CALTRANS FACT BOOKLET

2016_CFB

2016_CFB

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Financial Information<br />

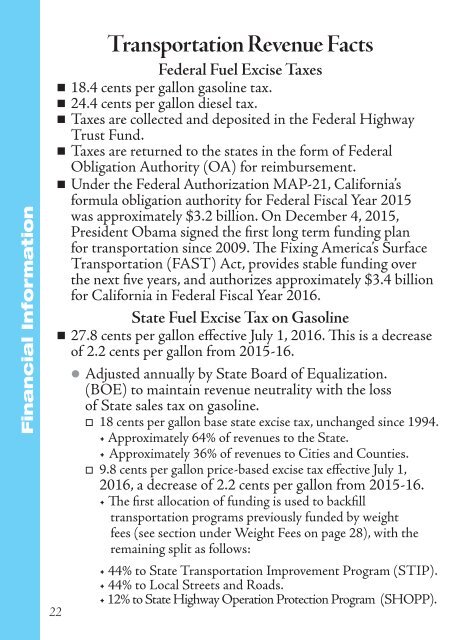

Transportation Revenue Facts<br />

Federal Fuel Excise Taxes<br />

• 18.4 cents per gallon gasoline tax.<br />

• 24.4 cents per gallon diesel tax.<br />

• Taxes are collected and deposited in the Federal Highway<br />

Trust Fund.<br />

• Taxes are returned to the states in the form of Federal<br />

Obligation Authority (OA) for reimbursement.<br />

• Under the Federal Authorization MAP-21, California’s<br />

formula obligation authority for Federal Fiscal Year 2015<br />

was approximately $3.2 billion. On December 4, 2015,<br />

President Obama signed the first long term funding plan<br />

for transportation since 2009. The Fixing America’s Surface<br />

Transportation (FAST) Act, provides stable funding over<br />

the next five years, and authorizes approximately $3.4 billion<br />

for California in Federal Fiscal Year 2016.<br />

State Fuel Excise Tax on Gasoline<br />

• 27.8 cents per gallon effective July 1, 2016. This is a decrease<br />

of 2.2 cents per gallon from 2015-16.<br />

• Adjusted annually by State Board of Equalization.<br />

(BOE) to maintain revenue neutrality with the loss<br />

of State sales tax on gasoline.<br />

o 18 cents per gallon base state excise tax, unchanged since 1994.<br />

• Approximately 64% of revenues to the State.<br />

• Approximately 36% of revenues to Cities and Counties.<br />

o 9.8 cents per gallon price-based excise tax effective July 1,<br />

2016, a decrease of 2.2 cents per gallon from 2015-16.<br />

• The first allocation of funding is used to backfill<br />

transportation programs previously funded by weight<br />

fees (see section under Weight Fees on page 28), with the<br />

remaining split as follows:<br />

Transportation Revenue Facts (cont.)<br />

Price-based Excise Tax<br />

Revenue Distribution<br />

State Fuel Excise Tax on Diesel<br />

• 16 cents per gallon effective July 1, 2016. This is an increase of<br />

three cents per gallon from 2015-16.<br />

• Adjusted annually by BOE to maintain revenue neutrality<br />

with the increase to State sales tax on diesel:<br />

o About 48% of revenue to the State.<br />

o About 52% of revenue to cities and counties.<br />

State Sales Tax on Gasoline<br />

• General Statewide sales tax on gasoline was eliminated July 1, 2010.<br />

State Sales Tax on Diesel<br />

(Available for Transportation Purposes)<br />

• 6.5% sales tax on diesel:<br />

• 4.75% base tax.<br />

• 1.75% additional tax, effective July 1, 2014.<br />

o About 64% of revenues to State Transit Assistance.<br />

o About 36% of revenues to the Public Transportation Account<br />

(PTA).<br />

Transportation Revenue Facts - Division of Budgets: Steven Keck, Chief (916) 654-4556<br />

• 44% to State Transportation Improvement Program (STIP).<br />

• 44% to Local Streets and Roads.<br />

22<br />

• 12% to State Highway Operation Protection Program (SHOPP).<br />

23<br />

Financial Information