reference document 2003 - Euler Hermes Kreditversicherungs-AG

reference document 2003 - Euler Hermes Kreditversicherungs-AG

reference document 2003 - Euler Hermes Kreditversicherungs-AG

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Underwriting result<br />

After allocation to the equalisation reserve<br />

and allocation of investment income, the<br />

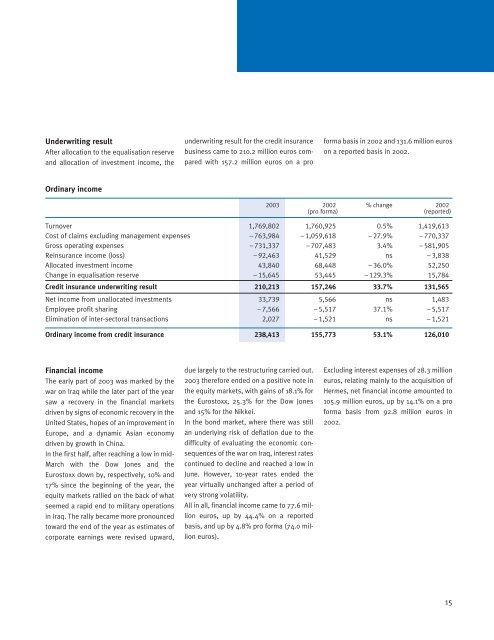

Ordinary income<br />

<strong>2003</strong> 2002 % change 2002<br />

(pro forma) (reported)<br />

Turnover 1,769,802 1,760,925 0.5% 1,419,613<br />

Cost of claims excluding management expenses – 763,984 – 1,059,618 – 27.9% – 770,337<br />

Gross operating expenses – 731,337 – 707,483 3.4% – 581,905<br />

Reinsurance income (loss) – 92,463 41,529 ns – 3,838<br />

Allocated investment income 43,840 68,448 – 36.0% 52,250<br />

Change in equalisation reserve – 15,645 53,445 – 129.3% 15,784<br />

Credit insurance underwriting result 210,213 157,246 33.7% 131,565<br />

Net income from unallocated investments 33,739 5,566 ns 1,483<br />

Employee profit sharing – 7,566 – 5,517 37.1% – 5,517<br />

Elimination of inter-sectoral transactions 2,027 – 1,521 ns – 1,521<br />

Ordinary income from credit insurance 238,413 155,773 53.1% 126,010<br />

Financial income<br />

The early part of <strong>2003</strong> was marked by the<br />

war on Iraq while the later part of the year<br />

saw a recovery in the financial markets<br />

driven by signs of economic recovery in the<br />

United States, hopes of an improvement in<br />

Europe, and a dynamic Asian economy<br />

driven by growth in China.<br />

In the first half, after reaching a low in mid-<br />

March with the Dow Jones and the<br />

Eurostoxx down by, respectively, 10% and<br />

17% since the beginning of the year, the<br />

equity markets rallied on the back of what<br />

seemed a rapid end to military operations<br />

in Iraq. The rally became more pronounced<br />

toward the end of the year as estimates of<br />

corporate earnings were revised upward,<br />

underwriting result for the credit insurance<br />

business came to 210.2 million euros compared<br />

with 157.2 million euros on a pro<br />

due largely to the restructuring carried out.<br />

<strong>2003</strong> therefore ended on a positive note in<br />

the equity markets, with gains of 18.1% for<br />

the Eurostoxx, 25.3% for the Dow Jones<br />

and 15% for the Nikkei.<br />

In the bond market, where there was still<br />

an underlying risk of deflation due to the<br />

difficulty of evaluating the economic consequences<br />

of the war on Iraq, interest rates<br />

continued to decline and reached a low in<br />

June. However, 10-year rates ended the<br />

year virtually unchanged after a period of<br />

very strong volatility.<br />

All in all, financial income came to 77.6 million<br />

euros, up by 44.4% on a reported<br />

basis, and up by 4.8% pro forma (74.0 million<br />

euros).<br />

forma basis in 2002 and 131.6 million euros<br />

on a reported basis in 2002.<br />

Excluding interest expenses of 28.3 million<br />

euros, relating mainly to the acquisition of<br />

<strong>Hermes</strong>, net financial income amounted to<br />

105.9 million euros, up by 14.1% on a pro<br />

forma basis from 92.8 million euros in<br />

2002.<br />

15