 101 consider th

- Page 224:

4.7 PROBLEMS 103 with those given b

- Page 228:

5 System Security and Ancillary Ser

- Page 232:

5.2 DESCRIBING THE NEEDS 107 5.2 De

- Page 236:

5.2 DESCRIBING THE NEEDS 109 Load (

- Page 240:

5.2 DESCRIBING THE NEEDS 111 Freque

- Page 244:

5.2 DESCRIBING THE NEEDS 113 that t

- Page 248:

5.2 DESCRIBING THE NEEDS 115 Reacti

- Page 252:

5.3 OBTAINING ANCILLARY SERVICES 11

- Page 256:

5.3 OBTAINING ANCILLARY SERVICES 11

- Page 260:

5.4 BUYING ANCILLARY SERVICES 121 I

- Page 264:

5.4 BUYING ANCILLARY SERVICES 123 r

- Page 268:

5.4 BUYING ANCILLARY SERVICES 125 o

- Page 272:

5.4 BUYING ANCILLARY SERVICES 127 5

- Page 276:

5.4 BUYING ANCILLARY SERVICES 129 w

- Page 280:

5.5 SELLING ANCILLARY SERVICES 131

- Page 284:

5.5 SELLING ANCILLARY SERVICES 133

- Page 288:

5.5 SELLING ANCILLARY SERVICES 135

- Page 292:

5.7 PROBLEMS 137 Billinton R, Allan

- Page 296:

5.7 PROBLEMS 139 Line R (p.u.) X (p

- Page 300:

142 6 TRANSMISSION NETWORKS AND ELE

- Page 304:

144 6 TRANSMISSION NETWORKS AND ELE

- Page 308:

146 6 TRANSMISSION NETWORKS AND ELE

- Page 312:

148 6 TRANSMISSION NETWORKS AND ELE

- Page 316:

150 6 TRANSMISSION NETWORKS AND ELE

- Page 320:

152 6 TRANSMISSION NETWORKS AND ELE

- Page 324:

154 6 TRANSMISSION NETWORKS AND ELE

- Page 328:

156 6 TRANSMISSION NETWORKS AND ELE

- Page 332:

158 6 TRANSMISSION NETWORKS AND ELE

- Page 336:

160 6 TRANSMISSION NETWORKS AND ELE

- Page 340:

162 6 TRANSMISSION NETWORKS AND ELE

- Page 344:

164 6 TRANSMISSION NETWORKS AND ELE

- Page 348:

166 6 TRANSMISSION NETWORKS AND ELE

- Page 352:

168 6 TRANSMISSION NETWORKS AND ELE

- Page 356:

170 6 TRANSMISSION NETWORKS AND ELE

- Page 360:

172 6 TRANSMISSION NETWORKS AND ELE

- Page 364:

174 6 TRANSMISSION NETWORKS AND ELE

- Page 368:

176 6 TRANSMISSION NETWORKS AND ELE

- Page 372:

178 6 TRANSMISSION NETWORKS AND ELE

- Page 376:

180 6 TRANSMISSION NETWORKS AND ELE

- Page 380:

182 6 TRANSMISSION NETWORKS AND ELE

- Page 384:

184 6 TRANSMISSION NETWORKS AND ELE

- Page 388:

186 6 TRANSMISSION NETWORKS AND ELE

- Page 392:

188 6 TRANSMISSION NETWORKS AND ELE

- Page 396:

190 6 TRANSMISSION NETWORKS AND ELE

- Page 400:

192 6 TRANSMISSION NETWORKS AND ELE

- Page 404:

194 6 TRANSMISSION NETWORKS AND ELE

- Page 408:

196 6 TRANSMISSION NETWORKS AND ELE

- Page 412:

198 6 TRANSMISSION NETWORKS AND ELE

- Page 416:

200 6 TRANSMISSION NETWORKS AND ELE

- Page 420:

202 6 TRANSMISSION NETWORKS AND ELE

- Page 424:

204 6 TRANSMISSION NETWORKS AND ELE

- Page 428:

206 7 INVESTING IN GENERATION by th

- Page 432:

208 7 INVESTING IN GENERATION Bruce

- Page 436:

210 7 INVESTING IN GENERATION Year

- Page 440:

212 7 INVESTING IN GENERATION Nick

- Page 444:

214 7 INVESTING IN GENERATION sione

- Page 448:

216 7 INVESTING IN GENERATION River

- Page 452:

218 7 INVESTING IN GENERATION capac

- Page 456:

220 7 INVESTING IN GENERATION vulne

- Page 460:

222 7 INVESTING IN GENERATION durin

- Page 464:

224 7 INVESTING IN GENERATION Schwe

- Page 468:

226 7 INVESTING IN GENERATION of it

- Page 472:

228 8 INVESTING IN TRANSMISSION Mor

- Page 476:

230 8 INVESTING IN TRANSMISSION pos

- Page 480:

232 8 INVESTING IN TRANSMISSION 8.3

- Page 484:

234 8 INVESTING IN TRANSMISSION 20

- Page 488:

236 8 INVESTING IN TRANSMISSION 8.4

- Page 492:

238 8 INVESTING IN TRANSMISSION con

- Page 496:

240 8 INVESTING IN TRANSMISSION 8.4

- Page 500:

242 8 INVESTING IN TRANSMISSION 0 3

- Page 504:

244 8 INVESTING IN TRANSMISSION Tab

- Page 508:

246 8 INVESTING IN TRANSMISSION For

- Page 512:

248 8 INVESTING IN TRANSMISSION Dur

- Page 516:

250 8 INVESTING IN TRANSMISSION Tab

- Page 520:

252 8 INVESTING IN TRANSMISSION Tab

- Page 524:

254 8 INVESTING IN TRANSMISSION P A

- Page 528:

256 8 INVESTING IN TRANSMISSION Dur

- Page 532:

258 8 INVESTING IN TRANSMISSION A 0

- Page 536:

260 8 INVESTING IN TRANSMISSION are

- Page 540:

262 8 INVESTING IN TRANSMISSION Cap

- Page 544:

264 8 INVESTING IN TRANSMISSION Plo

- Page 548:

266 APPENDIX: ANSWERS TO SELECTED P

- Page 552:

268 APPENDIX: ANSWERS TO SELECTED P

- Page 556:

270 APPENDIX: ANSWERS TO SELECTED P

- Page 560:

272 APPENDIX: ANSWERS TO SELECTED P

- Page 564:

274 APPENDIX: ANSWERS TO SELECTED P

- Page 568:

278 INDEX Commitment Unit See Unit,

- Page 572:

280 INDEX Imbalance See Balance Inc

- Page 576:

282 INDEX Price (continued) Market

- Page 580:

284 INDEX Unit Commitment 58, 85 Th