Dollars and Sense

Providing you with the tools to pursue and complete college

Providing you with the tools to pursue and complete college

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

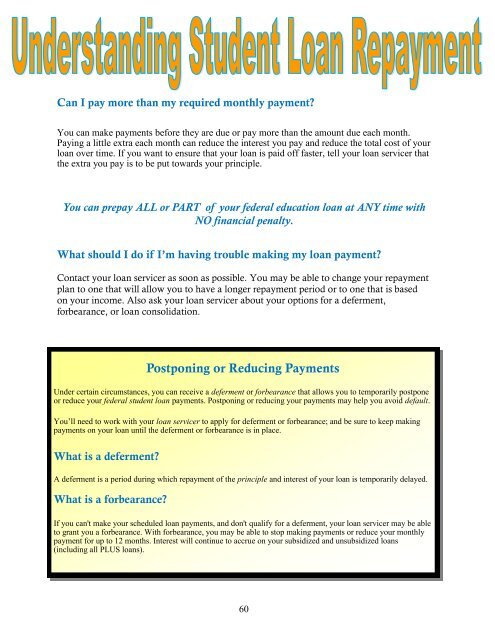

Can I pay more than my required monthly payment?<br />

You can make payments before they are due or pay more than the amount due each month.<br />

Paying a little extra each month can reduce the interest you pay <strong>and</strong> reduce the total cost of your<br />

loan over time. If you want to ensure that your loan is paid off faster, tell your loan servicer that<br />

the extra you pay is to be put towards your principle.<br />

You can prepay ALL or PART of your federal education loan at ANY time with<br />

NO financial penalty.<br />

What should I do if I’m having trouble making my loan payment?<br />

Contact your loan servicer as soon as possible. You may be able to change your repayment<br />

plan to one that will allow you to have a longer repayment period or to one that is based<br />

on your income. Also ask your loan servicer about your options for a deferment,<br />

forbearance, or loan consolidation.<br />

Postponing or Reducing Payments<br />

Under certain circumstances, you can receive a deferment or forbearance that allows you to temporarily postpone<br />

or reduce your federal student loan payments. Postponing or reducing your payments may help you avoid default.<br />

You’ll need to work with your loan servicer to apply for deferment or forbearance; <strong>and</strong> be sure to keep making<br />

payments on your loan until the deferment or forbearance is in place.<br />

What is a deferment?<br />

A deferment is a period during which repayment of the principle <strong>and</strong> interest of your loan is temporarily delayed.<br />

What is a forbearance?<br />

If you can't make your scheduled loan payments, <strong>and</strong> don't qualify for a deferment, your loan servicer may be able<br />

to grant you a forbearance. With forbearance, you may be able to stop making payments or reduce your monthly<br />

payment for up to 12 months. Interest will continue to accrue on your subsidized <strong>and</strong> unsubsidized loans<br />

(including all PLUS loans).<br />

60