Dimension

Taking you beyond the small screen, Dimension is an entertainment magazine for people who want to think critically about their TV.

Taking you beyond the small screen, Dimension is an entertainment magazine for people who want to think critically about their TV.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

“<br />

“There’s a lot more inertia in television than there was<br />

in the media that succumbed more quickly to disruption<br />

from the Internet,” says Andrew Frank, a longtime analyst<br />

at Gartner who follows the marketing industry.<br />

How have major broadcasters and cable networks held<br />

onto their dominant share of the public’s attention? Well,<br />

for one, people still watch a lot of TV on TV. Major sporting<br />

events, like the Super Bowl and the Olympics, draw<br />

millions of viewers. And yes, electoral politics still largely<br />

play out on television. “TV still has massive scale, it has<br />

that cachet,” Verna says. “If it’s on TV, it’s important.”<br />

And advertisers want to be where they can reach people.<br />

Even for those who don’t watch TV in the old-fashioned<br />

way, many networks have developed their own websites,<br />

It’s definitely a complicated<br />

picture, but it’s not easy to say<br />

digital is killing TV.<br />

”<br />

apps, and digital services. Advertisers consider ads on<br />

websites and apps “digital spend.” For networks, however,<br />

it’s all ad money coming their way.<br />

Take Fox. Advertisers can buy slots during The Simpsons<br />

on its broadcast station or The Americans on basic cable.<br />

They can serve ads during full episodes streaming on its<br />

website, streaming apps, and Hulu. (During last week’s<br />

earnings call, 21st Century Fox’s CEO James Murdoch<br />

called the going rate for ads for Fox’s shows on Hulu “very,<br />

very attractive.” Fox owns Hulu in a joint partnership with<br />

Disney–ABC and NBC Universal.)<br />

But when advertisers are spending money for ads attached<br />

to TV streaming on the internet, they don’t think of it as TV.<br />

“Hulu, Roku, Apple TV. Is that television? No, it’s not.<br />

It’s consumed on a big screen potentially in your living<br />

room, but we consider anything delivered by an IP device is<br />

not linear TV,” says David Cohen, the president of Magna<br />

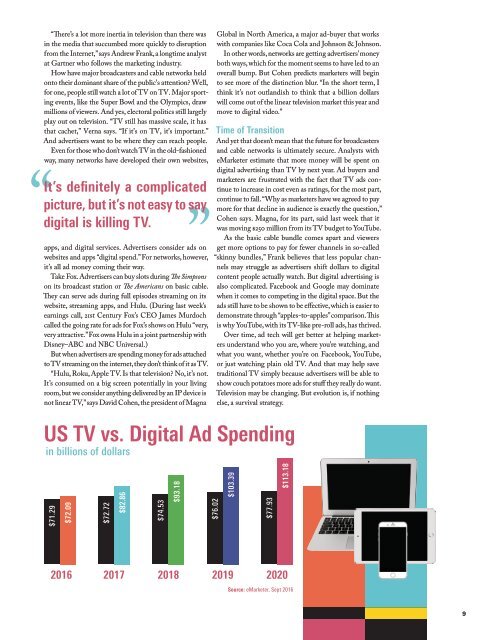

US TV vs. Digital Ad Spending<br />

in billions of dollars<br />

Global in North America, a major ad-buyer that works<br />

with companies like Coca Cola and Johnson & Johnson.<br />

In other words, networks are getting advertisers’ money<br />

both ways, which for the moment seems to have led to an<br />

overall bump. But Cohen predicts marketers will begin<br />

to see more of the distinction blur. “In the short term, I<br />

think it’s not outlandish to think that a billion dollars<br />

will come out of the linear television market this year and<br />

move to digital video.”<br />

Time of Transition<br />

And yet that doesn’t mean that the future for broadcasters<br />

and cable networks is ultimately secure. Analysts with<br />

eMarketer estimate that more money will be spent on<br />

digital advertising than TV by next year. Ad buyers and<br />

marketers are frustrated with the fact that TV ads continue<br />

to increase in cost even as ratings, for the most part,<br />

continue to fall. “Why as marketers have we agreed to pay<br />

more for that decline in audience is exactly the question,”<br />

Cohen says. Magna, for its part, said last week that it<br />

was moving $250 million from its TV budget to YouTube.<br />

As the basic cable bundle comes apart and viewers<br />

get more options to pay for fewer channels in so-called<br />

“skinny bundles,” Frank believes that less popular channels<br />

may struggle as advertisers shift dollars to digital<br />

content people actually watch. But digital advertising is<br />

also complicated. Facebook and Google may dominate<br />

when it comes to competing in the digital space. But the<br />

ads still have to be shown to be effective, which is easier to<br />

demonstrate through “apples-to-apples” comparison. This<br />

is why YouTube, with its TV-like pre-roll ads, has thrived.<br />

Over time, ad tech will get better at helping marketers<br />

understand who you are, where you’re watching, and<br />

what you want, whether you’re on Facebook, YouTube,<br />

or just watching plain old TV. And that may help save<br />

traditional TV simply because advertisers will be able to<br />

show couch potatoes more ads for stuff they really do want.<br />

Television may be changing. But evolution is, if nothing<br />

else, a survival strategy.<br />

$71.29<br />

$72.09<br />

$72.72<br />

$82.86<br />

$74.53<br />

$93.18<br />

$76.02<br />

$103.39<br />

$77.93<br />

$113.18<br />

2016<br />

2017<br />

2018<br />

2019<br />

2020<br />

Source: eMarketer, Sept 2016<br />

9