JPI Spring 2018

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

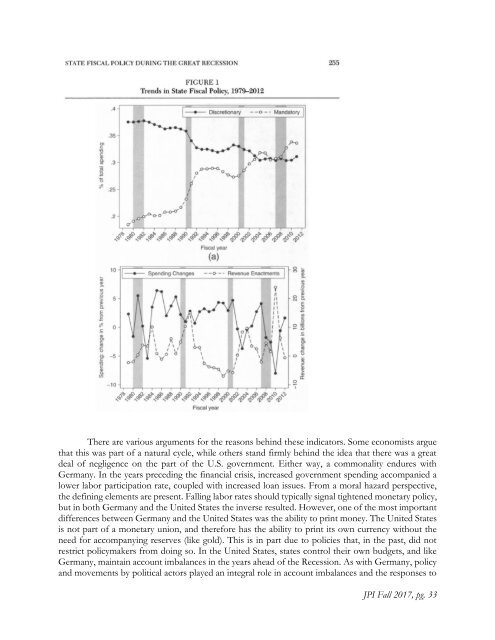

There are various arguments for the reasons behind these indicators. Some economists argue<br />

that this was part of a natural cycle, while others stand firmly behind the idea that there was a great<br />

deal of negligence on the part of the U.S. government. Either way, a commonality endures with<br />

Germany. In the years preceding the financial crisis, increased government spending accompanied a<br />

lower labor participation rate, coupled with increased loan issues. From a moral hazard perspective,<br />

the defining elements are present. Falling labor rates should typically signal tightened monetary policy,<br />

but in both Germany and the United States the inverse resulted. However, one of the most important<br />

differences between Germany and the United States was the ability to print money. The United States<br />

is not part of a monetary union, and therefore has the ability to print its own currency without the<br />

need for accompanying reserves (like gold). This is in part due to policies that, in the past, did not<br />

restrict policymakers from doing so. In the United States, states control their own budgets, and like<br />

Germany, maintain account imbalances in the years ahead of the Recession. As with Germany, policy<br />

and movements by political actors played an integral role in account imbalances and the responses to<br />

<strong>JPI</strong> Fall 2017, pg. 33