Annual Report - Brandhouse Retails

Annual Report - Brandhouse Retails

Annual Report - Brandhouse Retails

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

BRANDHOUSE<br />

R E T A I L S<br />

8 TH ANNUAL REPORT 2011-12 Consolidated Financial Statements<br />

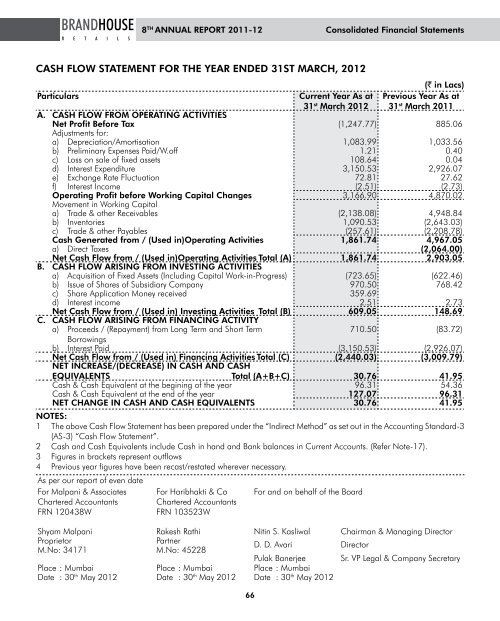

CASH FLOw STATEMENT FOR THE YEAR ENdEd 31ST MARCH, 2012<br />

Particulars Current Year As at<br />

(` in Lacs)<br />

31st Previous Year As at<br />

March 2012 31st March 2011<br />

A. CASH FLOw FROM OPERATiNg ACTiViTiES<br />

Net Profit Before Tax<br />

Adjustments for:<br />

(1,247.77) 885.06<br />

a) Depreciation/Amortisation 1,083.99 1,033.56<br />

b) Preliminary Expenses Paid/W.off 1.21 0.40<br />

c) Loss on sale of fixed assets 108.64 0.04<br />

d) Interest Expenditure 3,150.53 2,926.07<br />

e) Exchange Rate Fluctuation 72.81 27.62<br />

f) Interest Income (2.51) (2.73)<br />

Operating Profit before working Capital Changes<br />

Movement in Working Capital<br />

3,166.90 4,870.02<br />

a) Trade & other Receivables (2,138.08) 4,948.84<br />

b) Inventories 1,090.53 (2,643.03)<br />

c) Trade & other Payables (257.61) (2,208.78)<br />

Cash generated from / (Used in)Operating Activities 1,861.74 4,967.05<br />

a) Direct Taxes (2,064.00)<br />

Net Cash Flow from / (Used in)Operating Activities Total (A) 1,861.74 2,903.05<br />

B. CASH FLOw ARiSiNg FROM iNVESTiNg ACTiViTiES<br />

a) Acquisition of Fixed Assets (Including Capital Work-in-Progress) (723.65) (622.46)<br />

b) Issue of Shares of Subsidiary Company 970.50 768.42<br />

c) Share Application Money received 359.69<br />

d) Interest income 2.51 2.73<br />

Net Cash Flow from / (Used in) investing Activities Total (B) 609.05 148.69<br />

C. CASH FLOw ARiSiNg FROM FiNANCiNg ACTiViTY<br />

a) Proceeds / (Repayment) from Long Term and Short Term<br />

Borrowings<br />

710.50 (83.72)<br />

b) Interest Paid (3,150.53) (2,926.07)<br />

Net Cash Flow from / (Used in) Financing Activities Total (C)<br />

NET iNCREASE/(dECREASE) iN CASH ANd CASH<br />

(2,440.03) (3,009.79)<br />

EqUiVALENTS Total (A+B+C) 30.76 41.95<br />

Cash & Cash Equivalent at the begining of the year 96.31 54.36<br />

Cash & Cash Equivalent at the end of the year 127.07 96.31<br />

NET CHANgE iN CASH ANd CASH EqUiVALENTS<br />

NOTES:<br />

30.76 41.95<br />

1 The above Cash Flow Statement has been prepared under the “Indirect Method” as set out in the Accounting Standard-3<br />

(AS-3) “Cash Flow Statement”.<br />

2 Cash and Cash Equivalents include Cash in hand and Bank balances in Current Accounts. (Refer Note-17).<br />

3 Figures in brackets represent outflows<br />

4 Previous year figures have been recast/restated wherever necessary.<br />

As per our report of even date<br />

For Malpani & Associates For Haribhakti & Co For and on behalf of the Board<br />

Chartered Accountants Chartered Accountants<br />

FRN 120438W<br />

FRN 103523W<br />

Shyam Malpani<br />

Proprietor<br />

M.No: 34171<br />

Place : Mumbai<br />

Date : 30 th May 2012<br />

Rakesh Rathi<br />

Partner<br />

M.No: 45228<br />

Place : Mumbai<br />

Date : 30 th May 2012<br />

66<br />

Nitin S. Kasliwal Chairman & Managing Director<br />

D. D. Avari Director<br />

Pulak Banerjee Sr. VP Legal & Company Secretary<br />

Place : Mumbai<br />

Date : 30th May 2012