BusinessDay 26 Mar 2018

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Monday <strong>26</strong> <strong>Mar</strong>ch <strong>2018</strong><br />

C002D5556<br />

BUSINESS DAY 35<br />

Stocks Currencies Commodities Rates + Bonds Economics Funds Week Ahead Watchlist P.E<br />

Nigerian firms can tap into domestic<br />

debt market on lower rates Page 36<br />

ECONOMY<br />

Investors’ swoop on GSK, driven by<br />

high yield from special dividend<br />

MICHEAL ANI<br />

Investors have been<br />

lunging for GlaxoSmithKline<br />

PLC’s stock<br />

price, immediately the<br />

company announced<br />

a special dividend of N7.10k<br />

plus a final dividend of 40k.<br />

The above proposed payout<br />

sent dividend yields to as high<br />

as 30 percent, which means<br />

that investors expects a higher<br />

return on their investment?<br />

The consumer goods<br />

company said the special<br />

dividend would be paid from<br />

retained earnings brought<br />

forward as at year ended 31st<br />

December 2017, including<br />

profit sales of drinks as at 31<br />

December 2016.<br />

Stock price has rallied<br />

some 18 percent year to date,<br />

outperforming the market all<br />

share indexes at 8.4 percent,<br />

and closing at 25.50 the previous<br />

week.<br />

One would have expected<br />

the market to react to Glaxo-<br />

SmithKline giving its disappointing<br />

fourth quarter<br />

performance.<br />

The fast moving consumer<br />

goods (FMCG) industry and<br />

health care firm recorded a<br />

88.41 percent in full year 2017<br />

net income to N486.43 million<br />

while sales increased by<br />

11.90 percent to N16 billion.<br />

The company was beleaguered<br />

by rising material<br />

costs as production cost<br />

surged 114.3 percent from<br />

N5.4 billion in 2016 to N11.6<br />

BALA AUGIE<br />

Twenty Nigerian<br />

firms have declared<br />

a total of N412.96<br />

billion so far in 2017 as<br />

shareholders await more<br />

declarations.<br />

billion in 2017.<br />

GlaxoSmithKline Consumer<br />

Nigeria Plc., one of Africa’s<br />

largest consumer healthcare<br />

companies, producing leading<br />

brands such as Panadol with<br />

a market cap of N30.5 billion,<br />

according to data from the<br />

Bloomberg Terminal.<br />

The company like other<br />

top pharmaceutical players<br />

suffered a great challenge<br />

on the back of the lengthy<br />

recession that hammered the<br />

Nigerian economy in 2016,<br />

making the country go into<br />

its first full-year contraction<br />

in 25 years, and thus triggered<br />

acute dollar shortage that<br />

stifled the non-oil sector, as<br />

Africa most populous nation<br />

contracted 0.5 percent to<br />

record its worst performance<br />

since 1991.<br />

The sector was fraught<br />

with shortage of naira liquidity<br />

as an increase in government<br />

borrowing at that time<br />

spurred banks to invest in the<br />

safety of sovereign debt rather<br />

than lending to businesses<br />

or consumers, a situation that<br />

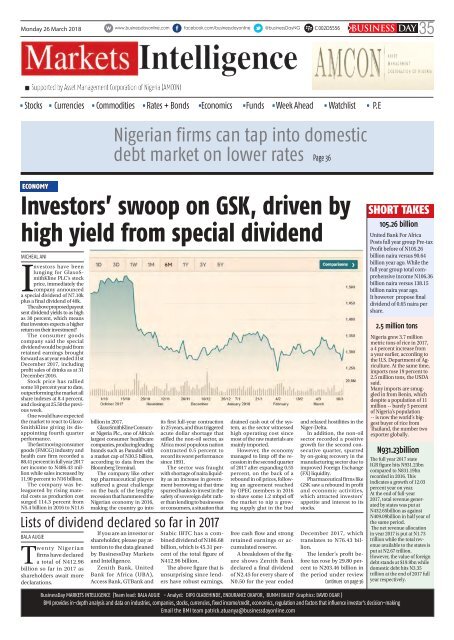

Lists of dividend declared so far in 2017<br />

drained cash out of the system,<br />

as the sector witnessed<br />

high operating cost since<br />

most of the raw materials are<br />

mainly imported.<br />

However, the economy<br />

managed to limp off the recession<br />

in the second quarter<br />

of 2017 after expanding 0.55<br />

percent, on the back of a<br />

rebound in oil prices, following<br />

an agreement reached<br />

by OPEC members in 2016<br />

to shave some 1.2 mbpd off<br />

the market to nip a growing<br />

supply glut in the bud<br />

and relaxed hostilities in the<br />

Niger-Delta.<br />

In addition, the non-oil<br />

sector recorded a positive<br />

growth for the second consecutive<br />

quarter, spurred<br />

by on-going recovery in the<br />

manufacturing sector due to<br />

improved Foreign Exchange<br />

(FX) liquidity.<br />

Pharmaceutical firms like<br />

GSK saw a rebound in profit<br />

and economic activities,<br />

which attracted investors’<br />

appetite and interest to its<br />

stocks.<br />

If you are an investor or<br />

shareholder, please pay attention<br />

to the data gleaned<br />

by <strong>BusinessDay</strong> <strong>Mar</strong>kets<br />

and Intelligence.<br />

Zenith Bank, United<br />

Bank for Africa (UBA),<br />

Access Bank, GTBank and<br />

Stabic IBTC has a combined<br />

dividend of N186.68<br />

billion, which is 45.31 percent<br />

of the total figure of<br />

N412.96 billion.<br />

The above figure that is<br />

unsurprising since lenders<br />

have robust earnings,<br />

free cash flow and strong<br />

retained earnings or accumulated<br />

reserve.<br />

A breakdown of the figure<br />

shows Zenith Bank<br />

declared a final dividend<br />

of N2.45 for every share of<br />

N0.50 for the year ended<br />

December 2017, which<br />

translates to N76.43 billion.<br />

The lender’s profit before<br />

tax rose by 29.80 percent<br />

to N203.46 billion in<br />

the period under review<br />

Continues on page 36<br />

SHORT TAKES<br />

105.<strong>26</strong> billion<br />

United Bank For Africa<br />

Posts full year group Pre-tax<br />

Profit before of N105.<strong>26</strong><br />

billion naira versus 90.64<br />

billion year ago . While the<br />

full year group total comprehensive<br />

income N106.36<br />

billion naira versus 138.15<br />

billion naira year ago.<br />

It however propose final<br />

dividend of 0.65 naira per<br />

share.<br />

2.5 million tons<br />

Nigeria grew 3.7 million<br />

metric tons of rice in 2017,<br />

a 4 percent increase from<br />

a year earlier, according to<br />

the U.S. Department of Agriculture.<br />

At the same time,<br />

imports rose 19 percent to<br />

2.5 million tons, the USDA<br />

said.<br />

Many imports are smuggled<br />

in from Benin, which<br />

despite a population of 11<br />

million -- barely 5 percent<br />

of Nigeria’s population<br />

-- is now the world’s biggest<br />

buyer of rice from<br />

Thailand, the number two<br />

exporter globally.<br />

N931.23billion<br />

The full year 2017 state<br />

IGR figure hits N931.23bn<br />

compared to N831.19bn<br />

recorded in 2016. This<br />

indicates a growth of 12.03<br />

percent year on year.<br />

At the end of full-year<br />

2017, total revenue generated<br />

by states was put at<br />

N432.65billion as against<br />

N409.09billion in half year of<br />

the same period.<br />

The net revenue allocation<br />

in year 2017 is put at N1.73<br />

trillion while the total revenue<br />

available to the states is<br />

put at N2.67 trillion.<br />

However, the value of foreign<br />

debt stands at $19.9bn while<br />

domestic debt hits N3.35<br />

trillion at the end of 2017 full<br />

year respectively.<br />

<strong>BusinessDay</strong> MARKETS INTELLIGENCE (Team lead: BALA AUGIE - Analyst: DIPO OLADEHINDE, ENDURANCE OKAFOR, BUNMI BAILEY Graphics: DAVID OGAR )<br />

BMI provides in-depth analysis and data on industries, companies, stocks, currencies, fixed income/credit, economics, regulation and factors that influence investor’s decision-making<br />

Email the BMI team patrick.atuanya@businessdayonline.com