JPI Spring 2018

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

and Italy, two of the largest and most influential economic players in Europe. Consider a hypothetical<br />

shift in the wine market, with a newfound international interest in Italian over French. Ordinarily,<br />

these types of competitive markets would have currencies that would be reflected in their respective<br />

exchange rates—in a monetary union though, this is not possible. This leads to out-of-sync cyclical<br />

positions and trade imbalances between the two markets subjected to the asymmetric shock. Bibow<br />

explains that an easy way to counter asymmetric shock involves exchange rate realignment. 10 Since<br />

this is not an option in a monetary union, the same outcome could be achieved through wage-price<br />

flexibility, with an “internal devaluation” in France (now that no one wants their wine anymore)<br />

and/or the opposite in Italy (in our example, an internal increase in value).<br />

According to Optimum Currency Area (OCA) theory, common wage bargaining—or wage<br />

coordination—is critical in preventing asymmetric shocks and sustaining a monetary union.<br />

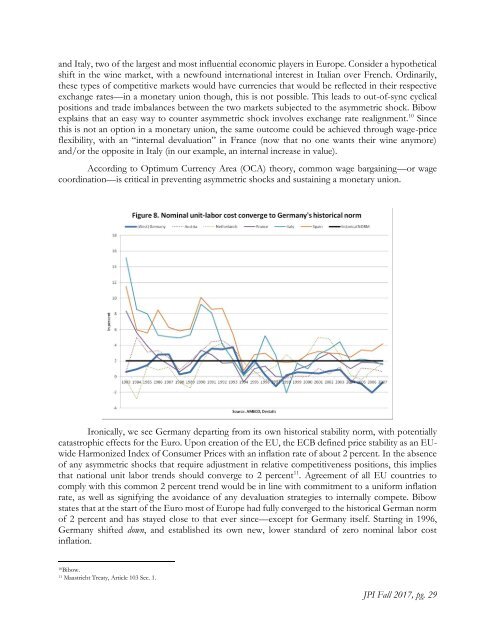

Ironically, we see Germany departing from its own historical stability norm, with potentially<br />

catastrophic effects for the Euro. Upon creation of the EU, the ECB defined price stability as an EUwide<br />

Harmonized Index of Consumer Prices with an inflation rate of about 2 percent. In the absence<br />

of any asymmetric shocks that require adjustment in relative competitiveness positions, this implies<br />

that national unit labor trends should converge to 2 percent 11 . Agreement of all EU countries to<br />

comply with this common 2 percent trend would be in line with commitment to a uniform inflation<br />

rate, as well as signifying the avoidance of any devaluation strategies to internally compete. Bibow<br />

states that at the start of the Euro most of Europe had fully converged to the historical German norm<br />

of 2 percent and has stayed close to that ever since—except for Germany itself. Starting in 1996,<br />

Germany shifted down, and established its own new, lower standard of zero nominal labor cost<br />

inflation.<br />

10<br />

Bibow.<br />

11<br />

Maastricht Treaty, Article 103 Sec. 1.<br />

<strong>JPI</strong> Fall 2017, pg. 29