Annual Report - Brandhouse Retails

Annual Report - Brandhouse Retails

Annual Report - Brandhouse Retails

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

BRANDHOUSE<br />

R E T A I L S<br />

8 TH ANNUAL REPORT 2011-12<br />

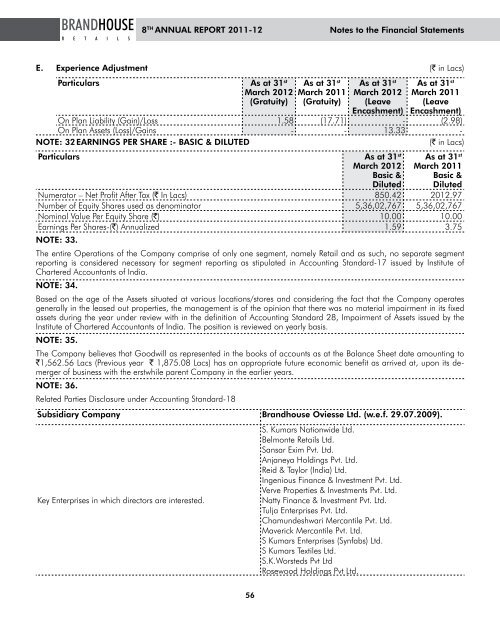

E. Experience Adjustment (` in Lacs)<br />

Particulars As at 31 st<br />

March 2012<br />

(gratuity)<br />

56<br />

As at 31 st<br />

March 2011<br />

(gratuity)<br />

As at 31 st<br />

March 2012<br />

(Leave<br />

Encashment)<br />

As at 31 st<br />

March 2011<br />

(Leave<br />

Encashment)<br />

On Plan Liability (Gain)/Loss 1.58 (17.71) - (2.98)<br />

On Plan Assets (Loss)/Gains - - 13.33 -<br />

NOTE: 32 EARNiNgs PER sHARE :- bAsiC & diLUTEd (` in Lacs)<br />

Particulars As at 31 st<br />

March 2012<br />

basic &<br />

diluted<br />

As at 31 st<br />

March 2011<br />

basic &<br />

diluted<br />

Numerator – Net Profit After Tax (` In Lacs) 850.42 2012.97<br />

Number of equity Shares used as denominator 5,36,02,767 5,36,02,767<br />

Nominal Value Per equity Share (`) 10.00 10.00<br />

earnings Per Shares-(`) <strong>Annual</strong>ized 1.59 3.75<br />

NOTE: 33.<br />

The entire Operations of the Company comprise of only one segment, namely Retail and as such, no separate segment<br />

reporting is considered necessary for segment reporting as stipulated in Accounting Standard-17 issued by Institute of<br />

Chartered Accountants of India.<br />

NOTE: 34.<br />

Based on the age of the Assets situated at various locations/stores and considering the fact that the Company operates<br />

generally in the leased out properties, the management is of the opinion that there was no material impairment in its fixed<br />

assets during the year under review with in the definition of Accounting Standard 28, Impairment of Assets issued by the<br />

Institute of Chartered Accountants of India. The position is reviewed on yearly basis.<br />

NOTE: 35.<br />

The Company believes that Goodwill as represented in the books of accounts as at the Balance Sheet date amounting to<br />

`1,562.56 Lacs (Previous year ` 1,875.08 Lacs) has an appropriate future economic benefit as arrived at, upon its demerger<br />

of business with the erstwhile parent Company in the earlier years.<br />

NOTE: 36.<br />

Related Parties Disclosure under Accounting Standard-18<br />

subsidiary Company brandhouse Oviesse Ltd. (w.e.f. 29.07.2009).<br />

Key enterprises in which directors are interested.<br />

Notes to the financial statements<br />

S. Kumars Nationwide Ltd.<br />

Belmonte <strong>Retails</strong> Ltd.<br />

Sansar exim Pvt. Ltd.<br />

Anjaneya Holdings Pvt. Ltd.<br />

Reid & Taylor (India) Ltd.<br />

Ingenious Finance & Investment Pvt. Ltd.<br />

Verve Properties & Investments Pvt. Ltd.<br />

Natty Finance & Investment Pvt. Ltd.<br />

Tulja enterprises Pvt. Ltd.<br />

Chamundeshwari Mercantile Pvt. Ltd.<br />

Maverick Mercantile Pvt. Ltd.<br />

S Kumars enterprises (Synfabs) Ltd.<br />

S Kumars Textiles Ltd.<br />

S.K.Worsteds Pvt Ltd<br />

Rosewood Holdings Pvt Ltd.