Expert Advisor Programming by Andrew R. Young

Expert Advisor Programming by Andrew R. Young

Expert Advisor Programming by Andrew R. Young

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Advanced Order Placement<br />

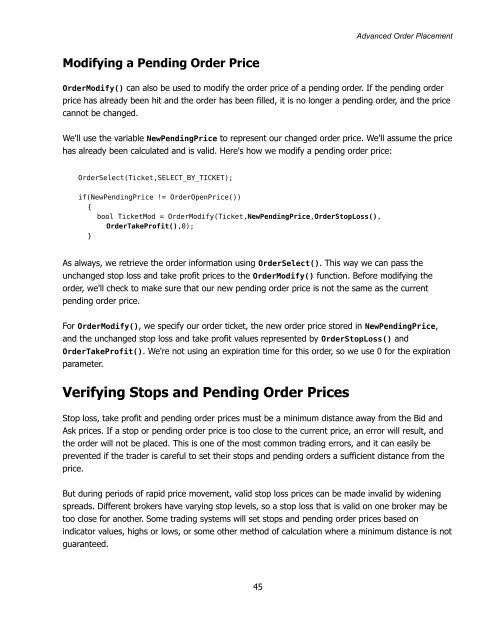

Modifying a Pending Order Price<br />

OrderModify() can also be used to modify the order price of a pending order. If the pending order<br />

price has already been hit and the order has been filled, it is no longer a pending order, and the price<br />

cannot be changed.<br />

We'll use the variable NewPendingPrice to represent our changed order price. We'll assume the price<br />

has already been calculated and is valid. Here's how we modify a pending order price:<br />

OrderSelect(Ticket,SELECT_BY_TICKET);<br />

if(NewPendingPrice != OrderOpenPrice())<br />

{<br />

bool TicketMod = OrderModify(Ticket,NewPendingPrice,OrderStopLoss(),<br />

OrderTakeProfit(),0);<br />

}<br />

As always, we retrieve the order information using OrderSelect(). This way we can pass the<br />

unchanged stop loss and take profit prices to the OrderModify() function. Before modifying the<br />

order, we'll check to make sure that our new pending order price is not the same as the current<br />

pending order price.<br />

For OrderModify(), we specify our order ticket, the new order price stored in NewPendingPrice,<br />

and the unchanged stop loss and take profit values represented <strong>by</strong> OrderStopLoss() and<br />

OrderTakeProfit(). We're not using an expiration time for this order, so we use 0 for the expiration<br />

parameter.<br />

Verifying Stops and Pending Order Prices<br />

Stop loss, take profit and pending order prices must be a minimum distance away from the Bid and<br />

Ask prices. If a stop or pending order price is too close to the current price, an error will result, and<br />

the order will not be placed. This is one of the most common trading errors, and it can easily be<br />

prevented if the trader is careful to set their stops and pending orders a sufficient distance from the<br />

price.<br />

But during periods of rapid price movement, valid stop loss prices can be made invalid <strong>by</strong> widening<br />

spreads. Different brokers have varying stop levels, so a stop loss that is valid on one broker may be<br />

too close for another. Some trading systems will set stops and pending order prices based on<br />

indicator values, highs or lows, or some other method of calculation where a minimum distance is not<br />

guaranteed.<br />

45