12-02-2018

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

BUSINESS A.M. FEBRUARY, MONDAY <strong>12</strong> - SUNDAY 18, <strong>2018</strong><br />

MARKETS DATA<br />

29<br />

Company<br />

Previous<br />

Closing Price<br />

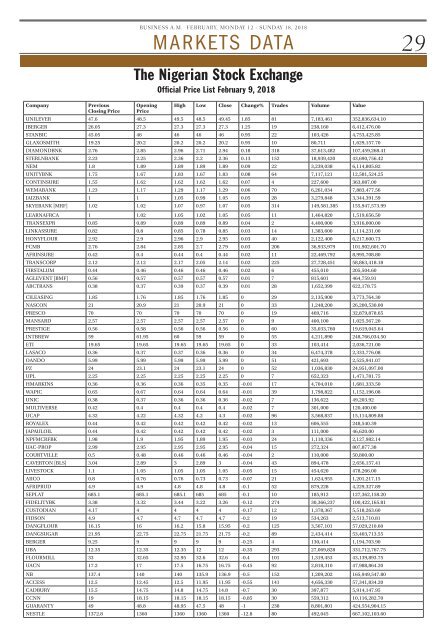

The Nigerian Stock Exchange<br />

Official Price List February 9, <strong>2018</strong><br />

Opening<br />

Price<br />

High Low Close Change% Trades Volume Value<br />

UNILEVER 47.6 48.5 49.5 48.5 49.45 1.85 81 7,183,461 352,836,634.10<br />

JBERGER 26.05 27.3 27.3 27.3 27.3 1.25 19 238,160 6,4<strong>12</strong>,476.00<br />

STANBIC 45.05 46 46 46 46 0.95 22 103,426 4,753,425.85<br />

GLAXOSMITH 19.25 20.2 20.2 20.2 20.2 0.95 10 80,711 1,629,157.70<br />

DIAMONDBNK 2.76 2.85 2.96 2.71 2.94 0.18 318 37,613,482 107,459,268.41<br />

STERLNBANK 2.23 2.25 2.36 2.2 2.36 0.13 152 18,939,420 43,690,756.42<br />

NEM 1.8 1.89 1.89 1.89 1.89 0.09 22 3,239,038 6,114,805.82<br />

UNITYBNK 1.75 1.67 1.83 1.67 1.83 0.08 64 7,117,<strong>12</strong>1 <strong>12</strong>,581,524.25<br />

CONTINSURE 1.55 1.62 1.62 1.62 1.62 0.07 4 227,600 363,087.00<br />

WEMABANK 1.23 1.17 1.29 1.17 1.29 0.06 70 6,261,034 7,883,477.56<br />

JAIZBANK 1 1 1.05 0.99 1.05 0.05 28 3,279,848 3,344,391.59<br />

SKYEBANK [MRF] 1.<strong>02</strong> 1.<strong>02</strong> 1.07 0.97 1.07 0.05 314 149,581,385 155,947,573.99<br />

LEARNAFRCA 1 1.<strong>02</strong> 1.05 1.<strong>02</strong> 1.05 0.05 11 1,464,820 1,519,656.50<br />

TRANSEXPR 0.85 0.89 0.89 0.89 0.89 0.04 2 4,400,000 3,916,000.00<br />

LINKASSURE 0.82 0.8 0.85 0.78 0.85 0.03 14 1,383,600 1,114,231.00<br />

HONYFLOUR 2.92 2.9 2.96 2.9 2.95 0.03 40 2,<strong>12</strong>2,400 6,217,600.73<br />

FCMB 2.76 2.84 2.85 2.7 2.79 0.03 206 36,933,979 101,9<strong>02</strong>,601.70<br />

AFRINSURE 0.42 0.4 0.44 0.4 0.44 0.<strong>02</strong> 11 22,469,792 8,995,708.80<br />

TRANSCORP 2.<strong>12</strong> 2.<strong>12</strong> 2.17 2.05 2.14 0.<strong>02</strong> 225 27,728,451 58,863,418.18<br />

FIRSTALUM 0.44 0.46 0.46 0.46 0.46 0.<strong>02</strong> 6 455,010 205,504.60<br />

AGLEVENT [BMF] 0.56 0.57 0.57 0.57 0.57 0.01 7 815,601 464,759.91<br />

ABCTRANS 0.38 0.37 0.39 0.37 0.39 0.01 28 1,652,399 622,178.75<br />

CILEASING 1.85 1.76 1.85 1.76 1.85 0 29 2,135,900 3,773,764.30<br />

NASCON 21 20.9 21 20.9 21 0 33 1,248,200 26,200,530.00<br />

PRESCO 70 70 70 70 70 0 19 469,716 32,879,878.65<br />

MANSARD 2.57 2.57 2.57 2.57 2.57 0 9 400,100 1,<strong>02</strong>5,567.20<br />

PRESTIGE 0.56 0.58 0.56 0.56 0.56 0 60 35,033,760 19,619,045.64<br />

INTBREW 59 61.95 60 59 59 0 55 4,211,890 248,766,034.50<br />

ETI 19.65 19.65 19.65 19.65 19.65 0 33 103,414 2,036,721.00<br />

LASACO 0.36 0.37 0.37 0.36 0.36 0 34 6,474,378 2,333,776.08<br />

OANDO 5.99 5.99 5.99 5.99 5.99 0 51 421,693 2,525,941.07<br />

PZ 24 23.1 24 23.1 24 0 52 1,036,830 24,951,097.00<br />

UPL 2.25 2.25 2.25 2.25 2.25 0 7 652,323 1,471,781.75<br />

HMARKINS 0.36 0.36 0.36 0.35 0.35 -0.01 17 4,704,010 1,681,333.50<br />

WAPIC 0.65 0.67 0.64 0.64 0.64 -0.01 39 1,798,822 1,152,196.08<br />

UNIC 0.38 0.37 0.36 0.36 0.36 -0.<strong>02</strong> 7 136,622 49,203.92<br />

MULTIVERSE 0.42 0.4 0.4 0.4 0.4 -0.<strong>02</strong> 7 301,000 <strong>12</strong>0,400.00<br />

UCAP 4.32 4.22 4.32 4.2 4.3 -0.<strong>02</strong> 96 3,568,837 15,114,809.88<br />

ROYALEX 0.44 0.42 0.42 0.42 0.42 -0.<strong>02</strong> 13 606,555 248,540.39<br />

JAPAULOIL 0.44 0.42 0.42 0.42 0.42 -0.<strong>02</strong> 3 111,000 46,620.00<br />

NPFMCRFBK 1.98 1.9 1.95 1.89 1.95 -0.03 24 1,118,336 2,<strong>12</strong>7,982.14<br />

UAC-PROP 2.99 2.95 2.95 2.95 2.95 -0.04 15 272,324 807,877.38<br />

COURTVILLE 0.5 0.48 0.46 0.46 0.46 -0.04 2 110,000 50,800.00<br />

CAVERTON [BLS] 3.04 2.89 3 2.89 3 -0.04 43 894,478 2,656,157.41<br />

LIVESTOCK 1.1 1.05 1.05 1.05 1.05 -0.05 15 454,620 478,266.00<br />

AIICO 0.8 0.76 0.76 0.73 0.73 -0.07 21 1,624,955 1,201,217.15<br />

AFRIPRUD 4.9 4.9 4.8 4.8 4.8 -0.1 52 879,228 4,229,327.89<br />

SEPLAT 685.1 685.1 685.1 685 685 -0.1 10 185,9<strong>12</strong> <strong>12</strong>7,362,158.20<br />

FIDELITYBK 3.38 3.32 3.44 3.22 3.26 -0.<strong>12</strong> 274 30,366,237 100,422,165.81<br />

CUSTODIAN 4.17 4 4 4 4 -0.17 <strong>12</strong> 1,378,367 5,518,263.60<br />

FIDSON 4.9 4.7 4.7 4.7 4.7 -0.2 19 534,263 2,513,710.81<br />

DANGFLOUR 16.15 16 16.2 15.8 15.95 -0.2 <strong>12</strong>5 3,567,101 57,<strong>02</strong>9,210.60<br />

DANGSUGAR 21.95 22.75 22.75 21.75 21.75 -0.2 89 2,434,414 53,403,713.55<br />

BERGER 9.25 9 9 9 9 -0.25 4 130,414 1,194,703.90<br />

UBA <strong>12</strong>.35 <strong>12</strong>.35 <strong>12</strong>.35 <strong>12</strong> <strong>12</strong> -0.35 293 27,069,828 331,7<strong>12</strong>,767.75<br />

FLOURMILL 33 32.65 32.95 32.6 32.6 -0.4 101 1,319,453 43,139,893.75<br />

UACN 17.2 17 17.5 16.75 16.75 -0.45 92 2,818,310 47,988,864.20<br />

NB 137.4 140 140 135.9 136.9 -0.5 152 1,209,2<strong>02</strong> 165,949,547.80<br />

ACCESS <strong>12</strong>.5 <strong>12</strong>.45 <strong>12</strong>.5 11.95 11.95 -0.55 141 4,656,330 57,341,834.20<br />

CADBURY 15.5 14.75 14.8 14.75 14.8 -0.7 30 397,877 5,914,147.95<br />

CCNN 19 18.15 18.15 18.15 18.15 -0.85 30 559,3<strong>12</strong> 10,116,282.70<br />

GUARANTY 49 48.8 48.95 47.5 48 -1 238 8,801,801 424,554,904.15<br />

NESTLE 1372.8 1360 1360 1360 1360 -<strong>12</strong>.8 80 492,045 667,1<strong>02</strong>,103.60