Expert Advisor Programming by Andrew R. Young

Expert Advisor Programming by Andrew R. Young

Expert Advisor Programming by Andrew R. Young

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Order Conditions and Indicators<br />

You could also generate trade signals when the current price passes above or below an indicator line.<br />

For example, the Bollinger Bands indicator can be used to generate trading signals based on the<br />

location of the price in comparison to the upper and lower bands.<br />

Oscillators<br />

The other major type of indicator is an oscillator. Oscillators are drawn in a separate window, and as<br />

their name suggests, they oscillate between high and low price extremes. Oscillators are either<br />

centered around a neutral axis (generally 0), or they are bound <strong>by</strong> an upper or lower extreme (such<br />

as 0 and 100). Examples of oscillators include momentum, stochastics and RSI.<br />

Oscillators indicate overbought and oversold levels. While they can be used as an indicator of trend,<br />

they are generally used to locate areas of pending reversal. These are used to produce counter-trend<br />

trading signals.<br />

Let's look at a popular oscillator, the stochastic. Stochastics consists of two lines, the stochastic line<br />

(also called the %K line), and the signal line (the %D line). The stochastic oscillates between 0 and<br />

100. When the stochastic is above 70, it is said to be overbought, and pending a possible reversal. If<br />

it is below 30, it is said to be oversold.<br />

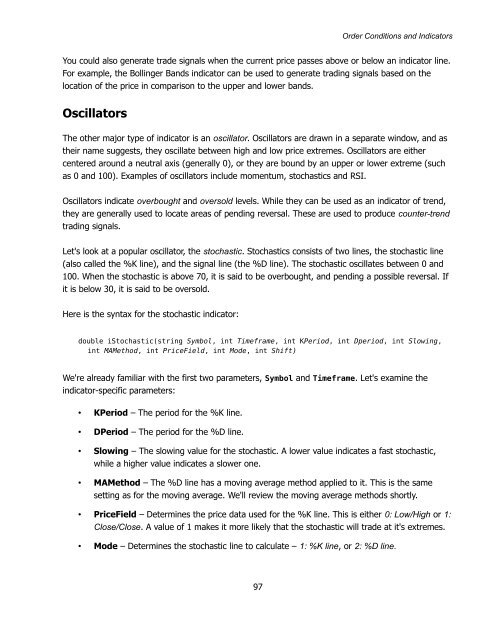

Here is the syntax for the stochastic indicator:<br />

double iStochastic(string Symbol, int Timeframe, int KPeriod, int Dperiod, int Slowing,<br />

int MAMethod, int PriceField, int Mode, int Shift)<br />

We're already familiar with the first two parameters, Symbol and Timeframe. Let's examine the<br />

indicator-specific parameters:<br />

• KPeriod – The period for the %K line.<br />

• DPeriod – The period for the %D line.<br />

• Slowing – The slowing value for the stochastic. A lower value indicates a fast stochastic,<br />

while a higher value indicates a slower one.<br />

• MAMethod – The %D line has a moving average method applied to it. This is the same<br />

setting as for the moving average. We'll review the moving average methods shortly.<br />

• PriceField – Determines the price data used for the %K line. This is either 0: Low/High or 1:<br />

Close/Close. A value of 1 makes it more likely that the stochastic will trade at it's extremes.<br />

• Mode – Determines the stochastic line to calculate – 1: %K line, or 2: %D line.<br />

97