CIO & LEADER-November 2017 (1)

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Every three years since 2001, the Reserve<br />

Bank of India (RBI) has been releasing what it<br />

calls a payment systems vision – a document<br />

that articulates the policy and regulatory<br />

stance it would take with regards to payment<br />

systems for next three years.<br />

In its fourth such document, called Payment System Vision<br />

2012-15, released as a draft in June 2012 and finalized in<br />

October the same year, the central bank moved from just talking<br />

about attributes such as safety, security, interoperability<br />

and efficiency to explicitly give itself a mandate to push electronic<br />

payments.<br />

The vision statement of that document read something like<br />

this: To proactively encourage electronic payment systems<br />

for ushering in a less-cash society in India and to ensure payment<br />

and settlement systems in the country are safe, efficient,<br />

interoperable, authorized, accessible, inclusive and compliant<br />

with international standards.<br />

For the first time, two phrases entered the vision lexicon:<br />

Electronic payment and less-cash society.<br />

To put it in context, the vision document came only five<br />

months after the then finance minister Pranab Mukherjee,<br />

releasing a white paper on black money that explicitly<br />

stressed on the need to move to electronic payments to curb<br />

the circulation of black money. The white paper is not available<br />

in the Department of Revenue site anymore.<br />

RBI’s insertion of the phrase ‘less-cash society’ was seen<br />

by many as a dream than a vision at that time, though many<br />

hailed the idea behind it.<br />

But in the next few months, RBI demonstrated that it was<br />

serious. For one, it slashed debit card transaction fees; it<br />

mandated the banks to go for electronic payments even while<br />

allowing some concessions to mobile wallets.<br />

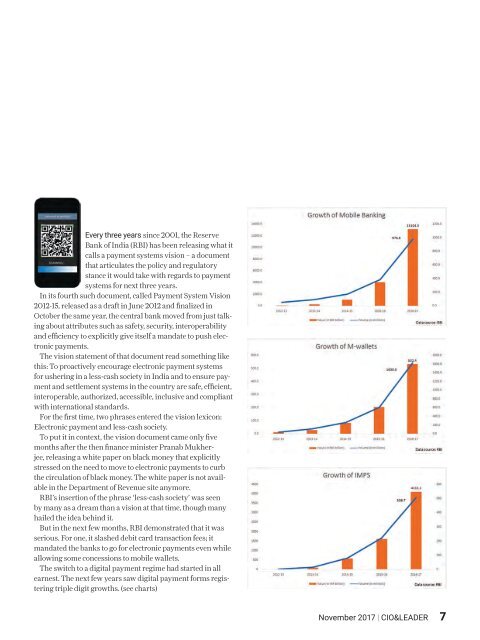

The switch to a digital payment regime had started in all<br />

earnest. The next few years saw digital payment forms registering<br />

triple digit growths. (see charts)<br />

<strong>November</strong> <strong>2017</strong> | <strong>CIO</strong>&<strong>LEADER</strong> 7