BusinessDay 11 Apr 2018

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Wednesday <strong>11</strong> <strong>Apr</strong>il <strong>2018</strong><br />

COMPANIES<br />

& MARKETS<br />

Company news analysis and insight<br />

BUSINESS DAY 13<br />

FCMB Opens Flexx Hub at<br />

LASPOTECH, Hands-over<br />

Reconstructed School Gate<br />

Pg. 14<br />

Lafarge Africa’s alarming leverage<br />

responsible for first loss in 5 years<br />

BALA AUGIE<br />

lion, which represents a<br />

145.05 percent surge from<br />

N104.70 billion it incurred<br />

the previous year.<br />

Lafarge Africa is making<br />

frantic efforts toward<br />

reducing financial leverage<br />

as it plans to raise N131.97<br />

billion in rights issue to<br />

refinance debt and fund its<br />

expansion plans.<br />

Analysts at Cordros Capital<br />

have reiterated their<br />

SELL rating on the stocks<br />

of the cement maker as they<br />

expect investors to react to<br />

the delayed results.<br />

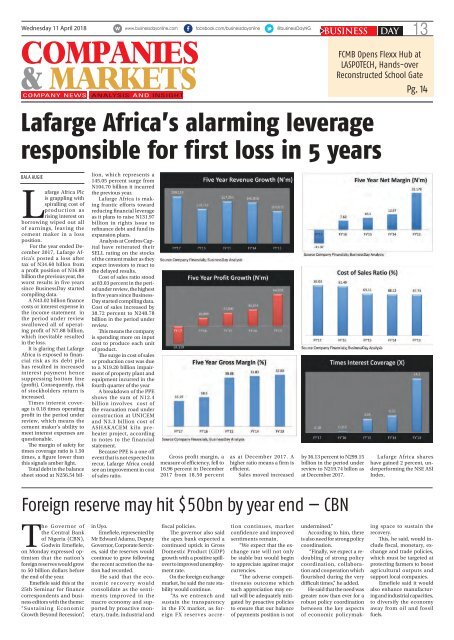

Cost of sales ratio stood<br />

at 83.03 percent in the period<br />

under review, the highest<br />

in five years since Business-<br />

Day started compiling data.<br />

Cost of sales increased by<br />

38.72 percent to N248.78<br />

billion in the period under<br />

review.<br />

This means the company<br />

is spending more on input<br />

cost to produce each unit<br />

of product.<br />

The surge in cost of sales<br />

or production cost was due<br />

to a N19.20 billion impairment<br />

of property plant and<br />

equipment incurred in the<br />

fourth quarter of the year<br />

A breakdown of the PPE<br />

shows the sum of N12.4<br />

billion involves cost of<br />

the evacuation road under<br />

construction at UNICEM<br />

and N3.3 billion cost of<br />

ASHAKACEM kiln preheater<br />

project, according<br />

to notes to the financial<br />

statement.<br />

Because PPE is a one off<br />

event that is not expected to<br />

recur, Lafarge Africa could<br />

see an improvement in cost<br />

of sales ratio.<br />

Gross profit margin, a<br />

measure of efficiency, fell to<br />

16.96 percent in December<br />

2017 from 18.50 percent<br />

Lafarge Africa Plc<br />

is grappling with<br />

spiralling cost of<br />

production as<br />

rising interest on<br />

borrowing wiped out all<br />

of earnings, leaving the<br />

cement maker in a loss<br />

position.<br />

For the year ended December<br />

2017, Lafarge Africa’s<br />

posted a loss after<br />

tax of N34.60 billon from<br />

a profit position of N16.89<br />

billion the previous year, the<br />

worst results in five years<br />

since <strong>BusinessDay</strong> started<br />

compiling data.<br />

A N43.02 billion finance<br />

costs or interest expense in<br />

the income statement in<br />

the period under review<br />

swallowed all of operating<br />

profit of N7.88 billion,<br />

which inevitable resulted<br />

in the loss.<br />

It is glaring that Lafarge<br />

Africa is exposed to financial<br />

risk as its debt pile<br />

has resulted in increased<br />

interest payment hence<br />

suppressing bottom line<br />

(profit). Consequently, risk<br />

of stockholders return is<br />

increased.<br />

Times interest coverage<br />

is 0.18 times operating<br />

profit in the period under<br />

review, which means the<br />

cement maker’s ability to<br />

meet interest expenses are<br />

questionable.<br />

The margin of safety for<br />

times coverage ratio is 1.50<br />

times, a figure lower than<br />

this signals amber light.<br />

Total debt in the balance<br />

sheet stood at N256.54 bilas<br />

at December 2017. A<br />

higher ratio means a firm is<br />

efficient.<br />

Sales moved increased<br />

by 36.13 percent to N299.15<br />

billion in the period under<br />

review to N219.74 billon as<br />

at December 2017.<br />

Lafarge Africa shares<br />

have gained 2 percent, underperforming<br />

the NSE ASI<br />

Index.<br />

Foreign reserve may hit $50bn by year end — CBN<br />

The Governor of<br />

the Central Bank<br />

of Nigeria (CBN),<br />

Godwin Emefiele,<br />

on Monday expressed optimism<br />

that the nation’s<br />

foreign reserves would grow<br />

to 50 billion dollars before<br />

the end of the year.<br />

Emefiele said this at the<br />

25th Seminar for finance<br />

correspondents and business<br />

editors with the theme:<br />

“Sustaining Economic<br />

Growth Beyond Recession”,<br />

in Uyo.<br />

Emefiele, represented by<br />

Mr Edward Adamu, Deputy<br />

Governor, Corporate Services,<br />

said the reserves would<br />

continue to grow following<br />

the recent accretion the nation<br />

had recorded.<br />

He said that the economic<br />

recovery would<br />

consolidate as the sentiments<br />

improved in the<br />

macro economy and supported<br />

by proactive monetary,<br />

trade, industrial and<br />

fiscal policies.<br />

The governor also said<br />

the apex bank expected a<br />

continued uptick in Gross<br />

Domestic Product (GDP)<br />

growth with a positive spillover<br />

to improved unemployment<br />

rate.<br />

On the foreign exchange<br />

market, he said the rate stability<br />

would continue.<br />

“As we entrench and<br />

sustain the transparency<br />

in the FX market, as foreign<br />

FX reserves accretion<br />

continues, market<br />

confidence and improved<br />

sentiments remain.<br />

“We expect that the exchange<br />

rate will not only<br />

be stable but would begin<br />

to appreciate against major<br />

currencies.<br />

“The adverse competitiveness<br />

outcome which<br />

such appreciation may entail<br />

will be adequately mitigated<br />

by proactive policies<br />

to ensure that our balance<br />

of payments position is not<br />

undermined.”<br />

According to him, there<br />

is also need for strong policy<br />

coordination.<br />

“Finally, we expect a redoubling<br />

of strong policy<br />

coordination, collaboration<br />

and cooperation which<br />

flourished during the very<br />

difficult times,” he added.<br />

He said that the need was<br />

greater now than ever for a<br />

robust policy coordination<br />

between the key aspects<br />

of economic policymak-<br />

ing space to sustain the<br />

recovery.<br />

This, he said, would include<br />

fiscal, monetary, exchange<br />

and trade policies,<br />

which must be targeted at<br />

protecting farmers to boost<br />

agricultural outputs and<br />

support local companies.<br />

Emefiele said it would<br />

also enhance manufacturing<br />

and industrial capacities,<br />

to diversify the economy<br />

away from oil and fossil<br />

fuels.