Business Supplement Issue-20

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

DT<br />

VOL1, ISSUE <strong>20</strong> | Sunday, July 9, <strong>20</strong>17<br />

<strong>Business</strong> Tribune<br />

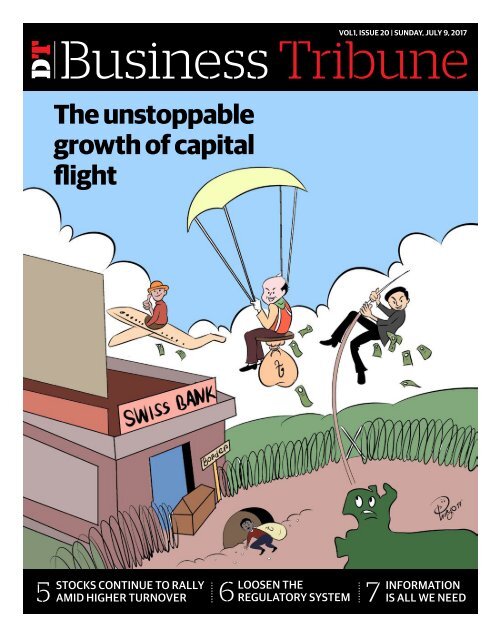

The unstoppable<br />

growth of capital<br />

flight<br />

Stocks continue to rally<br />

5 amid higher turnover<br />

6<br />

Loosen the<br />

regulatory system<br />

7<br />

Information<br />

is all we need

2<br />

Sunday, July 9, <strong>20</strong>17<br />

DT<br />

Special<br />

The unstoppable growth of capital flight<br />

• Shariful Islam<br />

Large amounts of money continues<br />

to be siphoned off as the country’s<br />

anti-money laundering act appears<br />

inadequate in deterring capital<br />

flight.<br />

The biggest chunk of laundered<br />

money ends up in Malaysia, Singapore,<br />

Thailand, USA, Canada,<br />

Switzerland, UK, and other places<br />

where the laws protect the capital<br />

inflows into their countries.<br />

The Swiss National Bank (SNB)<br />

published a series of annual reports<br />

on June 29 which revealed that deposits<br />

by Bangladeshi citizens had<br />

gone up remarkably.<br />

Last year’s report revealed that<br />

there had been a 19% increase<br />

in deposits since <strong>20</strong>15. The total<br />

deposit by Bangladeshi citizens<br />

to various Swiss banks totalled<br />

Tk5,566 crore in <strong>20</strong>16, which was<br />

Tk4,417 crore in <strong>20</strong>15.<br />

Overall, the United Kingdom has<br />

the biggest deposit in Swiss banks.<br />

In South Asia, Pakistan leads with<br />

the largest deposit, followed by<br />

India whose deposits are down by<br />

more than a half, with Bangladesh<br />

in third position.<br />

The unrecorded capital flow from<br />

Bangladesh stood at $61.63 billion<br />

between <strong>20</strong>05 and <strong>20</strong>14, riding mostly<br />

on mis-invoicing, according to a<br />

report of Global Financial Integrity.<br />

The GFI report also revealed that<br />

illicit capital outflow from Bangladesh<br />

has been on a growing curve<br />

from <strong>20</strong>07, in the wake of political<br />

turmoil during the period, and it<br />

continued till <strong>20</strong>13 when the highest<br />

$9.66 billion was siphoned off.<br />

Of the total $61.63 billion illicit<br />

capital flight, $56.83 billion went<br />

off through trade mis-invoicing<br />

while the rest $4.8 billion could<br />

not be traced in the balance of payments<br />

data, added the report.<br />

The Washington-based research<br />

and advisory organisation unveiled<br />

the report titled “Illicit Financial<br />

Flows (IFFs) to and from Developing<br />

Countries: <strong>20</strong>05-<strong>20</strong>14” on May 2.<br />

Experts say the racket of money<br />

launderers are a tight knit group,<br />

building a community with any incumbent<br />

government high-ups.<br />

Former Finance Adviser to the<br />

caretaker government AB Miza Azizul<br />

Islam claimed that wealthy people<br />

who launder money out of the<br />

country enjoyed political backing.<br />

Most of the money was laundered<br />

by unscrupulous businessmen<br />

through under- and over-invoicing<br />

in international trade, he said.<br />

“The government should take<br />

stern action against dishonest individuals<br />

involved in money laundering,”<br />

Mirza Aziz told the Dhaka<br />

Tribune.<br />

“However, the existing laws<br />

are insufficient and failing to stop<br />

money being siphoned off from the<br />

country.<br />

10<br />

8<br />

6<br />

4<br />

2<br />

0<br />

ILLEGAL CAPITAL FLIGHT FROM BANGLADESH<br />

4.26<br />

3.38<br />

Admitting the fact, Finance<br />

Minister AMA Muhith said the current<br />

laws are not adequate to stop<br />

money from being laundered.<br />

“Money laundering has recently<br />

risen due to existing laws and<br />

regulations. We are going to reform<br />

them,” he said at the signing<br />

ceremony of Annual Performance<br />

Agreement between the ministry<br />

and 16 state-run banks and financial<br />

institutions at the ministry auditorium<br />

on June 18.<br />

Laundering likely to go up ahead of<br />

next national polls<br />

Given the current situation and the<br />

next general elections looming,<br />

more money is likely to flow out of<br />

the country. According to reports<br />

from a host of foreign agencies, it is<br />

evident that a big chunk of wealth<br />

goes off from the country ahead<br />

of every national election. Economists<br />

apprehend that such a situation<br />

could emerge again.<br />

PRI Executive Director Ahsan H<br />

Mansur said: “If Tk4 or Tk5 billion<br />

had been laundered before, this<br />

year might witness <strong>20</strong>% more capital<br />

flight than the previous year.<br />

In the next year, such asset flight<br />

could go up 30%-40% than the year<br />

gone by. ”<br />

Mansur termed the capital flight<br />

“internal bleeding” of the country.<br />

Four ways money is laundered<br />

Every year a vast amount of money<br />

goes off primarily in four forms -<br />

through over and under-invoicing,<br />

tampering with shipment figures,<br />

multiple invoices and false declaration<br />

on goods and services, according<br />

to a study report of Bangladesh<br />

Institution of Bank Management<br />

(BIBM).<br />

4.1<br />

6.44<br />

BIBM Research Director Shah<br />

Md Ahsan Habib launched the report<br />

“Review of the Trade Services<br />

Operations of Banks-<strong>20</strong>16”.<br />

Habib said: “Among various<br />

forms of trade-related frauds,<br />

trade-based money laundering is<br />

perhaps the most concerning issue<br />

to policymakers all over the world,<br />

and the four basic techniques are<br />

followed by fraudsters in Bangladesh<br />

to launder money.”<br />

“The new online reporting system<br />

of Bangladesh Bank has turned<br />

out to be a great achievement in<br />

the banking sector, which greatly<br />

helps in monitoring and supervising<br />

day-to-day trade transactions.<br />

Also, this is a vital tool for data validation.”<br />

In spite of these improvements<br />

and achievements, cases of under-reporting<br />

and misreporting are<br />

still concerning, added Habib.<br />

Collective efforts necessary to<br />

curb money laundering<br />

A series of concerted efforts need<br />

to be taken to stem money laundering.<br />

According to think tanks and<br />

economists, if Bangladesh Bank,<br />

Anti-corruption Commission, NBR<br />

and the office of the attorney general<br />

work together, capital flight<br />

can be stopped while money siphoned<br />

off can be brought back to<br />

the country.<br />

Transparency International<br />

Total $61.63bn<br />

6.13<br />

<strong>20</strong>05 <strong>20</strong>06 <strong>20</strong>07 <strong>20</strong>08 <strong>20</strong>09 <strong>20</strong>10 <strong>20</strong>11 <strong>20</strong>12 <strong>20</strong>13 <strong>20</strong>14<br />

5.41<br />

5.92<br />

Given the current situation and the next<br />

general elections looming, more money is<br />

likely to flow out of the country<br />

7.23<br />

Executive Director Dr Iftekharuzzaman<br />

said: “If the financial unit<br />

of the central bank, Anti-Corruption<br />

Commission, National Board<br />

of Revenue and office of the attorney<br />

general team up, the move<br />

can prove effective to stop money<br />

laundering.”<br />

BB fails to get info about<br />

Bangladeshi depositors in Swiss<br />

Banks<br />

Over the last three years, the central<br />

bank has sought information about<br />

Bangladeshi depositors in Swiss<br />

banks but are yet to get any reply,<br />

said Finance Division officials.<br />

BB also sent two letters to SNB<br />

seeking wealth information about<br />

controversial Bangladeshi businessman<br />

Moosa Bin Shamsher and<br />

his family, but SNB didn’t respond.<br />

Unlike Bangladesh, India receives<br />

information about its depositors<br />

in Swiss Banks under the “Automatic<br />

Exchange of Information”<br />

agreement with Switzerland.<br />

However, Bangladesh has no<br />

such agreement with Switzerland.<br />

Last May, Switzerland succumbed<br />

to pressure from the United<br />

States and the European Union<br />

and relaxed its law of secrecy,<br />

which for generations has been the<br />

principal cause of attraction for deposits.<br />

It is alleged that a large amount<br />

of cash is laundered from different<br />

9.66<br />

9.1<br />

Amount in $ billion<br />

Source: GFI<br />

DhakaTribune<br />

branches of multinational banks in<br />

Bangladesh to SNB.<br />

Subhankar Saha, executive director<br />

of Bangladesh Bank, said<br />

different government agencies including<br />

Bangladesh Bank are trying<br />

to take strict measures against<br />

money laundering by Bangladeshi<br />

businessmen through over and under-invoicing.<br />

However, all of the deposits by<br />

Bangladeshis in Swiss banks were<br />

not directly from Bangladesh; a<br />

large portion of the money came<br />

from across the globe, he added.<br />

Subhankar Saha, executive director<br />

of Bangladesh Bank, told<br />

reporters that Bangladesh Bank is<br />

unaware of what the Swiss central<br />

bank based the report on.<br />

He said Bangladesh Bank works<br />

diligently to prevent money laundering.<br />

Seeking anonymity, a Bangladesh<br />

Bank official said they are not<br />

clear about the manner in which<br />

money goes out, but a lot of the<br />

money is actually siphoned off<br />

from Bangladesh.<br />

BB to seek info about Bangladeshi<br />

clients of Swiss Banks again<br />

Though the Swiss National Bank<br />

has not responded to the previous<br />

BB requests for information about<br />

Bangladeshi account holders in SNB,<br />

Bangladesh is going to make further<br />

requests as a new report suggests a<br />

rise in Bangladeshi deposits.<br />

“A letter has already been drafted<br />

in consultation with the government<br />

high-ups and it will be sent to<br />

Swiss authorities shortly,” according<br />

to an official of Bangladesh Bank.<br />

He said they hope SNB will<br />

respond with a list of Bangladeshi<br />

account holders in Swiss banks. •

Interview<br />

3<br />

Sunday, July 9, <strong>20</strong>17<br />

DT<br />

We need transparency, political will, good<br />

investment climate to curb capital flight<br />

Experts say that transparency in source of earning money, political will to stop corruption<br />

and ensuring investment-friendly environment and bringing money launderers into justice<br />

must be ensured to prevent illegal capital flights out of the country. Dhaka Tribune’s<br />

Ibrahim Hoosain Ovi talked to the experts about a recent report on illegal capital flights<br />

and Bangladeshi deposits to Swiss banks<br />

Md Shafiul Islam Mohiuddin<br />

President, FBCCI<br />

It is an allegation that capital flight is being<br />

taken place illegally through under-invoicing<br />

in export and over-invoicing in import. The<br />

government has separate wings to monitor<br />

export and import, and they are responsible<br />

for this.<br />

If the authorities concerned find any irregularities<br />

or corruption in export or import,<br />

they should take stern actions. In this regard,<br />

the government has to ensure proper investigation<br />

and scrutiny.<br />

On the other hand, it’s not true that all the<br />

money deposited in foreign banks are kept<br />

by the Bangladeshis. There are a good number<br />

of Bangladeshi people who live abroad<br />

and are doing business there. They also keep<br />

their money in the banks assuming it safe.<br />

I do not agree with the swipe comment<br />

that the business people are making all the<br />

illegal capital flights or deposits in Swiss National<br />

Bank. It is quite impossible to deposit<br />

a huge amount of money to foreign banks by<br />

a businessman as they do not have enough<br />

money to siphon off.<br />

Without having proper documents, we<br />

should not make any swipe comment about<br />

the business people, bureaucrats or any<br />

group about the capital flights.<br />

While taking findings of a report into the<br />

consideration, we should think about methodology<br />

and process of making of that report<br />

and its credibility. The report is not a sermon<br />

from the bible.<br />

To stop the capital flight, the government<br />

should ensure investment-friendly environment<br />

and the tax system and structure should<br />

be eased and the rate should be lowered.<br />

Above all, the National Board of Revenue<br />

and Bangladesh Bank need to strengthen<br />

their monitoring systems to curb the illegal<br />

capital flights.<br />

Honestly speaking, as a businessman and<br />

business leader, I can tell that no one wants<br />

to send his/her hardly-earned money to another<br />

country. It may only happen when any<br />

one feels insecure in home country. But the<br />

businesspeople always try to expand his/<br />

her business and make investments instead<br />

of depositing to another country’s banking<br />

system.<br />

Khondaker Golam Moazzem<br />

Research Director, Centre for Policy Dialogue<br />

Illegal capital flight and deposits to Swiss<br />

banks continue to rise. In the Panama Papers<br />

leak, names of some political and corporate<br />

leaders were revealed although we saw no<br />

steps were taken later to stop the illegal flight<br />

of capital out of the country. As a result, the<br />

money launderers feel easy about the matter.<br />

If we look into recent trend of illegal capital<br />

flights in India and Pakistan, it shows<br />

downward trend. This is because of their<br />

governments’ internal initiatives taken to<br />

curb money laundering. But in Bangladesh<br />

there is no visible improvement due to lack<br />

of the long-term government policy on the<br />

issue.<br />

Firstly, the government will have to find<br />

out the sources of big and dubious transactions.<br />

Secondly, transparency should be<br />

ensured in the pricing of imported and exported<br />

goods to stop misinvoicing in trade.<br />

Thirdly, monitoring on foreign exchange<br />

dealers should be strengthened to be learned<br />

how much currencies they trade everyday.<br />

In attaining theses goals, all the authority<br />

concerned have to be included with the<br />

Bangladesh Bank Money laundering cell.<br />

By establishing relationship with international<br />

organisations, Bangladesh government<br />

has to collect information about<br />

the laundered money. And then all the people<br />

connected with the misdeed should be<br />

brought under the book.<br />

Besides, the government can consider allowing<br />

business people to invest in foreign<br />

countries on the condition that the profits<br />

must be repatriated to Bangladesh in a transparent<br />

procedure.<br />

M Hafizuddin Khan<br />

Trustee Member, TIB<br />

The lion share of money deposited to Swiss<br />

National Bank and illegal capital flights are<br />

considered as black and earned in illicit way.<br />

But the government is not much aware of<br />

that and is not active about the siphoned-off<br />

money and its sources. Political parties do<br />

not pay heed to the issues of corruption.<br />

If we look into our neighboring countries<br />

like India and Pakistan, they have been able<br />

to reduce illegal capital flights by strengthening<br />

policy and monitoring.<br />

If Bangladesh government wants to stop<br />

illegal capital flight, at first, it will have to<br />

establish the rule of law in the country. The<br />

process of the government procurement and<br />

awarding contracts of job in development<br />

projects should be transparent.<br />

To stop black money, Bangladesh needs to<br />

prevent corruption and all the sectors have to<br />

be freed from illegal transactions.<br />

However, it is very important to ask about<br />

the source of funds when it is being invested<br />

or transferred to any bank. As the regulator<br />

of all financial institutions, Bangladesh Bank<br />

should take the lead in this matter.<br />

On the other hand, the regulatory frame<br />

is not enough to curb amassing of wealth<br />

through illegal means while the existing<br />

rules are weaker and not implemented effectively.<br />

Political stability and peaceful transition<br />

of power through neutral elections is very<br />

important. If political volatility exists in the<br />

country, the people may resort to capital<br />

flight.<br />

Subhankar Saha<br />

Executive Director, Bangladesh Bank<br />

Not only the Bangladeshis living at home but<br />

also those who live, run business and work<br />

in foreign countries are participating in illegal<br />

capital flights or having deposits to Swiss<br />

banks. The non-resident Bangladeshis are<br />

leading the Bangladeshi depositors in terms<br />

of share of deposits in Swiss banks. The money<br />

comes as profits of their business.<br />

However, illegal capital flight from Bangladesh<br />

is done through misinvoicing in export<br />

and import of goods.<br />

According to the Global Financial Integrity<br />

(GFI) report, an average of 87% of global<br />

illicit financial outflows over the <strong>20</strong>05-14 period<br />

were due to the fraudulent misinvoicing<br />

of trade.<br />

As a regulatory body of financial institutions,<br />

Bangladesh Bank is working very hard<br />

with other authorities concerned to stop illegal<br />

capital flight. The process of collecting<br />

information about the illegal capital flight<br />

and their senders. Bangladesh government is<br />

trying hard to sign a MoU to get information<br />

about the money laundering by the Bangladeshi<br />

people.<br />

Bangladesh Bank is seeking information<br />

from the Swiss National Bank management<br />

about the Bangladeshi deposits there. •

4<br />

Sunday, July 9, <strong>20</strong>17<br />

DT<br />

Week in Review<br />

RMG export earnings growth lowest in 15 years<br />

Bangladesh’s export earnings from the<br />

apparel industry, the lifeline of foreign<br />

currency earners, have seen only a<br />

0.<strong>20</strong>% rise to $28.15 billion, which is the<br />

lowest on record in the last one and a half<br />

decades, in the just-concluded fiscal year.<br />

However, Bangladesh’s overall<br />

export earnings stood at $34.83 billion<br />

in FY’17, which is 1.68% higher than the<br />

$34.25 billion a year ago.<br />

Since the inception of RMG export,<br />

Bangladesh has registered negative<br />

growth only once in <strong>20</strong>01-02 fiscal<br />

year, by 5.68%, to $4.58 billion.<br />

Trade analysts and businessmen<br />

have blamed average price fall of<br />

products, ongoing structural reforms<br />

in the apparel industry, economic slowdown<br />

and sluggish demand in export<br />

destinations, devaluation of Euro and<br />

appreciation of BDT against US dollar,<br />

for the lackluster export growth.<br />

According to provisional data of<br />

Export Promotion Bureau (EPB),<br />

Bangladesh’s export earnings from<br />

the RMG sector stood at $28.14 billion,<br />

posting 0.<strong>20</strong>% growth in the past fiscal<br />

year. The figure is 7.34% less than the<br />

target of $30.38 million.<br />

In the last fiscal year, Bangladesh<br />

earned $28.09 billion from the clothing<br />

industry.<br />

Of the total amount, Knitwear<br />

products earned $13.76 billion, which is<br />

3% higher than the $13.35 billion in the<br />

same period a year ago. Woven products<br />

earned $14.39 billion, down by 2.35%,<br />

compared to $14.73 billion a year ago.<br />

As per the provisional data, in FY’17,<br />

Bangladesh’s overall export earnings<br />

stood at $34.83 billion with 1.68%<br />

growth. The figure is over $2 billion less<br />

than that of the government target of<br />

$37 billion set for the previous fiscal. In<br />

June, export earnings saw a 15.27% fall<br />

to $3 billion, which was $3.59 billion in<br />

the same period last year.<br />

“The meager growth is a reality in<br />

the Bangladesh RMG sector. It comes<br />

as no surprise as the apparel industry<br />

is going through many challenges,<br />

including remediation, devaluation<br />

of Euro and labour unrest,” Exporters<br />

Association president Abdus Salam<br />

Murshedy told the Dhaka Tribune.<br />

RMG manufacturers are working<br />

hard to face the challenges by<br />

introducing production engineering,<br />

technological upgrade etc, but it is not<br />

enough, said Salam.<br />

Dhaka Tribune<br />

In continuation with the existing policy<br />

support, the government should offer<br />

special incentives, including 5% cash<br />

incentives on the value of Freight on<br />

Board (FoB) for at least next two years,<br />

the former BGMEA president said.<br />

On the other hand, to bring about<br />

sound export growth, the government<br />

has to come up with long-term policy<br />

support, including tax holiday for 10<br />

years, for new investors to attract<br />

investment. •<br />

World Bank, IMF<br />

unhappy with VAT<br />

law suspension<br />

The World Bank (WB) and the International<br />

Monetary Fund (IMF) has<br />

sent a letter to the Finance Ministry<br />

saying they were disappointed<br />

about the VAT Law <strong>20</strong>12 not being<br />

implemented this fiscal year.<br />

In the letter, the World Bank<br />

asked the government to implement<br />

the law immediately saying<br />

without the new law, the government’s<br />

revenue will slow down<br />

along with negatively impact GDP<br />

growth and create difficulties in<br />

getting foreign financial assistance.<br />

The WB and IMF said the government<br />

has stalled the implantation<br />

of the new VAT law the very<br />

last minute even though the law<br />

was complete. They collectively<br />

said that it was illogical to fear an<br />

increase in the inflation rate.<br />

They warned that keeping the old<br />

VAT law would be bad for Bangladesh’s<br />

relationship with the country’s<br />

development partners, adding:<br />

“The government has failed execute<br />

the <strong>20</strong>12 VAT law for five years.”<br />

The two development partner<br />

suggested that without the<br />

implementation of the new VAT<br />

law, Bangladesh’s aid and credit<br />

standard might be impacted. The<br />

development partners said the government<br />

will find it hard to finance<br />

and implement the new budget in<br />

the beginning of the fiscal year. •<br />

Corporate News<br />

Prime Minister’s Office (PMO) and Bangladesh Export Processing Zones Authority (BEPZA) have<br />

recently signed an annual performance agreement for the fiscal year <strong>20</strong>17-18, said a press release.<br />

Senior secretary at Prime Minister’s Office, Suraiya Begum and executive chairperson of BEPZA, Major<br />

General Mohd Habibur Rahman Khan have signed the agreement<br />

University Grants Commission (UGC) of Bangladesh and Council of Higher Education (CoHE) of Turkey<br />

have recently signed an agreement on providing seven Bangladeshi students with PhD scholarship<br />

facilities in textile education at Turkish universities every year, said a press release. Chairperson of UGC,<br />

Professor Abdul Mannan and Professor Dr MA Yekta Sarac, president at Council of Higher Education of<br />

Turkey have signed the agreement<br />

Social Islami Bank Limited has recently held its half-yearly business conference for the year <strong>20</strong>17, said a<br />

press release. The bank’s chairperson, Major Dr Md Rezaul Haque (retired) inaugurated the conference<br />

as chief guest<br />

PBL Exchange (UK) Ltd London, a wholly owned company of Prime Bank has recently held a gettogether<br />

programme with its agents and clients at its Birmingham and Oldham branches for boosting<br />

inward remittance, said a press release. The bank’s DMD, Habibur Rahman was present at the<br />

programme along others

Stocks<br />

5<br />

Sunday, July 9, <strong>20</strong>17<br />

DT<br />

W E E K L Y M a r k e t O v e r v i e w<br />

SUMMARY Points Change (%) Turnover (BDTmn) Volume (mn) Advanced issues Declined issues Unchanged <strong>Issue</strong>s<br />

DSEX<br />

5,749.7 DSEX 5,749.7 2.69% 52,956 1,659 281 41 11<br />

(+) 2.69%<br />

CSE ASI 17,819.4 1.73% 3,335 122 216 58 12<br />

Stocks continue to rally amid higher turnover<br />

• Tribune <strong>Business</strong> Desk<br />

Stocks have recorded yet another<br />

week of massive gains on increase<br />

investors participation last week.<br />

High level of investor participation<br />

has been one of the key drivers<br />

to the recent rally, said traders<br />

at several stock brokerages. They<br />

added, the market is anticipating<br />

overall positive earnings results<br />

this July and satisfactory dividend<br />

announcements of the June-ending<br />

companies as well.<br />

Participation in the Dhaka Stock<br />

Exchange increased substantially<br />

by 48.2% to amount an average<br />

daily turnover of Tk1059cr, crossing<br />

the Tk1,000cr mark.<br />

Fresh funds are being injected<br />

into the market based on recent<br />

turnover, suggested a technical analyst<br />

of a leading stock brokerage.<br />

The benchmark index, DSEX<br />

Most Traded Price Weekly change<br />

LankaBangla 57.0 2.52%<br />

Regent Textile 31.1 0.32%<br />

Baraka Power 46.4 6.42%<br />

Fu Wang Food 21.0 32.91%<br />

Keya Cosmetics 16.4 13.89%<br />

Doreen Power 156.1 1.42%<br />

BEXIMCO 34.4 4.24%<br />

Prime Bank 23.9 6.70%<br />

SAIF Powertec 46.1 5.98%<br />

ICB 195.2 10.59%<br />

Dhaka Tribune has accumulated the stock market related data primarily from Dhaka Stock Exchange website. The basis of information collected was primarily from daily stock quotations and audited/unaudited<br />

reports of publicly listed companies. High level of caution has been taken to collect and present the above information and data. The publisher will not take any responsibility if any body uses this information and<br />

data for his/her investment decision. For any query please email to news@dhakatribune.com.<br />

Asian stocks hit by Wall Street stumble<br />

• Reuters, Tokyo<br />

Asian shares lost ground on Friday<br />

after a weak session on Wall Street,<br />

while global sovereign debt yields<br />

were elevated across the board on<br />

bets the European Central Bank<br />

is moving closer to unwinding its<br />

massive monetary stimulus.<br />

Spreadbetters expected Britain’s<br />

FTSE to open 0.25% lower,<br />

Germany’s DAX to open 0.3%<br />

lower and France’s CAC to open<br />

down 0.2%.<br />

MSCI’s broadest index of<br />

Asia-Pacific shares outside Japan<br />

slipped 0.4%, after the Dow lost<br />

0.7% and the tech-heavy Nasdaq<br />

fell 1% on Thursday, partly as<br />

higher Treasury yields dimmed<br />

the appeal of equities.<br />

Japan’s Nikkei was down 0.5%,<br />

closed at 5,749.7 points on last<br />

Thursday after gaining 150.58<br />

points or 2.69% over the week<br />

while CSE ASI advanced 302.7<br />

points or 1.73% to end at 17,819.4<br />

points.<br />

5,800<br />

5,780<br />

5,760<br />

5,740<br />

5,7<strong>20</strong><br />

5,700<br />

5,680<br />

5,660<br />

5,640<br />

5,6<strong>20</strong><br />

5,600<br />

5,580<br />

Dhaka Tribune<br />

Textile equities contributed<br />

17.7% of the week’s total turnover,<br />

said the weekly market report of<br />

UCB Capital Management Ltd.<br />

Fu Wang Food Limited secured<br />

the highest weekly gain of 32.9%<br />

MOVEMENT OF DSEX INDEX LAST WEEK<br />

South Korea’s KOSPI dropped<br />

0.3% and Australian stocks declined<br />

0.9%. Hong Kong’s Hang<br />

Seng slipped 0.4%.<br />

The prospect of the ECB turning<br />

off the flow of easy money<br />

has been a dominant global market<br />

theme since President Mario<br />

Draghi’s hawkish comments last<br />

week, pushing bond yields higher<br />

and hurting equities.<br />

The pan-European STOXX 600<br />

fell to an 11-week low the previous<br />

day and the German 10-year<br />

bund yield rose above 0.5% to<br />

an 18-month high after the ECB’s<br />

June meeting minutes showed<br />

the central bank opening the door<br />

to dropping a long-standing bond<br />

buying pledge.<br />

“It is natural for risk assets in<br />

developed markets to adjust lower<br />

on prospects of curbed liquidity,<br />

as easy money has allowed<br />

them to rise far out of proportion<br />

with their underlying real economies,”<br />

said Yoshinori Shigemi,<br />

global market strategist at JPMorgan<br />

Asset Management.<br />

“For the ECB, tapering of easy<br />

policy and hiking rates are two totally<br />

different things, and it is likely<br />

to make this clear. But right now<br />

the markets are having a hard time<br />

believing the ECB’s intentions.”<br />

The 10-year Treasury note<br />

yield stood near a two-month<br />

high of 2.39%. With more focus<br />

on the euro zone bond market’s<br />

rise in yields, Treasuries brushed<br />

off Thursday’s weaker-than-expected<br />

US ADP employment data.<br />

“Expectations that the European<br />

Central Bank and other central<br />

while Shinepukur Ceramics Limited<br />

turned out the worst loser<br />

with its price declining by 10.1%.<br />

LankaBangla Finance Ltd secured<br />

leadership position on the<br />

top turnover chart with a turnover<br />

of Tk157cr over the week with<br />

its share price advancing 2.5% by<br />

the end of week.<br />

DS30, the blue-chip index<br />

gained 32.2 points or 1.55% to end<br />

at 2,103.6 points, while DSE Shariah<br />

based index advanced 21.1<br />

points or 1.64% to close at 1,307<br />

points.<br />

Among the traded issues 281<br />

gained, 41 declined and 11 remained<br />

unchanged during the<br />

week.<br />

The Dhaka Stock Exchange currently<br />

has a market capitalisation<br />

of BDT 385,426cr with the benchmark<br />

index, DSEX up by 14.2%<br />

since beginning of this year. •<br />

DAY 0 DAY 1 DAY 2 DAY 3 DAY 4 DAY 5<br />

banks joining the Federal Reserve<br />

in moving towards tighter policies<br />

are causing a diversification<br />

of funds away from Treasuries,”<br />

said Junichi Ishikawa, senior forex<br />

strategist at IG Securities in Tokyo.<br />

“The key point is that higher<br />

US yields also tend to weigh on<br />

high-tech sectors by increasing<br />

their funding costs.”<br />

The 10-year Japanese government<br />

bond (JGB) yield initially<br />

reached 0.105%, its highest since<br />

February.<br />

But the rise prompted the Bank<br />

of Japan to act, pushing the 10-year<br />

JGB yield back to 0.09%. The central<br />

bank, which has tasked itself<br />

to control the yield curve as a part<br />

of its easy policy, offered to buy an<br />

unlimited amount of 10-year JGBs<br />

on Friday in order to cap yields. •<br />

DSE NEWS<br />

PRAGATILIF: The Board of Directors<br />

has recommended 8% cash dividend<br />

and 17 % stock dividend for the year<br />

ended on December 31, <strong>20</strong>16. Date of<br />

AGM: 28.09.<strong>20</strong>17, Time: 10:30 AM, Venue:<br />

To be notified later. Record Date:<br />

27.07.<strong>20</strong>17. Q1 Un-audited: Increase in<br />

life revenue account for Jan-Mar, <strong>20</strong>17<br />

was Tk. 108.58 million with total life<br />

insurance fund of Tk. 4,869.71 million as<br />

against increase in life revenue account<br />

of Tk. 92.98 million and Tk. 4,353.12<br />

million respectively for the same period<br />

of the previous year.<br />

DOREENPWR: The Company has<br />

informed that Dhaka Southern Power<br />

Generations Limited (DSPGL), a subsidiary<br />

of Doreen Power Generations and<br />

Systems Limited (DPGSL) has allotted<br />

50,66,700 Ordinary shares of Tk.<br />

100.00 each to DPGSL (against share<br />

money deposit) after getting consent<br />

from the BSEC vide letter No. BSEC/CI/<br />

CPLC (Pvt.)-653/<strong>20</strong>15/318 dated July<br />

02, <strong>20</strong>17. After this allotment of the<br />

shares, holding of DPGSL in the books<br />

of DSPGL has been increased to 99.14%<br />

from 96.78%.<br />

IFADAUTOS: The Company has<br />

informed that the Board of Directors<br />

has decided to sell 402.34 decimal<br />

land (Book Value Tk. 63,891,592.00)<br />

at Khalia, Dhamrai, Dhaka and<br />

767.25 decimal land (Book Value Tk.<br />

121,839,300.00) at Khulla, Dhamrai,<br />

Dhaka and subsequently purchase land<br />

adjacent to IFAD Autos Limited’s assembly<br />

unit. The detailed proceed of sale<br />

will be notified after its execution.<br />

PTL: With reference to their earlier<br />

news (disseminated by DSE on<br />

31.05.<strong>20</strong>17), the Company has further<br />

informed that the Board of Directors of<br />

the Company has decided to participate<br />

to develop HSD Based 2X100 MW IPP/<br />

Rental Power Plant in the First Track<br />

Project of the Ministry of Power and<br />

Energy under Paramount-Aggretech<br />

Energy Consortium at the same ratio<br />

i.e. 55% of equity capital in the project<br />

on Build, Own and Operate (BOO)<br />

basis upon getting permission from<br />

the concern authority at Bheramara,<br />

Kushtia/Santahar/Thakurgaon or<br />

any other place in Bangladesh under<br />

Bangladesh Power Development Board<br />

(BPDB). The Board of Directors has also<br />

decided to act as the Lead Member and<br />

contribute 55% on total equity of the<br />

project amongst the members of the<br />

consortium. Contributions of the other<br />

parties will be as follows: Aggretech AG<br />

(as Operating Member): <strong>20</strong>% of total<br />

equity, Paramount Holdings Ltd. (as<br />

Other Member-1): 10% of total equity,<br />

Paramount Spinning Ltd. (as Other<br />

Member-2): 15% of total equity. •

6<br />

Sunday, July 9, <strong>20</strong>17<br />

DT<br />

OPINION<br />

Loosen the regulatory system<br />

We have to make moves to build a forward-looking and fast-growing trading nation<br />

• Mamun Rashid<br />

Despite a lot of constraints and<br />

somewhat love for the “Approval<br />

Raj,” the Bangladesh Bank<br />

has offered a lot of support and<br />

“hand-holding” to the growing<br />

private sector in Bangladesh.<br />

Starting from allowing backto-back<br />

import L/Cs for apparel<br />

exports, it continued with export<br />

retention quotas, holding foreign<br />

exchange for overseas business<br />

development, loans from foreign<br />

bilateral and multilateral agencies,<br />

parent company loans, issuance of<br />

repatriation guarantee, increase of<br />

the travel quotas, special quotas<br />

for treatment abroad, remittance<br />

of tuition fees for studying abroad,<br />

remittance of foreign consultants<br />

fees and technical fees, repatriation<br />

of profit or dividend against foreign<br />

direct investment, and investment<br />

in traded securities in the bourses.<br />

In fact, most Bangladesh Bank<br />

officials are busy processing<br />

approval requests for various<br />

private sector entities on a day-today<br />

basis. Even after 45 years of<br />

independence, almost every third<br />

inward or outward remittance<br />

requires central bank clarification,<br />

or consent, or mostly approval.<br />

While individual remittance has<br />

gone through reasonable reforms<br />

or liberalisation, enterprise-level<br />

inward and outward inflow still<br />

remains an issue which warrants<br />

a lot of filtering, making the outward<br />

flows still quite complex and<br />

cumbersome.<br />

After independence, we inherited<br />

a war-torn economy with a<br />

very low foreign exchange reserve.<br />

Therefore, we appreciated the<br />

slow pace of reforms in the foreign<br />

exchange regime. In <strong>20</strong>01, our net<br />

foreign exchange reserve dropped<br />

to lower than $1 billion. The then<br />

Governor of central bank contacted<br />

his many counterparts in the<br />

Middle East to provide some foreign<br />

currency liquidity support to<br />

take care of increasing commodity<br />

imports and imports for exports.<br />

Known to be the foreign exchange<br />

man, Allah Malik Kazemi<br />

requested all global banks operating<br />

locally to put in some foreign<br />

currency deposits with the central<br />

bank. The good thing was, despite<br />

all the challenges, our trade was<br />

happening, and L/Cs were opened,<br />

routed, and confirmed through<br />

the global banks. Where L/Cs were<br />

being opened and settlement monitoring<br />

was heightened, Bangladesh<br />

Bank didn’t follow the route of RBI,<br />

such as putting up a 300% cash<br />

margin for opening L/Cs or “no export,<br />

no import” commandments.<br />

Bangladesh Bank is still trying<br />

to hand-hold private enterprises<br />

Foreign currency being counted at a money exchange<br />

Nothing can happen if our regulatory regime does not become<br />

more friendly and helpful. Even if the regulators are helpful, they<br />

can’t do much without the right tools and guidelines<br />

through quick disposal of their<br />

FCY inflow-outflow requests.<br />

This is taking a lot of their time in<br />

the absence of clear guidelines.<br />

Emerging realities also don’t allow<br />

them to take shelter under existing<br />

guidelines for foreign exchange<br />

transactions or relevant core risk<br />

management guidelines.<br />

Development partners, especially<br />

the IMF, have been talking of the<br />

further liberalisation of the current<br />

account transactions and updating<br />

the outdated Foreign Exchange<br />

Regulation Act (FERA) 1947.<br />

Although it looks very odd<br />

for an independent country like<br />

Bangladesh to chalk out its growth<br />

path to a middle income country<br />

with this 1947 cross border<br />

transaction rule, the reality tells<br />

us that we don’t know when our<br />

distinguished members of the<br />

parliament could approve a new<br />

foreign exchange regulation act,<br />

suited more to the dreams of a<br />

forward-looking and fast-growing<br />

trading nation.<br />

The archaic 1947 act is not<br />

allowing Bangladesh Bank’s “very<br />

helpful officials” to do much in<br />

attending to emerging issues in<br />

international trade and remittance<br />

flows. They have been issuing<br />

prudential guidelines to: Increase<br />

travel quota (though still miniscule<br />

against the increasing travel needs<br />

of the individual business person or<br />

professionals), creating space within<br />

the student quota, remittance of<br />

withdrawal proceeds by a foreign<br />

investor, expansion of the EDF<br />

program, and extension of the deferred<br />

payment for USANCE L/Cs or<br />

increasing the space for e-wallets.<br />

They have issued almost 50 circulars<br />

in this regard in recent times.<br />

Our foreign exchange reserve is<br />

on its way to $35bn, yet a traveler<br />

can’t deposit more than $5,000 on<br />

his/her return to his/her account if<br />

not declared at the airport, or easily<br />

buy tickets for overseas travels.<br />

Remitting a single dollar<br />

outside the country for investment<br />

abroad still raises a lot of<br />

eyebrows. Establishing the local<br />

representative office or agency by<br />

the global corporations is still a<br />

tough exercise.<br />

The consular section at the local<br />

US or European country embassies<br />

or Indian high commission reportedly<br />

increased the issuance of<br />

non-immigrant or business visas<br />

manifold.<br />

When I asked the US consular<br />

head the reasons behind the move,<br />

she promptly replied: “Bangladesh’s<br />

economy is growing at a<br />

steady pace; its entrepreneurship<br />

is growing fast, they need to<br />

connect with their US counterparts<br />

for their exports and raw materials<br />

or capital equipment sourcing<br />

Syed Zakir Hossain<br />

or know-how purchases; there<br />

are more and more Bangladeshi<br />

students qualifying for good US<br />

colleges and universities; more<br />

Bangladeshi graduates are making<br />

their presence felt in the US professional<br />

world, and these realities are<br />

convincing us to facilitate their entry<br />

to the US for our own interest.”<br />

The whole world has started<br />

to accept Bangladesh as a global<br />

player in its chosen field.<br />

The buyers want our capacity<br />

to increase, see our performance<br />

improve, our workers’ productivity<br />

to go up, and entrepreneurs to<br />

reduce their business’ costs.<br />

Nothing can happen if our regulatory<br />

regime does not become<br />

more friendly and helpful. Even<br />

if the regulators are helpful, they<br />

can’t do much without the right<br />

tools and guidelines. We need to<br />

change, revise, and upgrade our<br />

foreign exchange rules.<br />

It also has to happen fast.<br />

Bangladesh not only requires<br />

continuous liberalisation in current<br />

account transactions, time<br />

is possibly ripe to start thinking<br />

about capital account convertibility<br />

in order for us to be ahead<br />

of our peers or competitors in the<br />

identified opportunity spaces. •<br />

Mamun Rashid is a leading banker and<br />

economic analyst in Bangladesh.

OPINION 7<br />

Information is all we need<br />

No need to reinvent the wheel<br />

DT<br />

Sunday, July 9, <strong>20</strong>17<br />

GROSS NATIONAL INCOME (GNI) PER CAPITA, ATLAS METHOD (CURRENT USD)<br />

1,400.0<br />

1,<strong>20</strong>0.0<br />

1,000.0<br />

800.0<br />

600.0<br />

400.0<br />

<strong>20</strong>0.0<br />

1972<br />

1973<br />

1974<br />

1975<br />

1976<br />

1977<br />

1978<br />

1979<br />

1980<br />

1981<br />

1982<br />

1983<br />

1984<br />

1985<br />

1986<br />

1987<br />

1988<br />

1989<br />

1990<br />

1991<br />

1992<br />

1993<br />

1994<br />

1995<br />

1996<br />

1997<br />

1998<br />

1999<br />

<strong>20</strong>00<br />

<strong>20</strong>01<br />

<strong>20</strong>02<br />

<strong>20</strong>03<br />

<strong>20</strong>04<br />

<strong>20</strong>05<br />

<strong>20</strong>06<br />

<strong>20</strong>07<br />

<strong>20</strong>08<br />

<strong>20</strong>09<br />

<strong>20</strong>10<br />

<strong>20</strong>11<br />

<strong>20</strong>12<br />

<strong>20</strong>13<br />

<strong>20</strong>14<br />

<strong>20</strong>15<br />

<strong>20</strong>16<br />

Source: World Bank<br />

But what will<br />

really drive<br />

that growth<br />

is the people<br />

in Bangladesh<br />

applying the<br />

methods of<br />

adding value<br />

that others have<br />

already worked<br />

out<br />

THE lAST<br />

WORD<br />

• Tim Worstall<br />

Sheikh Hasina has announced that<br />

income per capita in Bangladesh<br />

will be $12,000 by <strong>20</strong>41. That’s up<br />

from the current $1,600 or so but<br />

we should point out that the PM<br />

hasn’t quite announced that it will<br />

be so, rather that we are aiming to<br />

reach that amount.<br />

We should also point out that<br />

while it is not unlikely to be easy,<br />

nor will it be a straight path, there<br />

is no fundamental reason why it<br />

should not or cannot happen.<br />

Compound economic growth<br />

just works that way; if growth is<br />

just a little higher than it is currently<br />

and continues on for those<br />

decades then it will happen.<br />

There is also no particular reason<br />

to think that it won’t happen<br />

that way.<br />

Of course, there is always the<br />

possibility of disaster, a rather<br />

higher possibility of bad economic<br />

policy being implemented, but<br />

it is a general assumption in the<br />

economic world that the currently<br />

developing countries will continue<br />

to develop.<br />

It’s such a basic assumption<br />

that it is even built into all our<br />

calculations about climate change,<br />

for example.<br />

This process is called convergence<br />

and there’s a very good<br />

reason we think it should happen.<br />

The difficulty with economic<br />

growth is that we’ve got to<br />

work out what to do next. Gross<br />

domestic product, or GDP, is the<br />

value that is added in an economy<br />

each year and we generally define<br />

economic growth as being a rise<br />

in GDP.<br />

The head scratcher, the puzzler,<br />

is always, well, what is it that we<br />

do to add more value? At which<br />

point a developing country has an<br />

advantage over a developed one.<br />

By definition, a developed<br />

country is at the technological<br />

frontier. They’ve already implemented<br />

all the ways to add value<br />

that they know of and thus to<br />

advance any more they’ve got to<br />

invent some more.<br />

This is not an easy task and<br />

that’s why it takes time. Thus the<br />

currently advanced countries grow<br />

at 1, 2 and if they’re lucky 3% a<br />

year, simply because there aren’t<br />

all that many bright people to<br />

work out how to add more value.<br />

A developing country, again by<br />

definition, is not at that frontier.<br />

If it were it would be rich already.<br />

But they have plenty of examples<br />

to follow – as in, developed<br />

countries – in terms of what to do<br />

to add more value.<br />

As we all remember from school<br />

– OK, there will be a clever clogs<br />

who never did this but for the rest<br />

of us – homework is a lot easier if<br />

you can copy it rather than having<br />

to work it all out yourself.<br />

A developing country can and<br />

should grow faster than an already<br />

rich one – thus that convergence<br />

– so that in the end we should all<br />

end up in roughly the same place,<br />

the same level of income and<br />

wealth.<br />

One such idea is using VAT as a<br />

major part of the tax system. VAT<br />

is a tax upon consumption and<br />

this causes less economic distortion<br />

or dislocation than taxes upon<br />

incomes or capital.<br />

So, the general move to a<br />

simple VAT system is a good idea<br />

for Bangladesh, despite it having<br />

just been postponed for a couple<br />

of years.<br />

The rise in taxation upon SIM<br />

cards probably isn’t such a good<br />

idea. Of course, I’m not trying to<br />

tell the government what they<br />

should do but a general observation<br />

is that mobile telephony is the<br />

one single technology we know of<br />

that promotes economic growth<br />

more than any other.<br />

The actual finding is that 10% of<br />

the population with a phone, in a<br />

country previously without a general<br />

landline network, adds 0.5%<br />

each year. That’s not 0.5% of extra<br />

growth, that’s 0.5% of GDP growth<br />

just from that 10% having a phone.<br />

Sadly, it doesn’t scale all the way,<br />

we don’t then assume we’ll get<br />

5% GDP growth each year just by<br />

everyone having a phone.<br />

But information is the lifeblood<br />

of economic growth – as above,<br />

we’re trying to apply, in most<br />

circumstances, things that others<br />

have already worked out. Thus<br />

we must know, of course, what it<br />

is that those others have already<br />

worked out.<br />

We should therefore treat mobile<br />

telephony, and the next stage<br />

mobile internet, not as a consumption<br />

good but rather an intermediate.<br />

What that means is that<br />

communication is something that<br />

then feeds into the production of<br />

other things. And we tend to think<br />

that we shouldn’t tax intermediate<br />

goods, only final consumption,<br />

and or income.<br />

In general Sheikh Hasina’s goal<br />

is entirely achievable, even if I’d<br />

prefer to agree that it will be a bit<br />

of a stretch.<br />

I’m not the world’s greatest<br />

mathematician but I see that as<br />

being 8% compound GDP growth<br />

over the next couple of decades.<br />

China has recently achieved<br />

that, South Korea and Japan before<br />

that, India looks on the way to it<br />

and Bangladesh has been managing<br />

just under that for two decades<br />

now.<br />

Yes, it’s possible. Others have<br />

done it and Bangladesh is close to<br />

it already.<br />

As to how, well, generally a<br />

market and capitalist economy is<br />

going to help, for no one has done<br />

it without that.<br />

Other than that, the various<br />

policy decisions like VAT, or SIM<br />

card taxation, are going to make a<br />

difference at the edges.<br />

But what will really drive that<br />

growth is the people in Bangladesh<br />

applying the methods of adding<br />

value that others have already<br />

worked out. •<br />

Tim Worstall is a Senior Fellow at the<br />

Adam Smith Institute in London.