reference document 2003 - Euler Hermes Kreditversicherungs-AG

reference document 2003 - Euler Hermes Kreditversicherungs-AG

reference document 2003 - Euler Hermes Kreditversicherungs-AG

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

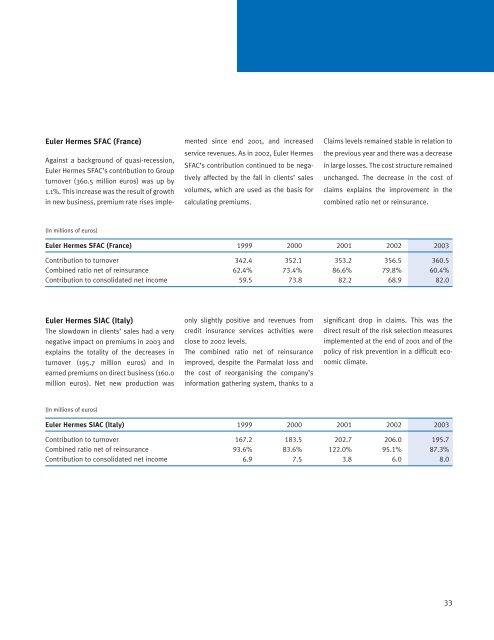

<strong>Euler</strong> <strong>Hermes</strong> SFAC (France)<br />

Against a background of quasi-recession,<br />

<strong>Euler</strong> <strong>Hermes</strong> SFAC’s contribution to Group<br />

turnover (360.5 million euros) was up by<br />

1.1%. This increase was the result of growth<br />

in new business, premium rate rises imple-<br />

(In millions of euros)<br />

mented since end 2001, and increased<br />

service revenues. As in 2002, <strong>Euler</strong> <strong>Hermes</strong><br />

SFAC’s contribution continued to be negatively<br />

affected by the fall in clients’ sales<br />

volumes, which are used as the basis for<br />

calculating premiums.<br />

Claims levels remained stable in relation to<br />

the previous year and there was a decrease<br />

in large losses. The cost structure remained<br />

unchanged. The decrease in the cost of<br />

claims explains the improvement in the<br />

combined ratio net or reinsurance.<br />

<strong>Euler</strong> <strong>Hermes</strong> SFAC (France) 1999 2000 2001 2002 <strong>2003</strong><br />

Contribution to turnover 342.4 352.1 353.2 356.5 360.5<br />

Combined ratio net of reinsurance 62.4% 73.4% 86.6% 79.8% 60.4%<br />

Contribution to consolidated net income 59.5 73.8 82.2 68.9 82.0<br />

<strong>Euler</strong> <strong>Hermes</strong> SIAC (Italy)<br />

The slowdown in clients’ sales had a very<br />

negative impact on premiums in <strong>2003</strong> and<br />

explains the totality of the decreases in<br />

turnover (195.7 million euros) and in<br />

earned premiums on direct business (160.0<br />

million euros). Net new production was<br />

(In millions of euros)<br />

only slightly positive and revenues from<br />

credit insurance services activities were<br />

close to 2002 levels.<br />

The combined ratio net of reinsurance<br />

improved, despite the Parmalat loss and<br />

the cost of reorganising the company’s<br />

information gathering system, thanks to a<br />

significant drop in claims. This was the<br />

direct result of the risk selection measures<br />

implemented at the end of 2001 and of the<br />

policy of risk prevention in a difficult economic<br />

climate.<br />

<strong>Euler</strong> <strong>Hermes</strong> SIAC (Italy) 1999 2000 2001 2002 <strong>2003</strong><br />

Contribution to turnover 167.2 183.5 202.7 206.0 195.7<br />

Combined ratio net of reinsurance 93.6% 83.6% 122.0% 95.1% 87.3%<br />

Contribution to consolidated net income 6.9 7.5 3.8 6.0 8.0<br />

33