CCMA_ACCLM_2018

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

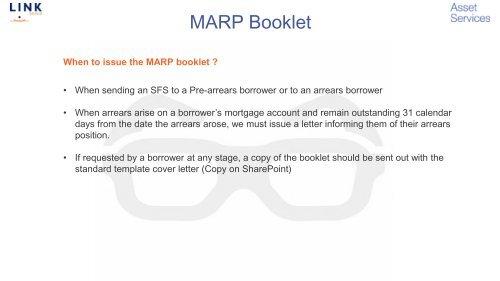

MARP Booklet<br />

When to issue the MARP booklet ?<br />

• When sending an SFS to a Pre-arrears borrower or to an arrears borrower<br />

• When arrears arise on a borrower’s mortgage account and remain outstanding 31 calendar<br />

days from the date the arrears arose, we must issue a letter informing them of their arrears<br />

position.<br />

• If requested by a borrower at any stage, a copy of the booklet should be sent out with the<br />

standard template cover letter (Copy on SharePoint)