Annual Report - Brandhouse Retails

Annual Report - Brandhouse Retails

Annual Report - Brandhouse Retails

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

BRANDHOUSE<br />

R E T A I L S<br />

8 TH ANNUAL REPORT 2011-12<br />

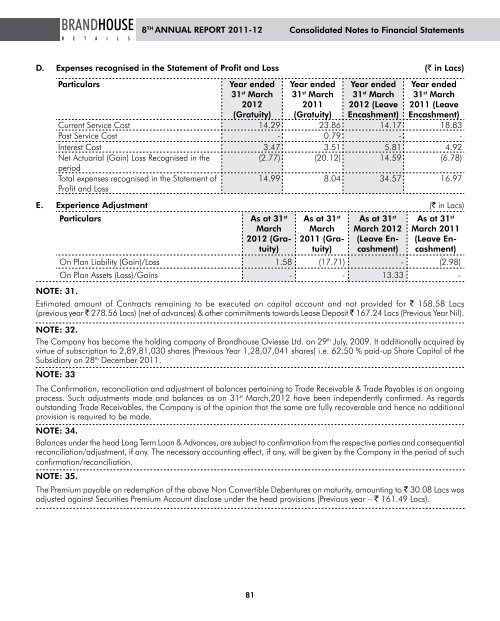

d. Expenses recognised in the Statement of Profit and Loss (` in Lacs)<br />

Particulars Year ended<br />

31st March<br />

2012<br />

(gratuity)<br />

81<br />

Consolidated Notes to Financial Statements<br />

Year ended<br />

31st March<br />

2011<br />

(gratuity)<br />

Year ended<br />

31st March<br />

2012 (Leave<br />

Encashment)<br />

Year ended<br />

31 st March<br />

2011 (Leave<br />

Encashment)<br />

Current Service Cost 14.29 23.86 14.17 18.83<br />

Past Service Cost - 0.79 - -<br />

Interest Cost 3.47 3.51 5.81 4.92<br />

Net Actuarial (Gain) Loss Recognised in the<br />

period<br />

(2.77) (20.12) 14.59 (6.78)<br />

Total expenses recognised in the Statement of<br />

Profit and Loss<br />

14.99 8.04 34.57 16.97<br />

E. Experience Adjustment (` in Lacs)<br />

Particulars As at 31st As at 31<br />

March<br />

2012 (gratuity)<br />

st As at 31<br />

March<br />

2011 (gratuity)<br />

st As at 31<br />

March 2012<br />

(Leave Encashment)<br />

st<br />

March 2011<br />

(Leave Encashment)<br />

On Plan Liability (Gain)/Loss 1.58 (17.71) - (2.98)<br />

On Plan Assets (Loss)/Gains - - 13.33 -<br />

NOTE: 31.<br />

Estimated amount of Contracts remaining to be executed on capital account and not provided for ` 158.58 Lacs<br />

(previous year ` 278.56 Lacs) (net of advances) & other commitments towards Lease Deposit ` 167.24 Lacs (Previous year Nil).<br />

NOTE: 32.<br />

The Company has become the holding company of <strong>Brandhouse</strong> Oviesse Ltd. on 29 th July, 2009. It additionally acquired by<br />

virtue of subscription to 2,89,81,030 shares (Previous year 1,28,07,041 shares) i.e. 62.50 % paid-up Share Capital of the<br />

Subsidiary on 28 th December 2011.<br />

NOTE: 33<br />

The Confirmation, reconciliation and adjustment of balances pertaining to Trade Receivable & Trade Payables is an ongoing<br />

process. Such adjustments made and balances as on 31st March,2012 have been independently confirmed. As regards<br />

outstanding Trade Receivables, the Company is of the opinion that the same are fully recoverable and hence no additional<br />

provision is required to be made.<br />

NOTE: 34.<br />

Balances under the head Long Term Loan & Advances, are subject to confirmation from the respective parties and consequential<br />

reconciliation/adjustment, if any. The necessary accounting effect, if any, will be given by the Company in the period of such<br />

confirmation/reconciliation.<br />

NOTE: 35.<br />

The Premium payable on redemption of the above Non Convertible Debentures on maturity, amounting to ` 30.08 Lacs was<br />

adjusted against Securities Premium Account disclose under the head provisions (Previous year – ` 161.49 Lacs).