CIO & LEADER-November 2017 (1)

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Insight<br />

FFour out of five respondents (81%) in a recent<br />

survey said security is an important factor while<br />

considering online payments. This is similar across<br />

the board - gender, ages, household income and even<br />

education levels.<br />

The study, conducted by Visa, observed high<br />

inclination amongst Indian consumers (78%) in<br />

favour of adopting newer modes of digital payments,<br />

indicating increased awareness, acceptance<br />

and adoption of digital forms of payments among<br />

Indian consumers.<br />

One of the factors that surfaced as the key driver<br />

of this adoption was the ease of transition to digital<br />

form factors of payments, as stated by 86% of the<br />

respondents. Amongst those who have used lesscash<br />

currently than before, 70% state that the main<br />

reasons to transit away from cash include – convenience,<br />

efficiency and speed of transaction offered<br />

by digital modes.<br />

This survey was aimed at understanding the<br />

pulse of the Indian consumer and their views<br />

towards the transition to a digital economy. The<br />

study indicates that amongst people for whom this<br />

transition was tough:<br />

41% find that merchants they go to only<br />

accept cash<br />

39% are worried about the security of their<br />

transactions.<br />

52% find insufficient modes of payments as a<br />

key barrier.<br />

Visa, the world’s leader in digital payments,<br />

today announced an independent study, examining<br />

the consumer sentiment around digital payments<br />

in India.<br />

The survey also shows that millennials are more<br />

likely to use digital payments for everyday essentials<br />

like shopping at supermarkets, online, department<br />

stores, fast food restaurants, taxis/cabs etc.<br />

than other generations. The study also shows that<br />

the inclination towards embracing digital is higher<br />

amongst those from a higher income household.<br />

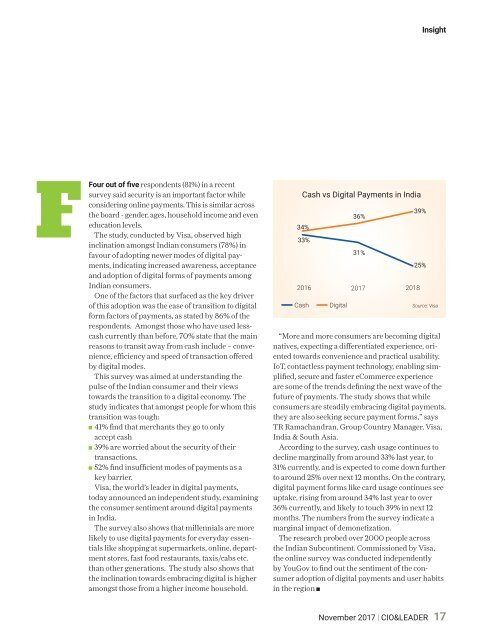

Cash vs Digital Payments in India<br />

34%<br />

33%<br />

36%<br />

31%<br />

2016 <strong>2017</strong> 2018<br />

Cash<br />

Digital<br />

39%<br />

25%<br />

Source: Visa<br />

“More and more consumers are becoming digital<br />

natives, expecting a differentiated experience, oriented<br />

towards convenience and practical usability.<br />

IoT, contactless payment technology, enabling simplified,<br />

secure and faster eCommerce experience<br />

are some of the trends defining the next wave of the<br />

future of payments. The study shows that while<br />

consumers are steadily embracing digital payments,<br />

they are also seeking secure payment forms,” says<br />

TR Ramachandran, Group Country Manager, Visa,<br />

India & South Asia.<br />

According to the survey, cash usage continues to<br />

decline marginally from around 33% last year, to<br />

31% currently, and is expected to come down further<br />

to around 25% over next 12 months. On the contrary,<br />

digital payment forms like card usage continues see<br />

uptake, rising from around 34% last year to over<br />

36% currently, and likely to touch 39% in next 12<br />

months. The numbers from the survey indicate a<br />

marginal impact of demonetization.<br />

The research probed over 2000 people across<br />

the Indian Subcontinent. Commissioned by Visa,<br />

the online survey was conducted independently<br />

by YouGov to find out the sentiment of the consumer<br />

adoption of digital payments and user habits<br />

in the region<br />

<strong>November</strong> <strong>2017</strong> | <strong>CIO</strong>&<strong>LEADER</strong><br />

17