SAMSA Annual Report 2015 - 2016

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

CHAPTER 06 ANNUAL FINANCIAL STATEMENTS ANNUAL FINANCIAL STATEMENTS CHAPTER 06<br />

NOTES TO THE FINANCIAL STATEMENTS<br />

NOTES TO THE FINANCIAL STATEMENTS<br />

FINANCIAL STATEMENTS FOR THE YEAR ENDED 31 MARCH <strong>2016</strong> FINANCIAL STATEMENTS FOR THE YEAR ENDED 31 MARCH <strong>2016</strong><br />

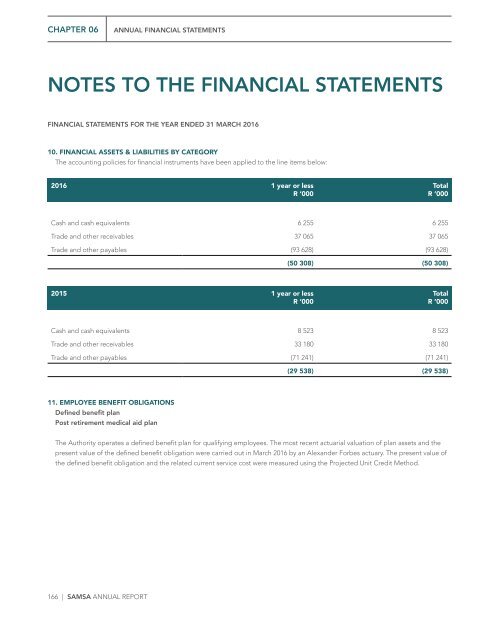

10. FINANCIAL ASSETS & LIABILITIES BY CATEGORY<br />

The accounting policies for financial instruments have been applied to the line items below:<br />

<strong>2016</strong> 1 year or less<br />

R ‘000<br />

Total<br />

R ’000<br />

The amounts recognised in the statement of financial position are as follows:<br />

Opening Balance <strong>2016</strong><br />

R ‘000<br />

<strong>2015</strong><br />

R ‘000<br />

Opening Balance (19 274) (16 104)<br />

Cash and cash equivalents 6 255 6 255<br />

Trade and other receivables 37 065 37 065<br />

Trade and other payables (93 628) (93 628)<br />

(50 308) (50 308)<br />

Amounts charged to income (751) (3 170)<br />

(20 025) (19 274)<br />

Non-current liabilities (19 249) (18 550)<br />

Current liabilities (776) (724)<br />

(20 025) (19 274)<br />

<strong>2015</strong> 1 year or less<br />

R ‘000<br />

Total<br />

R ’000<br />

Changes in the present value of the defined benefit obligation are as follows:<br />

Cash and cash equivalents 8 523 8 523<br />

Trade and other receivables 33 180 33 180<br />

Trade and other payables (71 241) (71 241)<br />

(29 538) (29 538)<br />

Opening balance 19 274 16 104<br />

Current Service Cost 302 238<br />

Interest Cost 1 529 1 512<br />

(Actuarial Gain)/Loss (330) 2 092<br />

Expected Employer Payments/(Benefit) (750) (672)<br />

11. EMPLOYEE BENEFIT OBLIGATIONS<br />

Defined benefit plan<br />

Post retirement medical aid plan<br />

Key assumptions used<br />

Assumptions used at the reporting date:<br />

20 025 19 274<br />

The Authority operates a defined benefit plan for qualifying employees. The most recent actuarial valuation of plan assets and the<br />

present value of the defined benefit obligation were carried out in March <strong>2016</strong> by an Alexander Forbes actuary. The present value of<br />

the defined benefit obligation and the related current service cost were measured using the Projected Unit Credit Method.<br />

Average Retirement Age rate Males - Years 60 60<br />

Discount rate - Percentage 10 % 8 %<br />

Expected rate of salary increases 9 % 10 %<br />

Medical cost trend rates (Health Care Cost Inflation) 10 % 7 %<br />

Consumer Price Index Inflation 8 % 7 %<br />

In-service members 15 18<br />

Continuation Membership of membership at retirement - number of employees 9 6<br />

166 | <strong>SAMSA</strong> ANNUAL REPORT <strong>SAMSA</strong> ANNUAL REPORT | 167