Annual Report - Brandhouse Retails

Annual Report - Brandhouse Retails

Annual Report - Brandhouse Retails

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

BRANDHOUSE<br />

R E T A I L S<br />

8 TH ANNUAL REPORT 2011-12<br />

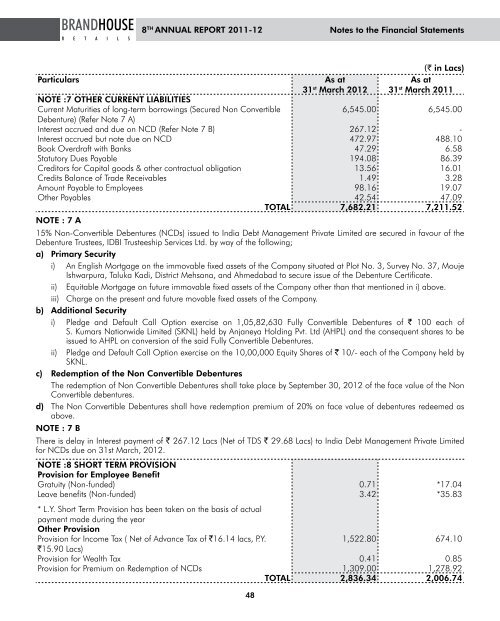

Particulars As at<br />

(` in Lacs)<br />

31st As at<br />

March 2012 31st NOTE :7 OTHER CURRENT LiAbiLiTiEs<br />

March 2011<br />

Current Maturities of long-term borrowings (Secured Non Convertible<br />

Debenture) (Refer Note 7 A)<br />

6,545.00 6,545.00<br />

Interest accrued and due on NCD (Refer Note 7 B) 267.12 -<br />

Interest accrued but note due on NCD 472.97 488.10<br />

Book Overdraft with Banks 47.29 6.58<br />

Statutory Dues Payable 194.08 86.39<br />

Creditors for Capital goods & other contractual obligation 13.56 16.01<br />

Credits Balance of Trade Receivables 1.49 3.28<br />

Amount Payable to employees 98.16 19.07<br />

Other Payables 42.54 47.09<br />

TOTAL<br />

NOTE : 7 A<br />

7,682.21 7,211.52<br />

15% Non-Convertible Debentures (NCDs) issued to India Debt Management Private Limited are secured in favour of the<br />

Debenture Trustees, IDBI Trusteeship Services Ltd. by way of the following;<br />

a) Primary security<br />

i) An english Mortgage on the immovable fixed assets of the Company situated at Plot No. 3, Survey No. 37, Mouje<br />

Ishwarpura, Taluka Kadi, District Mehsana, and Ahmedabad to secure issue of the Debenture Certificate.<br />

ii) equitable Mortgage on future immovable fixed assets of the Company other than that mentioned in i) above.<br />

iii) Charge on the present and future movable fixed assets of the Company.<br />

b) Additional security<br />

i) Pledge and Default Call Option exercise on 1,05,82,630 Fully Convertible Debentures of ` 100 each of<br />

S. Kumars Nationwide Limited (SKNL) held by Anjaneya Holding Pvt. Ltd (AHPL) and the consequent shares to be<br />

issued to AHPL on conversion of the said Fully Convertible Debentures.<br />

ii) Pledge and Default Call Option exercise on the 10,00,000 equity Shares of ` 10/- each of the Company held by<br />

SKNL.<br />

c) Redemption of the Non Convertible debentures<br />

The redemption of Non Convertible Debentures shall take place by September 30, 2012 of the face value of the Non<br />

Convertible debentures.<br />

d) The Non Convertible Debentures shall have redemption premium of 20% on face value of debentures redeemed as<br />

above.<br />

NOTE : 7 b<br />

There is delay in Interest payment of ` 267.12 Lacs (Net of TDS ` 29.68 Lacs) to India Debt Management Private Limited<br />

for NCDs due on 31st March, 2012.<br />

NOTE :8 sHORT TERM PROVisiON<br />

Provision for Employee benefit<br />

Gratuity (Non-funded) 0.71 *17.04<br />

Leave benefits (Non-funded) 3.42 *35.83<br />

* L.Y. Short Term Provision has been taken on the basis of actual<br />

payment made during the year<br />

Other Provision<br />

Provision for Income Tax ( Net of Advance Tax of `16.14 lacs, P.Y.<br />

`15.90 Lacs)<br />

48<br />

Notes to the financial statements<br />

1,522.80 674.10<br />

Provision for Wealth Tax 0.41 0.85<br />

Provision for Premium on Redemption of NCDs 1,309.00 1,278.92<br />

TOTAL 2,836.34 2,006.74