BusinessDay 26 Mar 2018

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

36 BUSINESS DAY C002D5556 Monday <strong>26</strong> <strong>Mar</strong>ch <strong>2018</strong><br />

ECONOMY<br />

<strong>Mar</strong>kets Intelligence<br />

Nigerian firms can tap into domestic debt market on lower rates<br />

ENDURANCE OKAFOR<br />

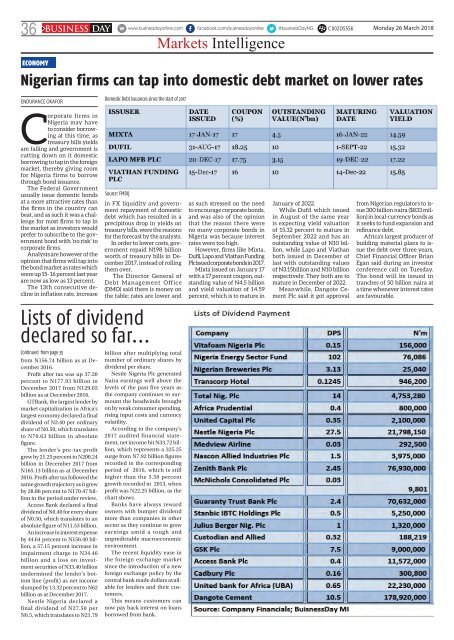

Domestic Debt issuances since the start of 2017<br />

Corporate firms in<br />

Nigeria may have<br />

to consider borrowing<br />

at this time, as<br />

treasury bills yields<br />

are falling and government is<br />

cutting down on it domestic<br />

borrowing to tap in the foreign<br />

market, thereby giving room<br />

for Nigeria firms to borrow<br />

through bond issuance.<br />

The Federal Government<br />

usually issue domestic bonds<br />

at a more attractive rates than<br />

the firms in the country can<br />

beat, and as such it was a challenge<br />

for most firms to tap in<br />

the market as investors would<br />

prefer to subscribe to the government<br />

bond with ‘no risk’ to<br />

corporate firms.<br />

Analysts are however of the<br />

opinion that firms will tap into<br />

the bond market as rates which<br />

were up 15- 16 percent last year<br />

are now as low as 13 percent.<br />

The 13th consecutive decline<br />

in inflation rate, increase<br />

Source: FMDQ<br />

in FX liquidity and government<br />

repayment of domestic<br />

debt which has resulted in a<br />

precipitous drop in yields on<br />

treasury bills, were the reasons<br />

for the forecast by the analysts.<br />

In order to lower costs, government<br />

repaid N198 billion<br />

worth of treasury bills in December<br />

2017, instead of rolling<br />

them over,<br />

The Director General of<br />

Debt Management Office<br />

(DMO) said there is money on<br />

the table; rates are lower and<br />

as such stressed on the need<br />

to encourage corporate bonds,<br />

and was also of the opinion<br />

that the reason there were<br />

no many corporate bonds in<br />

Nigeria was because interest<br />

rates were too high.<br />

However, firms like Mixta,<br />

Dufil, Lapo and Viathan Funding<br />

Plc issued corporate bonds in 2017.<br />

Mixta issued on January 17<br />

with a 17 percent coupon, outstanding<br />

value of N4.5 billion<br />

and yield valuation of 14.59<br />

percent, which is to mature in<br />

January of 2022.<br />

While Dufil which issued<br />

in August of the same year<br />

is expecting yield valuation<br />

of 15.32 percent to mature in<br />

September 2022 and has an<br />

outstanding value of N10 billion,<br />

while Lapo and Viathan<br />

both issued in December of<br />

last with outstanding values<br />

of N3.15billion and N10 billion<br />

respectively. They both are to<br />

mature in December of 2022.<br />

Meanwhile, Dangote Cement<br />

Plc said it got approval<br />

from Nigerian regulators to issue<br />

300 billion naira ($833 million)<br />

in local-currency bonds as<br />

it seeks to fund expansion and<br />

refinance debt.<br />

Africa’s largest producer of<br />

building material plans to issue<br />

the debt over three years,<br />

Chief Financial Officer Brian<br />

Egan said during an investor<br />

conference call on Tuesday.<br />

The bond will be issued in<br />

tranches of 50 billion naira at<br />

a time whenever interest rates<br />

are favourable.<br />

Lists of dividend<br />

declared so far...<br />

Continued from page 35<br />

from N156.74 billion as at December<br />

2016.<br />

Profit after tax was up 37.20<br />

percent to N177.93 billion in<br />

December 2017 from N129.65<br />

billion as at December 2016.<br />

GTBank, the largest lender by<br />

market capitalization in Africa’s<br />

largest economy declared a final<br />

dividend of N2.40 per ordinary<br />

share of N0.50, which translates<br />

to N70.63 billion in absolute<br />

figure.<br />

The lender’s pre-tax profit<br />

grew by 21.25 percent to N200.24<br />

billion in December 2017 from<br />

N165.13 billion as at December<br />

2016. Profit after tax followed the<br />

same growth trajectory as it grew<br />

by 28.86 percent to N170.47 billion<br />

in the period under review.<br />

Access Bank declared a final<br />

dividend of N0.40 for every share<br />

of N0.50, which translates to an<br />

absolute figure of N11.53 billion.<br />

An increase in interest expense<br />

by 44.64 percent to N156.40 billion,<br />

a 57.15 percent increase in<br />

impairment charge to N34.46<br />

billion and a loss on investment<br />

securities of N33.40 billion<br />

undermined the lender’s bottom<br />

line (profit) as net income<br />

slumped by 13.32 percent to N62<br />

billion as at December 2017.<br />

Nestle Nigeria declared a<br />

final dividend of N27.50 per<br />

N0.5, which translates to N21.79<br />

billion after multiplying total<br />

number of ordinary shares by<br />

dividend per share.<br />

Nestle Nigeria Plc generated<br />

Naira earnings well above the<br />

levels of the past five years as<br />

the company continues to surmount<br />

the headwinds brought<br />

on by weak consumer spending,<br />

rising input costs and currency<br />

volatility.<br />

According to the company’s<br />

2017 audited financial statement,<br />

net income hit N33.72 billion,<br />

which represents a 325.25<br />

surge from N7.92 billion figures<br />

recorded in the corresponding<br />

period of 2016, which is still<br />

higher than the 5.50 percent<br />

growth recorded in 2013, when<br />

profit was N22.25 billion, as the<br />

chart shows.<br />

Banks have always reward<br />

owners with bumper dividend<br />

more than companies in other<br />

sector as they continue to grow<br />

earnings amid a tough and<br />

unpredictable macroeconomic<br />

environment.<br />

The recent liquidity ease in<br />

the foreign exchange market<br />

since the introduction of a new<br />

foreign exchange policy by the<br />

central bank made dollars available<br />

for lenders and their customers.<br />

This means customers can<br />

now pay back interest on loans<br />

borrowed from bank.