PPO/DRP Medical Plan - Advocate Benefits - Advocate Health Care

PPO/DRP Medical Plan - Advocate Benefits - Advocate Health Care

PPO/DRP Medical Plan - Advocate Benefits - Advocate Health Care

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

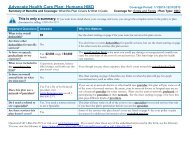

Type of Services In-Network Out-of-Network<br />

Hospital and Surgery Centers<br />

Inpatient care2,3 Outpatient surgery2 Outpatient non-surgical care2 Emergency Room<br />

Facility charges2 Physician charges<br />

Physician Services<br />

Pediatric care<br />

Office visit for treatment of<br />

illness or injury<br />

Diagnostic lab test and x-rays<br />

In-office allergy treatment and<br />

materials<br />

Casts, splints, crutches, braces<br />

and prosthetic devices<br />

Hearing and vision exams due to<br />

illness or injury<br />

Outpatient surgery<br />

Infertility<br />

Inpatient care<br />

After you pay the deductible, <strong>Plan</strong> pays<br />

80% of covered expenses<br />

After you pay the deductible<br />

and a $200 copayment per visit<br />

(copayment waived if admitted to<br />

hospital), <strong>Plan</strong> pays 80% of covered<br />

expenses<br />

After you pay the deductible,<br />

<strong>Plan</strong> pays 80% of covered expenses<br />

After you pay the deductible, <strong>Plan</strong> pays<br />

80% of covered expenses<br />

After you pay the deductible, <strong>Plan</strong> pays<br />

60% of reasonable and customary<br />

charges<br />

After you pay the deductible<br />

and a $200 copayment per visit<br />

(copayment waived if admitted<br />

to hospital), <strong>Plan</strong> pays 80% of<br />

reasonable and customary charges<br />

After you pay the deductible and a<br />

$200 copayment per visit, <strong>Plan</strong> pays<br />

60% of reasonable and customary<br />

charges (if treatment is for a nonemergency)<br />

After you pay the deductible,<br />

the <strong>Plan</strong> pays 80% of reasonable and<br />

customary charges<br />

After you pay the deductible,<br />

the <strong>Plan</strong> pays 60% of reasonable and<br />

customary charges (if treatment is<br />

for a non-emergency)<br />

After you pay the deductible, <strong>Plan</strong> pays<br />

60% of reasonable and customary<br />

charges<br />

$50,000 lifetime maximum benefit<br />

2 When you receive services from an <strong>Advocate</strong> facility—<strong>Advocate</strong> will waive 10% of your portion of the coinsurance amount; you will be<br />

responsible for 10%. You must still satisfy the annual deductible before benefits begin—except for preventive care.<br />

3 <strong>Care</strong> must be pre-certified; the number to call to initiate the pre-certification process is on the back of your coverage ID card.<br />

8