Annual Report - Screen Australia

Annual Report - Screen Australia

Annual Report - Screen Australia

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

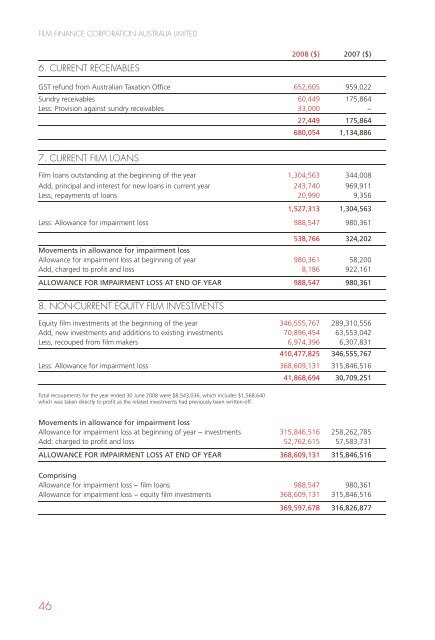

FILM FINANCE CORPORATION AUSTRALIA LIMITED<br />

6. CURRENT RECEIVABLES<br />

46<br />

2008 ($) 2007 ($)<br />

GST refund from <strong>Australia</strong>n Taxation Office 652,605 959,022<br />

Sundry receivables 60,449 175,864<br />

Less: Provision against sundry receivables 33,000 −<br />

7. CURRENT FILM LOANS<br />

27,449 175,864<br />

680,054 1,134,886<br />

Film loans outstanding at the beginning of the year 1,304,563 344,008<br />

Add, principal and interest for new loans in current year 243,740 969,911<br />

Less, repayments of loans 20,990 9,356<br />

1,527,313 1,304,563<br />

Less: Allowance for impairment loss 988,547 980,361<br />

538,766 324,202<br />

Movements in allowance for impairment loss<br />

Allowance for impairment loss at beginning of year 980,361 58,200<br />

Add, charged to profit and loss 8,186 922,161<br />

ALLOWANCE FOR IMPAIRMENT LOSS AT END OF YEAR 988,547 980,361<br />

8. NON-CURRENT EQUITY FILM INVESTMENTS<br />

Equity film investments at the beginning of the year 346,555,767 289,310,556<br />

Add, new investments and additions to existing investments 70,896,454 63,553,042<br />

Less, recouped from film makers 6,974,396 6,307,831<br />

410,477,825 346,555,767<br />

Less: Allowance for impairment loss 368,609,131 315,846,516<br />

Total recoupments for the year ended 30 June 2008 were $8,543,036, which includes $1,568,640<br />

which was taken directly to profit as the related investments had previously been written-off.<br />

41,868,694 30,709,251<br />

Movements in allowance for impairment loss<br />

Allowance for impairment loss at beginning of year − investments 315,846,516 258,262,785<br />

Add: charged to profit and loss 52,762,615 57,583,731<br />

ALLOWANCE FOR IMPAIRMENT LOSS AT END OF YEAR 368,609,131 315,846,516<br />

Comprising<br />

Allowance for impairment loss − film loans 988,547 980,361<br />

Allowance for impairment loss − equity film investments 368,609,131 315,846,516<br />

369,597,678 316,826,877<br />

9. PLANT AND EQUIPMENT<br />

ABN 22 008 642 564<br />

2008 ($) 2007 ($)<br />

Computer equipment − at cost 245,456 232,754<br />

Less, accumulated depreciation 188,752 192,918<br />

NET CARRYING AMOUNT 56,704 39,836<br />

Leasehold improvements − at cost 1,295,495 1,238,428<br />

Less, accumulated depreciation 738,038 581,991<br />

NET CARRYING AMOUNT 557,457 656,437<br />

Motor vehicle − at cost 19,864 19,864<br />

Less, accumulated depreciation 14,898 11,918<br />

NET CARRYING AMOUNT 4,966 7,946<br />

Office equipment − at cost 106,666 134,218<br />

Less, accumulated depreciation 104,435 130,662<br />

NET CARRYING AMOUNT 2,231 3,556<br />

Office furniture and fittings − at cost 448,390 451,413<br />

Less, accumulated depreciation 442,832 442,358<br />

NET CARRYING AMOUNT 5,558 9,055<br />

Video equipment - at cost 114,568 115,645<br />

Less, accumulated depreciation 112,734 103,254<br />

NET CARRYING AMOUNT 1,834 12,391<br />

TOTAL NET CARRYING AMOUNT 628,750 729,221<br />

Movements in plant and equipment<br />

Net carrying amount at beginning of year 729,221 882,381<br />

Add, additions at cost 103,923 43,760<br />

833,144 926,141<br />

Less disposals at cost 65,806 30,594<br />

767,338 895,547<br />

Add, depreciation adjustment on disposals 65,454 29,600<br />

832,792 925,147<br />

Less, amortisation and depreciation expense 204,042 195,926<br />

NET CARRYING AMOUNT AT END OF YEAR 628,750 729,221<br />

10. CURRENT PAYABLES<br />

Accrued expenses 416,988 385,015<br />

11. PROVISIONS<br />

416,988 385,015<br />

Current<br />

Provision for employee benefits<br />

Non-current<br />

564,309 529,149<br />

Provision for employee benefits 307,792 258,314<br />

Provision for onerous film contracts 28,137,040 14,050,475<br />

Provison for make good on leased premises 190,450 179,914<br />

28,635,282 14,488,703<br />

Make good provision. The company’s leased premises are required to be returned to the lessor in original<br />

condition. The provision for make good is measured at the present value of the expected cost of<br />

refurbishment as at each reporting date.<br />

47