PPO/DRP Medical Plan - Advocate Benefits - Advocate Health Care

PPO/DRP Medical Plan - Advocate Benefits - Advocate Health Care

PPO/DRP Medical Plan - Advocate Benefits - Advocate Health Care

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

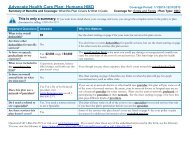

<strong>PPO</strong>/<strong>DRP</strong> At-A-Glance<br />

Feature How the <strong>PPO</strong>/<strong>DRP</strong> Works<br />

When Coverage Begins If you are eligible, coverage for you and your eligible dependents can<br />

begin on the day after you complete 30 days of employment with<br />

<strong>Advocate</strong> or one of its affiliated companies.<br />

Cost of Coverage You and <strong>Advocate</strong> share the cost of coverage. Your contributions—<br />

which are based on your length of service as an <strong>Advocate</strong> associate<br />

and , if you are a full-time associate, your annual pay—are deducted<br />

from your pay on a pre-tax basis.<br />

Choice of <strong>Medical</strong> Providers You can choose any licensed health care provider. (You will generally<br />

receive a higher level of benefits if you use a participating provider.)<br />

Annual Deductible3 Single<br />

Associate + Child(ren)<br />

Associate + Spouse/Domestic Partner/<br />

Civil Union or Family<br />

Annual Out-of-Pocket Coinsurance Limit4 Individual<br />

Family<br />

Lifetime Benefit Maximum for Infertility<br />

Treatment (not including pharmacy)<br />

In-Network<br />

$1,600<br />

$2,600<br />

$3,200<br />

$2,000<br />

$4,000<br />

Out-of-Network<br />

$3,200<br />

$5,200<br />

$6,400<br />

$5,000<br />

$10,000<br />

$50,000 $50,000<br />

1 When you receive services from <strong>Advocate</strong> facilities, <strong>Advocate</strong> will waive 10% of the cost of covered services; you will be responsible for 10%.<br />

You must still satisfy the annual deductible before benefits begin—except for preventive care.<br />

2 When you receive medically necessary care from nonparticipating providers, the <strong>PPO</strong>/<strong>DRP</strong> will pay 60% of eligible costs (based on reasonable<br />

and customary charges, according to the applicable reimbursement schedule). You must satisfy a higher annual deductible before benefits<br />

begin and pay higher coinsurance for all services.<br />

3 There are no cost-sharing requirements (e.g., coinsurance, deductibles, and copayments) for preventive care services provided by a<br />

participating provider.<br />

4 Annual out-of-pocket coinsurance limit does not include deductibles, ER copayments, penalties that result from no pre-approval (when<br />

required), and amounts above the maximum allowance when services are received in-network (or the reasonable and customary charge when<br />

services are received out-of-network). Eligible expenses incurred out-of-network apply to the in-network deductible and out-of-pocket limit and<br />

vice versa. No deductible, co-payment or coinsurance aaplies to preventive care services provided by participating providers.<br />

6