ROBOTICS CLUSTER

Massachusetts%20Robotics%20Cluster%20Report%20Final

Massachusetts%20Robotics%20Cluster%20Report%20Final

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Key Market: Collaborative Robotics<br />

Industrial robots have been engineered to serve multiple purposes and, as a group, they have found great<br />

success. Yet for all their accomplishments, the usefulness of these same systems has been limited by their<br />

high costs, complex programming, inflexibility, and inability to work in close association with humans.<br />

Rethink Robotics is located in the<br />

Boston area, as is Teradyne, the<br />

parent company to Universal Robots.<br />

The collaborative robotics sector is<br />

expected to increase roughly tenfold<br />

between 2015 and 2020.<br />

As a result, the market for collaborative robots—human-scale systems that are easy to set up and program,<br />

are capable of being used by workers with a wide range of qualification levels, can support multiple types of<br />

automation, and can work safely in close proximity to human workers, often collaboratively—is very active<br />

at this time. Both large, established robotics suppliers, as well as new, smaller firms, have released or are<br />

developing innovative collaborative robotics technologies into the market. Larger firms are actively acquiring<br />

smaller companies with proven technology. Examples of collaborative robots include ABB’s YuMi and<br />

Roberta platforms, Rethink Robotics’ Baxter and Sawyer, Universal Robots’s (Teradyne) UR family of robots,<br />

KUKA’s LBR iiwa, and Kawada Industries’s Nextage.<br />

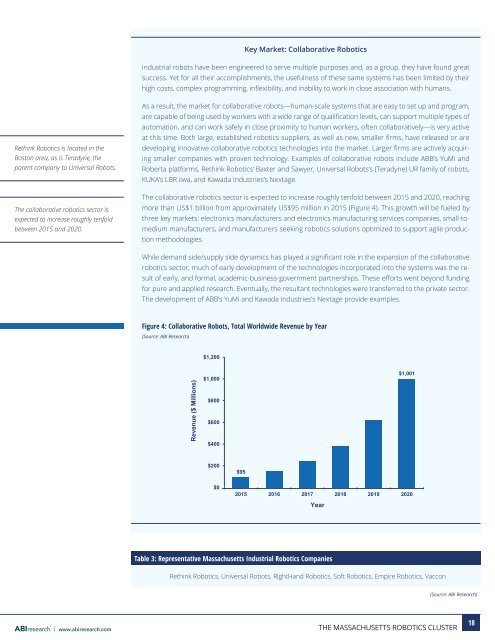

The collaborative robotics sector is expected to increase roughly tenfold between 2015 and 2020, reaching<br />

more than US$1 billion from approximately US$95 million in 2015 (Figure 4). This growth will be fueled by<br />

three key markets: electronics manufacturers and electronics manufacturing services companies, small-tomedium<br />

manufacturers, and manufacturers seeking robotics solutions optimized to support agile production<br />

methodologies.<br />

While demand side/supply side dynamics has played a significant role in the expansion of the collaborative<br />

robotics sector, much of early development of the technologies incorporated into the systems was the result<br />

of early, and formal, academic-business-government partnerships. These efforts went beyond funding<br />

for pure and applied research. Eventually, the resultant technologies were transferred to the private sector.<br />

The development of ABB’s YuMi and Kawada Industries’s Nextage provide examples.<br />

Figure 4: Collaborative Robots, Total Worldwide Revenue by Year<br />

(Source: ABI Research)<br />

$1,200<br />

Revenue ($ Millions)<br />

$1,000<br />

$800<br />

$600<br />

$400<br />

$1,001<br />

$200<br />

$95<br />

$0<br />

2015 2016 2017 2018 2019 2020<br />

Year<br />

Table 3: Representative Massachusetts Industrial Robotics Companies<br />

Rethink Robotics, Universal Robots, RightHand Robotics, Soft Robotics, Empire Robotics, Vaccon<br />

(Source: ABI Research)<br />

www.abiresearch.com<br />

THE MASSACHUSETTS <strong>ROBOTICS</strong> <strong>CLUSTER</strong><br />

18