DOWNSTREAM OIL THEFT

cAFWC5

cAFWC5

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Downstream Oil Theft: Global Modalities, Trends, and Remedies<br />

creditors including SOCAR Trading—the trading arm of<br />

Azerbaijan’s state-owned oil company—are sustaining<br />

losses from the ongoing closure of the refinery. SOCAR<br />

reported a $9 million loss in July 2016 relative to<br />

January through July of 2015. 212 As of June, the court<br />

gave Amoudi another six months to find a buyer to<br />

rehabilitate the refinery, but so far, there do not seem<br />

to be signs of success. 213<br />

Facts and Figures on SAMIR’s Refinery<br />

Location: Casablanca, Morocco<br />

Website: http://www.samir.ma/<br />

Established: 1959<br />

Capacity: 8.25 million tons/annum & 220,000 billion bpd<br />

Products: 50 Parts per Million Diesel; Unleaded<br />

Gasoline; Jet A1; Fuel Oil; Propane; Butane; Base Oil;<br />

Bitumen (see figure 1 for breakdown).<br />

According to its website:<br />

SAMIR has storage facilities of nearly 280 tanks,<br />

with a total capacity of 2 million m 3 of crude oil,<br />

intermediate and refined products distributed in<br />

three sites:<br />

• Main site (refinery): 1.51 million m 3<br />

• Mohammedia terminal: 309,000 m 3<br />

• Sidi Kacem site: 180,000 m 3<br />

SAMIR storage facility is connected to a pipeline<br />

network between the petrol terminal, the truck<br />

loading installations bays, the ONE power station in<br />

Mohammedia and the distributors’ various storage<br />

depots. Storage tanks are equipped with metering<br />

systems and gauging systems that enable optimal<br />

management of different movements (internal and<br />

external to the refinery) of petroleum products. 214<br />

Oil and Gas Imports<br />

Morocco may be Africa’s fifth-largest consumer of oil,<br />

but it is extremely difficult to obtain clear data on the<br />

breakdown of products or their quantities. Despite<br />

its stability and reputation for good governance,<br />

Morocco is incredibly opaque with regard to its<br />

oil and gas sector, and even more so now that the<br />

SAMIR refinery has shut. Statistics provided by the<br />

Massachusetts Institute of Technology indicate that,<br />

in 2014, 8.1 percent of imports consisted of refined<br />

petroleum, 4.9 percent of LPG, and 6.5 percent of<br />

212 “SOCAR Oil Production Drops 9 Percent in 7m; Gas Down<br />

7.2,” Azerbaijan News Network, August 11, 2016, http://ann.<br />

az/en/socar-oil-production-drops-9-in-7m-gas-down-72/#.<br />

V7fKqpMrK1s.<br />

213 “Moroccan Court Gives Oil Refiner Samir More Time to Restart<br />

Production,” Reuters Africa, June 21, 2016, http://af.reuters.<br />

com/article/investingNews/idAFKCN0Z71U2.<br />

214 “Storage,” SAMIR, http://www.samir.ma/en/index.<br />

php?option=com_content&view=article&id=101&Itemid=229.<br />

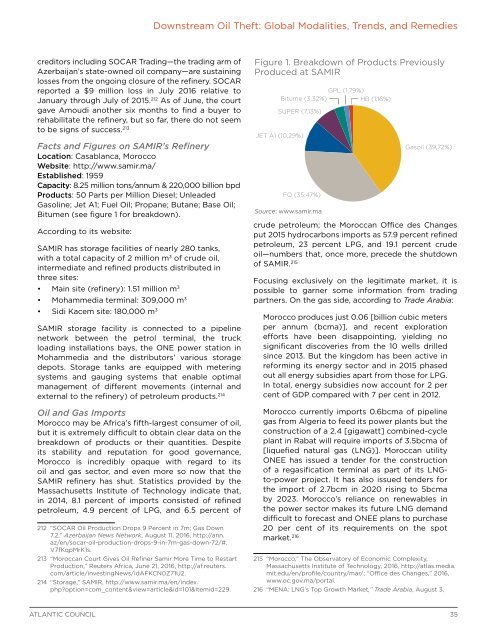

Figure 1. Breakdown of Products Previously<br />

Produced at SAMIR<br />

JET A1 (10,29%)<br />

GPL (1,79%)<br />

Bitume (3,32%)<br />

HB (1,16%)<br />

SUPER (7,13%)<br />

FO (35,47%)<br />

Source: www.samir.ma<br />

Gasoil (39,72%)<br />

crude petroleum; the Moroccan Office des Changes<br />

put 2015 hydrocarbons imports as 57.9 percent refined<br />

petroleum, 23 percent LPG, and 19.1 percent crude<br />

oil—numbers that, once more, precede the shutdown<br />

of SAMIR. 215<br />

Focusing exclusively on the legitimate market, it is<br />

possible to garner some information from trading<br />

partners. On the gas side, according to Trade Arabia:<br />

Morocco produces just 0.06 [billion cubic meters<br />

per annum (bcma)], and recent exploration<br />

efforts have been disappointing, yielding no<br />

significant discoveries from the 10 wells drilled<br />

since 2013. But the kingdom has been active in<br />

reforming its energy sector and in 2015 phased<br />

out all energy subsidies apart from those for LPG.<br />

In total, energy subsidies now account for 2 per<br />

cent of GDP compared with 7 per cent in 2012.<br />

Morocco currently imports 0.6bcma of pipeline<br />

gas from Algeria to feed its power plants but the<br />

construction of a 2.4 [gigawatt] combined-cycle<br />

plant in Rabat will require imports of 3.5bcma of<br />

[liquefied natural gas (LNG)]. Moroccan utility<br />

ONEE has issued a tender for the construction<br />

of a regasification terminal as part of its LNGto-power<br />

project. It has also issued tenders for<br />

the import of 2.7bcm in 2020 rising to 5bcma<br />

by 2023. Morocco’s reliance on renewables in<br />

the power sector makes its future LNG demand<br />

difficult to forecast and ONEE plans to purchase<br />

20 per cent of its requirements on the spot<br />

market. 216<br />

215 “Morocco,” The Observatory of Economic Complexity,<br />

Massachusetts Institute of Technology, 2016, http://atlas.media.<br />

mit.edu/en/profile/country/mar/; “Office des Changes,” 2016,<br />

www.oc.gov.ma/portal.<br />

216 “MENA: LNG’s Top Growth Market,” Trade Arabia, August 3,<br />

ATLANTIC COUNCIL<br />

35