Building_Entrepreneur_to print

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

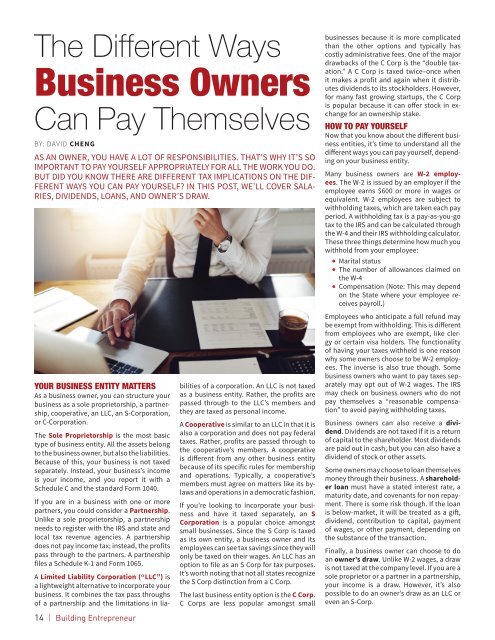

The Different Ways<br />

Business Owners<br />

Can Pay Themselves<br />

BY: DAVID CHENG<br />

AS AN OWNER, YOU HAVE A LOT OF RESPONSIBILITIES. THAT’S WHY IT’S SO<br />

IMPORTANT TO PAY YOURSELF APPROPRIATELY FOR ALL THE WORK YOU DO.<br />

BUT DID YOU KNOW THERE ARE DIFFERENT TAX IMPLICATIONS ON THE DIF-<br />

FERENT WAYS YOU CAN PAY YOURSELF? IN THIS POST, WE’LL COVER SALA-<br />

RIES, DIVIDENDS, LOANS, AND OWNER’S DRAW.<br />

YOUR BUSINESS ENTITY MATTERS<br />

As a business owner, you can structure your<br />

business as a sole proprie<strong>to</strong>rship, a partnership,<br />

cooperative, an LLC, an S-Corporation,<br />

or C-Corporation.<br />

The Sole Proprie<strong>to</strong>rship is the most basic<br />

type of business entity. All the assets belong<br />

<strong>to</strong> the business owner, but also the liabilities.<br />

Because of this, your business is not taxed<br />

separately. Instead, your business’s income<br />

is your income, and you report it with a<br />

Schedule C and the standard Form 1040.<br />

If you are in a business with one or more<br />

partners, you could consider a Partnership.<br />

Unlike a sole proprie<strong>to</strong>rship, a partnership<br />

needs <strong>to</strong> register with the IRS and state and<br />

local tax revenue agencies. A partnership<br />

does not pay income tax; instead, the profits<br />

pass through <strong>to</strong> the partners. A partnership<br />

files a Schedule K-1 and Form 1065.<br />

A Limited Liability Corporation (“LLC”) is<br />

a lightweight alternative <strong>to</strong> incorporate your<br />

business. It combines the tax pass throughs<br />

of a partnership and the limitations in lia-<br />

bilities of a corporation. An LLC is not taxed<br />

as a business entity. Rather, the profits are<br />

passed through <strong>to</strong> the LLC’s members and<br />

they are taxed as personal income.<br />

A Cooperative is similar <strong>to</strong> an LLC in that it is<br />

also a corporation and does not pay federal<br />

taxes. Rather, profits are passed through <strong>to</strong><br />

the cooperative’s members. A cooperative<br />

is different from any other business entity<br />

because of its specific rules for membership<br />

and operations. Typically, a cooperative’s<br />

members must agree on matters like its bylaws<br />

and operations in a democratic fashion.<br />

If you’re looking <strong>to</strong> incorporate your business<br />

and have it taxed separately, an S<br />

Corporation is a popular choice amongst<br />

small businesses. Since the S Corp is taxed<br />

as its own entity, a business owner and its<br />

employees can see tax savings since they will<br />

only be taxed on their wages. An LLC has an<br />

option <strong>to</strong> file as an S Corp for tax purposes.<br />

It’s worth noting that not all states recognize<br />

the S Corp distinction from a C Corp.<br />

The last business entity option is the C Corp.<br />

C Corps are less popular amongst small<br />

businesses because it is more complicated<br />

than the other options and typically has<br />

costly administrative fees. One of the major<br />

drawbacks of the C Corp is the “double taxation.”<br />

A C Corp is taxed twice–once when<br />

it makes a profit and again when it distributes<br />

dividends <strong>to</strong> its s<strong>to</strong>ckholders. However,<br />

for many fast growing startups, the C Corp<br />

is popular because it can offer s<strong>to</strong>ck in exchange<br />

for an ownership stake.<br />

HOW TO PAY YOURSELF<br />

Now that you know about the different business<br />

entities, it’s time <strong>to</strong> understand all the<br />

different ways you can pay yourself, depending<br />

on your business entity.<br />

Many business owners are W-2 employees.<br />

The W-2 is issued by an employer if the<br />

employee earns $600 or more in wages or<br />

equivalent. W-2 employees are subject <strong>to</strong><br />

withholding taxes, which are taken each pay<br />

period. A withholding tax is a pay-as-you-go<br />

tax <strong>to</strong> the IRS and can be calculated through<br />

the W-4 and their IRS withholding calcula<strong>to</strong>r.<br />

These three things determine how much you<br />

withhold from your employee:<br />

• Marital status<br />

• The number of allowances claimed on<br />

the W-4<br />

• Compensation (Note: This may depend<br />

on the State where your employee receives<br />

payroll.)<br />

Employees who anticipate a full refund may<br />

be exempt from withholding. This is different<br />

from employees who are exempt, like clergy<br />

or certain visa holders. The functionality<br />

of having your taxes withheld is one reason<br />

why some owners choose <strong>to</strong> be W-2 employees.<br />

The inverse is also true though. Some<br />

business owners who want <strong>to</strong> pay taxes separately<br />

may opt out of W-2 wages. The IRS<br />

may check on business owners who do not<br />

pay themselves a “reasonable compensation”<br />

<strong>to</strong> avoid paying withholding taxes.<br />

Business owners can also receive a dividend.<br />

Dividends are not taxed if it is a return<br />

of capital <strong>to</strong> the shareholder. Most dividends<br />

are paid out in cash, but you can also have a<br />

dividend of s<strong>to</strong>ck or other assets.<br />

Some owners may choose <strong>to</strong> loan themselves<br />

money through their business. A shareholder<br />

loan must have a stated interest rate, a<br />

maturity date, and covenants for non repayment.<br />

There is some risk though. If the loan<br />

is below-market, it will be treated as a gift,<br />

dividend, contribution <strong>to</strong> capital, payment<br />

of wages, or other payment, depending on<br />

the substance of the transaction.<br />

Finally, a business owner can choose <strong>to</strong> do<br />

an owner’s draw. Unlike W-2 wages, a draw<br />

is not taxed at the company level. If you are a<br />

sole proprie<strong>to</strong>r or a partner in a partnership,<br />

your income is a draw. However, it’s also<br />

possible <strong>to</strong> do an owner’s draw as an LLC or<br />

even an S-Corp.<br />

14 | <strong>Building</strong> <strong>Entrepreneur</strong>