Dollars and Sense

Providing you with the tools to pursue and complete college

Providing you with the tools to pursue and complete college

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

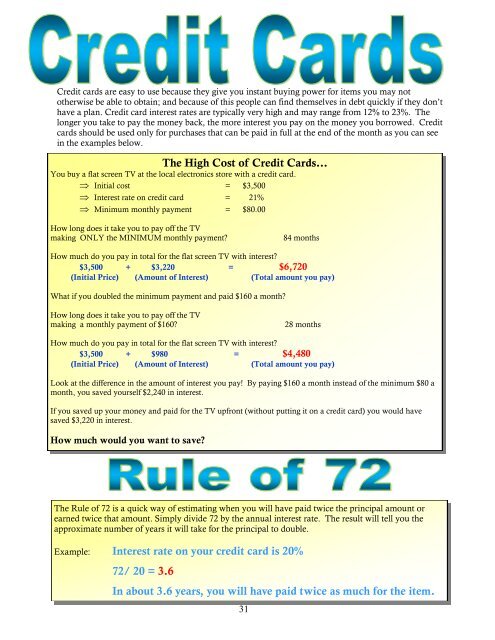

Credit cards are easy to use because they give you instant buying power for items you may not<br />

otherwise be able to obtain; <strong>and</strong> because of this people can find themselves in debt quickly if they don’t<br />

have a plan. Credit card interest rates are typically very high <strong>and</strong> may range from 12% to 23%. The<br />

longer you take to pay the money back, the more interest you pay on the money you borrowed. Credit<br />

cards should be used only for purchases that can be paid in full at the end of the month as you can see<br />

in the examples below.<br />

The High Cost of Credit Cards…<br />

You buy a flat screen TV at the local electronics store with a credit card.<br />

Initial cost = $3,500<br />

Interest rate on credit card = 21%<br />

Minimum monthly payment = $80.00<br />

How long does it take you to pay off the TV<br />

making ONLY the MINIMUM monthly payment?<br />

84 months<br />

How much do you pay in total for the flat screen TV with interest?<br />

$3,500 + $3,220 = $6,720<br />

(Initial Price) (Amount of Interest) (Total amount you pay)<br />

What if you doubled the minimum payment <strong>and</strong> paid $160 a month?<br />

How long does it take you to pay off the TV<br />

making a monthly payment of $160?<br />

28 months<br />

How much do you pay in total for the flat screen TV with interest?<br />

$3,500 + $980 = $4,480<br />

(Initial Price) (Amount of Interest) (Total amount you pay)<br />

Look at the difference in the amount of interest you pay! By paying $160 a month instead of the minimum $80 a<br />

month, you saved yourself $2,240 in interest.<br />

If you saved up your money <strong>and</strong> paid for the TV upfront (without putting it on a credit card) you would have<br />

saved $3,220 in interest.<br />

How much would you want to save?<br />

The Rule of 72 is a quick way of estimating when you will have paid twice the principal amount or<br />

earned twice that amount. Simply divide 72 by the annual interest rate. The result will tell you the<br />

approximate number of years it will take for the principal to double.<br />

Example: Interest rate on your credit card is 20%<br />

72/ 20 = 3.6<br />

In about 3.6 years, you will have paid twice as much for the item.<br />

31