FLEISCHWIRTSCHAFT international 6/2017

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

............................................<br />

...............................................<br />

...............................................<br />

Fleischwirtschaft <strong>international</strong> 6_<strong>2017</strong><br />

19<br />

Ranking<br />

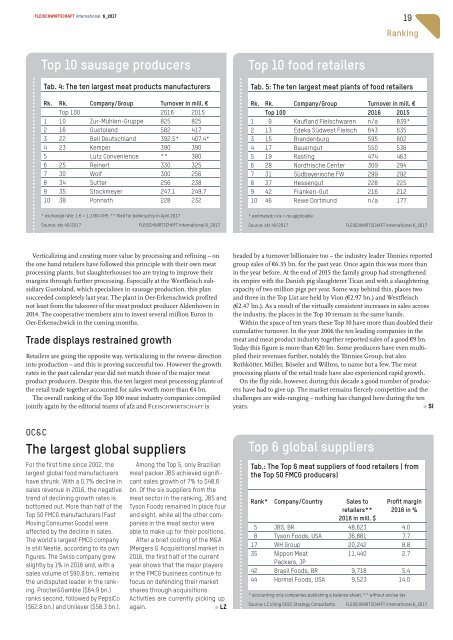

Top10sausage producers<br />

Tab. 4: The ten largest meat products manufacturers<br />

Rk. Rk. Company/Group Turnover in mill. €<br />

Top100 2016 2015<br />

1 10 Zur-Mühlen-Gruppe 825 825<br />

2 16 Gustoland 582 417<br />

3 22 Bell Deutschland 392.5* 407.4*<br />

4 23 Kemper 390 390<br />

5 LutzConvenience ** 380<br />

6 25 Reinert 330 325<br />

7 30 Wolf 300 256<br />

8 34 Sutter 256 238<br />

9 35 Stockmeyer 247.1 249.7<br />

10 38 Ponnath 228 232<br />

*exchange rate: 1€=1,1364 CHF; ** filed for bankruptcy in April <strong>2017</strong><br />

Source: afz 40/<strong>2017</strong> <strong>FLEISCHWIRTSCHAFT</strong> <strong>international</strong> 6_<strong>2017</strong><br />

Verticalizing and creating more value by processing and refining –on<br />

the one hand retailers have followed this principle with their own meat<br />

processing plants, but slaughterhouses too are trying to improve their<br />

margins through further processing. Especially at the Westfleisch subsidiary<br />

Gustoland, which specialises in sausage production, this plan<br />

succeeded completely last year.The plant in Oer-Erkenschwick profited<br />

not least from the takeover of the meat product producer Aldenhoven in<br />

2014.The cooperative members aim to invest several million Euros in<br />

Oer-Erkenschwick in the coming months.<br />

Trade displays restrained growth<br />

Retailers are going the opposite way,verticalizing in the reverse direction<br />

into production –and this is proving successful too. However the growth<br />

rates in the past calendar year did not match those of the major meat<br />

product producers. Despite this, the ten largest meat processing plants of<br />

the retail trade together accounted for sales worth more than €4 bn.<br />

The overall ranking of the Top100 meat industry companies compiled<br />

jointly again by the editorial teams of afz and <strong>FLEISCHWIRTSCHAFT</strong> is<br />

Top10food retailers<br />

Tab. 5: The ten largest meat plants of food retailers<br />

Rk. Rk. Company/Group Turnover in mill. €<br />

Top100 2016 2015<br />

1 9 Kaufland Fleischwaren n/a 839*<br />

2 13 Edeka Südwest Fleisch 643 635<br />

3 15 Brandenburg 595 602<br />

4 17 Bauerngut 550 536<br />

5 19 Rasting 474 463<br />

6 28 Nordfrische Center 309 294<br />

7 31 Südbayerische FW 299 292<br />

8 37 Hessengut 228 225<br />

9 42 Franken-Gut 216 212<br />

10 46 Rewe Dortmund n/a 177<br />

*estimated; n/a =noapplicable<br />

Source: afz 40/<strong>2017</strong> <strong>FLEISCHWIRTSCHAFT</strong> <strong>international</strong> 6_<strong>2017</strong><br />

headed by aturnover billionaire too –the industry leader Tönnies reported<br />

group sales of €6.35 bn. for the past year.Once again this was more than<br />

in the year before. At the end of 2015 the family group had strengthened<br />

its empire with the Danish pig slaughterer Tican and with aslaughtering<br />

capacity of two million pigs per year.Some way behind this, places two<br />

and three in the TopList are held by Vion (€2.97 bn.) and Westfleisch<br />

(€2.47 bn.). As aresult of the virtually consistent increases in sales across<br />

the industry,the places in the Top10remain in the same hands.<br />

Within the space of ten years these Top10have more than doubled their<br />

cumulative turnover.Inthe year 2006 the ten leading companies in the<br />

meat and meat product industry together reported sales of agood €9 bn.<br />

Today this figure is more than €20 bn. Some producers have even multiplied<br />

their revenues further,notably the Tönnies Group, but also<br />

Rothkötter,Müller,Böseler and Willms, to name but afew.The meat<br />

processing plants of the retail trade have also experienced rapid growth.<br />

On the flip side, however,during this decade agood number of producers<br />

have had to give up. The market remains fiercely competitive and the<br />

challenges are wide-ranging –nothing has changed here during the ten<br />

years.<br />

r si<br />

OC&C<br />

The largest global suppliers<br />

For the first time since 2002, the<br />

largest global food manufacturers<br />

have shrunk. With a0.7% decline in<br />

sales revenue in 2016,the negative<br />

trend of declining growth rates is<br />

bottomed out. More than half of the<br />

Top50FMCG manufacturers (Fast<br />

Moving Consumer Goods) were<br />

affected by the decline in sales.<br />

The world's largest FMCG company<br />

is still Nestlé, according to its own<br />

figures. The Swiss company grew<br />

slightlyby1%in2016and, with a<br />

sales volume of $90.8 bn., remains<br />

the undisputed leader in the ranking.<br />

Procter&Gamble ($64.9 bn.)<br />

ranks second, followed by PepsiCo<br />

($62.8 bn.) and Unilever ($58.3 bn.).<br />

Among the Top5,onlyBrazilian<br />

meat packer JBS achieved significant<br />

sales growth of 7% to $48.6<br />

bn. Of the six suppliers from the<br />

meat sector in the ranking, JBS and<br />

Tyson Foods remained in place four<br />

and eight, while all the other companies<br />

in the meat sector were<br />

able to make up for their positions.<br />

After abrief cooling of the M&A<br />

(Mergers &Acquisitions) market in<br />

2016,the first half of the current<br />

year shows that the major players<br />

in the FMCG business continue to<br />

focus on defending their market<br />

shares through acquisitions.<br />

Activities are currently picking up<br />

again.<br />

r LZ<br />

Top 6global suppliers<br />

//www.occstrategy.com<br />

Tab.: The Top6meat suppliers of food retailers (from<br />

the Top50FMCG producers)<br />

Rank* Company/Country Sales to<br />

retailers**<br />

2016 in mill. $<br />

Profit margin<br />

2016 in %<br />

5 JBS, BR 48,623 4.0<br />

8 Tyson Foods, USA 36,881 7.7<br />

17 WH Group 20,242 8.8<br />

35 Nippon Meat<br />

11,440 2.7<br />

Packers, JP<br />

42 Brasil Foods, BR 9,718 5.4<br />

44 Hormel Foods, USA 9,523 14.0<br />

*accounting onlycompanies publishing abalance sheet; ** without excise tax<br />

Source: LZ citing OC&C Strategy Consultants <strong>FLEISCHWIRTSCHAFT</strong> <strong>international</strong> 6_<strong>2017</strong>