Dollars and Sense

Providing you with the tools to pursue and complete college

Providing you with the tools to pursue and complete college

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Student loans have become an essential part of financing a college education <strong>and</strong> can be an<br />

excellent tool for meeting your financial needs. To avoid student loans becoming a<br />

financial burden, here are a few suggestions:<br />

Borrow only what you need. The more money you borrow the more you will owe <strong>and</strong><br />

the higher your monthly payment will be. See the estimated payment chart on page 55.<br />

Keep track of your total loan amount. Each time you accept a loan, track the total<br />

amount that you have borrowed by going to www.mus.edu/Prepare. Many financial<br />

difficulties arise from being caught off guard by the total balance of your loan when you<br />

enter repayment. Read all correspondence regarding your student loan.<br />

Make payments while in school. This is not required but it can save you money. Here’s<br />

why:<br />

If you have subsidized loans, any portion that you repay while you are in school<br />

will be interest free. Because you are not responsible for the interest that accrues<br />

while in school, any payments you send in will go directly towards the principal<br />

of your loan. This will lower the total amount you owe when you leave school.<br />

If you have unsubsidized loans you should try to at least pay the interest that is<br />

accruing on the loan. You are not required to make interest payments while you<br />

are in school, but any outst<strong>and</strong>ing interest on a loan when you enter repayment<br />

will be capitalized. Capitalization is the process where lenders add the interest<br />

that has accrued to the principal balance <strong>and</strong> the account will then accrue<br />

interest on that higher principal balance. In essence you will pay interest on the<br />

interest.<br />

Make extra payments whenever you can. By paying extra each month, you will reduce<br />

the total amount of interest you will pay over the life of the loan.<br />

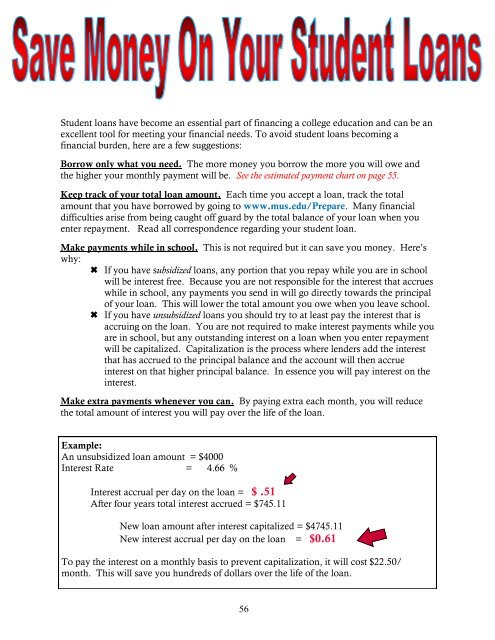

Example:<br />

An unsubsidized loan amount = $4000<br />

Interest Rate = 4.66 %<br />

Interest accrual per day on the loan = $ .51<br />

After four years total interest accrued = $745.11<br />

New loan amount after interest capitalized = $4745.11<br />

New interest accrual per day on the loan = $0.61<br />

To pay the interest on a monthly basis to prevent capitalization, it will cost $22.50/<br />

month. This will save you hundreds of dollars over the life of the loan.<br />

56