ZaraAnnual-English2016

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

22 Non-controlling Interests<br />

This item represents the subsidiaries net equity after deducting the Holding Company direct and indirect interests, through<br />

its subsidiaries, in these subsidiaries.<br />

23 Income Tax<br />

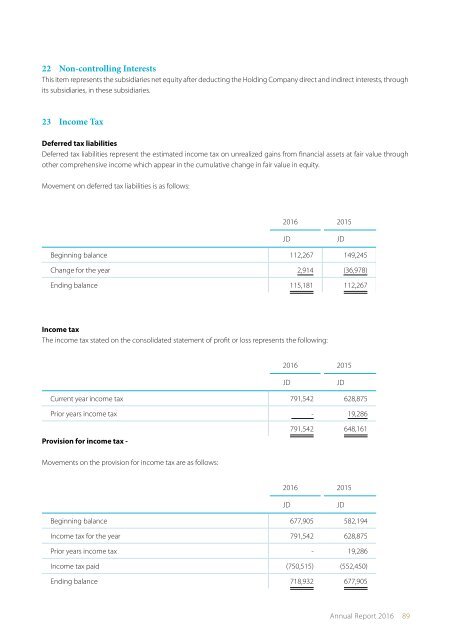

Deferred tax liabilities<br />

Deferred tax liabilities represent the estimated income tax on unrealized gains from financial assets at fair value through<br />

other comprehensive income which appear in the cumulative change in fair value in equity.<br />

Movement on deferred tax liabilities is as follows:<br />

2016 2015<br />

JD<br />

JD<br />

Beginning balance 112,267 149,245<br />

Change for the year 2,914 (36,978)<br />

Ending balance 115,181 112,267<br />

Income tax<br />

The income tax stated on the consolidated statement of profit or loss represents the following:<br />

2016 2015<br />

JD<br />

JD<br />

Current year income tax 791,542 628,875<br />

Prior years income tax - 19,286<br />

Provision for income tax -<br />

791,542 648,161<br />

Movements on the provision for income tax are as follows:<br />

2016 2015<br />

JD<br />

JD<br />

Beginning balance 677,905 582,194<br />

Income tax for the year 791,542 628,875<br />

Prior years income tax - 19,286<br />

Income tax paid (750,515) (552,450)<br />

Ending balance 718,932 677,905<br />

Annual Report 2016 89