Nanotechnology

A big future for small things? Global Investor Focus, 02/2005 Credit Suisse

A big future for small things?

Global Investor Focus, 02/2005

Credit Suisse

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

GLOBAL INVESTOR FOCUS<br />

<strong>Nanotechnology</strong>—32<br />

Investing in nanotechnology is<br />

its own science<br />

The burgeoning field of nanotechnology<br />

promises huge potential in many sectors<br />

of the economy. Investors who want to<br />

position themselves in this technology<br />

must be able to distinguish between<br />

reality and science fiction.<br />

Maria Custer / Credit Suisse<br />

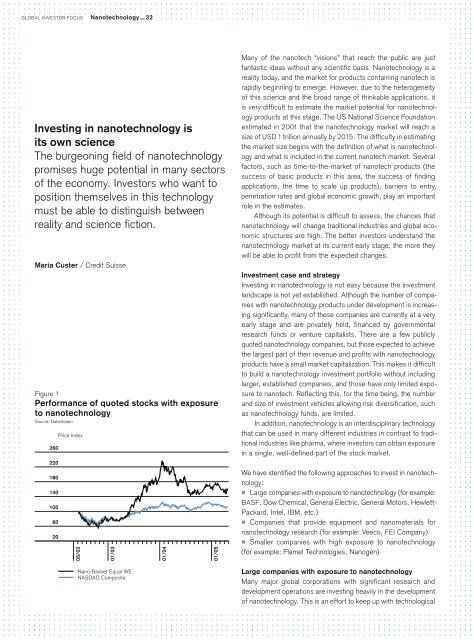

Figure 1<br />

Performance of quoted stocks with exposure<br />

to nanotechnology<br />

Source: Datastream<br />

260<br />

220<br />

180<br />

140<br />

100<br />

60<br />

20<br />

Price Index<br />

05/02<br />

01/03<br />

Nano Basket Equal WE<br />

NASDAQ Composite<br />

01/04<br />

01/05<br />

Many of the nanotech “visions” that reach the public are just<br />

fantastic ideas without any scientific basis. <strong>Nanotechnology</strong> is a<br />

reality today, and the market for products containing nanotech is<br />

rapidly beginning to emerge. However, due to the heterogeneity<br />

of this science and the broad range of thinkable applications, it<br />

is very difficult to estimate the market potential for nanotechnology<br />

products at this stage. The US National Science Foundation<br />

estimated in 2001 that the nanotechnology market will reach a<br />

size of USD 1 trillion annually by 2015. The difficulty in estimating<br />

the market size begins with the definition of what is nanotechnology<br />

and what is included in the current nanotech market. Several<br />

factors, such as time-to-the-market of nanotech products (the<br />

success of basic products in this area, the success of finding<br />

applications, the time to scale up products), barriers to entry,<br />

penetration rates and global economic growth, play an important<br />

role in the estimates.<br />

Although its potential is difficult to assess, the chances that<br />

nanotechnology will change traditional industries and global economic<br />

structures are high. The better investors understand the<br />

nanotechnology market at its current early stage, the more they<br />

will be able to profit from the expected changes.<br />

Investment case and strategy<br />

Investing in nanotechnology is not easy because the investment<br />

landscape is not yet established. Although the number of companies<br />

with nanotechnology products under development is increasing<br />

significantly, many of these companies are currently at a very<br />

early stage and are privately held, financed by governmental<br />

research funds or venture capitalists. There are a few publicly<br />

quoted nanotechnology companies, but those expected to achieve<br />

the largest part of their revenue and profits with nanotechnology<br />

products have a small market capitalization. This makes it difficult<br />

to build a nanotechnology investment portfolio without including<br />

larger, established companies, and those have only limited exposure<br />

to nanotech. Reflecting this, for the time being, the number<br />

and size of investment vehicles allowing risk diversification, such<br />

as nanotechnology funds, are limited.<br />

In addition, nanotechnology is an interdisciplinary technology<br />

that can be used in many different industries in contrast to traditional<br />

industries like pharma, where investors can obtain exposure<br />

in a single, well-defined part of the stock market.<br />

We have identified the following approaches to invest in nanotechnology:<br />

p Large companies with exposure to nanotechnology (for example:<br />

BASF, Dow Chemical, General Electric, General Motors, Hewlett-<br />

Packard, Intel, IBM, etc.)<br />

p Companies that provide equipment and nanomaterials for<br />

nanotechnology research (for example: Veeco, FEI Company)<br />

p Smaller companies with high exposure to nanotechnology<br />

(for example: Flamel Technologies, Nanogen)<br />

Large companies with exposure to nanotechnology<br />

Many major global corporations with significant research and<br />

development operations are investing heavily in the development<br />

of nanotechnology. This is an effort to keep up with technological