PPO/DRP Medical Plan - Advocate Benefits - Advocate Health Care

PPO/DRP Medical Plan - Advocate Benefits - Advocate Health Care

PPO/DRP Medical Plan - Advocate Benefits - Advocate Health Care

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>PPO</strong>/<strong>DRP</strong><br />

<strong>Medical</strong> <strong>Plan</strong>

In This Summary...<br />

<strong>PPO</strong>/<strong>DRP</strong> <strong>Medical</strong> <strong>Plan</strong> ...................................................... 3<br />

Keeping <strong>Health</strong>y: A Common Goal, A Shared Commitment ................. 4<br />

<strong>PPO</strong>/<strong>DRP</strong> At-A-Glance ...................................................... 6<br />

The Basics .................................................................. 10<br />

Eligibility<br />

Cost<br />

When Coverage Begins<br />

Making Changes<br />

<strong>PPO</strong>/<strong>DRP</strong> <strong>Benefits</strong> .......................................................... 15<br />

Choosing a Provider<br />

Coverage Amounts<br />

<strong>Health</strong><strong>Care</strong> Management Program<br />

Covered Services<br />

Services That Are Not Covered<br />

Prescription <strong>Benefits</strong><br />

Making a Claim ............................................................ 31<br />

Filing a Claim<br />

Claims and Appeal Procedures<br />

Other <strong>Plan</strong> Information ..................................................... 39<br />

When <strong>Medical</strong> Coverage Ends<br />

Non-Duplication of <strong>Benefits</strong><br />

Rights of the <strong>PPO</strong>/<strong>DRP</strong> Administrator<br />

Subrogation/Reimbursement<br />

<strong>Health</strong> Insurance Portability and Accessibility Act of 1996 (HIPAA)<br />

Integrating <strong>Benefits</strong> with Medicare<br />

Assignment of <strong>Benefits</strong><br />

Coverage During Leaves and Disability<br />

Continuation of Coverage<br />

Evidence of Creditable Coverage<br />

<strong>Plan</strong> Administration<br />

2

<strong>PPO</strong>/<strong>DRP</strong> <strong>Medical</strong> <strong>Plan</strong><br />

If you are an eligible associate (see the Eligibility<br />

section on page 10), the Preferred Provider<br />

Organization Deductible Reimbursement <strong>Plan</strong><br />

(<strong>PPO</strong>/<strong>DRP</strong>) coverage option offers important<br />

protection against the high cost of medical care<br />

for you and your covered family members, as<br />

described in this summary booklet.<br />

If you choose <strong>PPO</strong>/<strong>DRP</strong> coverage, it will pay<br />

benefits toward the cost of covered medical<br />

services you and your eligible family members<br />

receive from any physician or medical facility you<br />

choose—but will generally pay a higher level of<br />

benefits when services are provided by a <strong>PPO</strong>/<br />

<strong>DRP</strong> participating provider.<br />

When you elect <strong>PPO</strong>/<strong>DRP</strong> coverage, you will<br />

automatically participate in an <strong>Advocate</strong>-funded<br />

Deductible Reimbursement Account (DRA) that<br />

you can use to offset a portion of your annual<br />

deductible. <strong>Advocate</strong>’s contribution to your DRA<br />

will be:<br />

$600—if you elect single coverage, or<br />

$1,200—if you elect associate + child(ren) or<br />

associate + spouse or family coverage.<br />

For more information about the DRA—and<br />

the <strong>Health</strong>e Futures Account—see the <strong>Health</strong><br />

Reimbursement Accounts <strong>Plan</strong> Summary.<br />

This is a summary of the benefits available through the <strong>PPO</strong>/<strong>DRP</strong> <strong>Medical</strong> <strong>Plan</strong>, which is a medical coverage option under the<br />

<strong>Advocate</strong> <strong>Health</strong> <strong>Care</strong> Network Welfare <strong>Benefits</strong> <strong>Plan</strong> (the “<strong>Plan</strong>”). While every effort has been made to accurately describe<br />

the <strong>Plan</strong> and the <strong>PPO</strong>/<strong>DRP</strong> <strong>Medical</strong> <strong>Plan</strong> option, this booklet—as a summary—does not cover all the details of the <strong>Plan</strong> (or the<br />

underlying medical plan options) or how the rules will apply to every person, in every situation. The complete rules that govern the<br />

<strong>Plan</strong> (and the underlying medical plan options) are contained in the official <strong>Plan</strong> document. In the event of a discrepancy between<br />

the information contained in this summary and the official <strong>Plan</strong> document, the <strong>Plan</strong> document will always govern.<br />

<strong>Advocate</strong> intends to continue the <strong>Plan</strong>, but reserves the right to amend, modify or terminate the <strong>Plan</strong>, in whole or in part, at any<br />

time for any reason. In the event of a change, the <strong>Plan</strong> document will always govern.If the <strong>Plan</strong> is terminated, your coverage will<br />

end; however, you will be entitled to <strong>Plan</strong> benefits for any covered services incurred before the date the <strong>Plan</strong> was terminated.<br />

This booklet is not a contract of employment and nothing in the <strong>Plan</strong> gives any associate the right to be retained in the service of<br />

<strong>Advocate</strong> <strong>Health</strong> <strong>Care</strong> Network (“<strong>Advocate</strong>”) or any of its affiliated companies.<br />

3

Keeping <strong>Health</strong>y:<br />

A Common Goal, A Shared Commitment<br />

At <strong>Advocate</strong>, we know the value of good health<br />

and we understand what it takes to be healthy.<br />

After all, it’s our business.<br />

For all of us at <strong>Advocate</strong>, good health is a<br />

common goal and a shared commitment not<br />

only for our patients, but for our associates and<br />

their families. While it’s up to you to take care of<br />

yourself and your family, <strong>Advocate</strong> is committed<br />

to helping you keep well. That’s why <strong>Advocate</strong>’s<br />

plan options:<br />

Offer valuable features designed to encourage<br />

you to take advantage of preventive care services<br />

that can detect conditions that can benefit from<br />

early treatment (before they become more<br />

serious or potentially life threatening), and<br />

Provide valuable benefits to help pay the cost<br />

of the care that’s needed to treat—and cure—<br />

health conditions that do arise.<br />

It’s also why <strong>Advocate</strong> sponsors <strong>Health</strong>e You—a<br />

special benefit program that complements<br />

your coverage under an <strong>Advocate</strong> medical plan<br />

option—to promote wellness and support healthy<br />

lifestyle choices.<br />

<strong>Health</strong>e You: It’s All About a <strong>Health</strong>ier You<br />

Depending on your individual needs and health<br />

status, <strong>Health</strong>e You is designed to help you:<br />

Manage an illness or chronic condition<br />

Maintain a healthy lifestyle, and/or<br />

Improve your health.<br />

Based on these partnerships, there are four types<br />

of support and information you may receive:<br />

4<br />

When you complete a Succeed Questionnaire<br />

personal health assessment, you will receive<br />

a personal health action plan to encourage<br />

you to make use of specific online tools,<br />

resources and other programs (see <strong>Health</strong>e<br />

You Programs, page 5).<br />

From time-to-time you may receive a<br />

personalized <strong>Care</strong> Consideration—a patient–<br />

specific clinical alert. This alert—mailed to<br />

your home and to your doctor’s office—will<br />

provide valuable information that can help you<br />

and your doctor make more informed decisions<br />

regarding your health care and improve the<br />

quality of the care you receive overall.<br />

From time-to-time you also may receive a call<br />

from the disease management company. This<br />

call—based on a review of recent health and<br />

pharmacy claims data—will mark the beginning<br />

of <strong>Health</strong>e <strong>Care</strong>, a personal support program<br />

designed to help patients suffering from<br />

coronary artery disease, heart failure, diabetes<br />

or asthma to follow their doctor’s treatment<br />

plan and better manage their chronic health<br />

condition.<br />

All associates, eligible spouses, domestic<br />

partners and civil union partners enrolled<br />

in an <strong>Advocate</strong>-sponsored medical plan<br />

option—and who complete a Succeed<br />

Questionnaire—will be eligible to participate in<br />

the <strong>Health</strong>e Rewards program through which<br />

they can receive valuable credits and points<br />

for participating in healthy activities. Note:<br />

While you don’t need to complete a Succeed<br />

Questionnaire before participating in <strong>Health</strong>e<br />

Rewards activities, you will not earn any<br />

<strong>Health</strong>e Rewards until you do.

You also may be invited to participate in<br />

<strong>Advocate</strong>’s Integrated <strong>Health</strong> Advocacy<br />

Program SM —a holistic approach to health care<br />

designed to help you and your dependents cope<br />

with challenging or continuing health problems<br />

by partnering with you to improve your overall<br />

health and life status. While participation in IHAP<br />

is completely voluntary and strictly confidential,<br />

the program will identify associates and/or family<br />

members who may benefit from participation in<br />

the program. Note: You may nominate yourself<br />

or a family member for participation in IHAP<br />

(subject to approval by IHAP).<br />

More information about <strong>Health</strong>e You is available<br />

at www.advocatebenefits.com (go to <strong>Benefits</strong><br />

Information > <strong>Health</strong>e You).<br />

Important! Protecting your confidentiality and privacy is our top priority. Personal health<br />

information created or used by the <strong>Health</strong>e You program—including information used to<br />

develop personal health action plans, patient-specific clinical alerts and personal support<br />

programs—is handled in accordance with privacy standards established by the <strong>Health</strong> Insurance<br />

Portability and Accountability Act (HIPAA). No one will have access to your personal health<br />

information other than you and your health care provider or a firm retained by the <strong>Plan</strong> to<br />

provide the <strong>Health</strong>e You programs (e.g., Active<strong>Health</strong>).<br />

<strong>Health</strong>e You Programs<br />

<strong>Health</strong>e Actions To make it easier and more convenient to get the physical activity you need to maintain good<br />

health, <strong>Advocate</strong> has expanded its internal fitness facility options and arranged discounts with<br />

external fitness companies.<br />

<strong>Health</strong>e <strong>Care</strong><br />

Live life to the fullest! This condition support service assists those living with coronary artery<br />

disease, congestive heart failure, diabetes and/or asthma. Call 800.227.3728 to enroll today!<br />

<strong>Health</strong>e Breathing This program is designed for smokers who are trying to quit. It combines individualized<br />

coaching—provided free by Nationwide Better <strong>Health</strong> ® —with the resources and tools available<br />

through the <strong>Health</strong>Media Breathe program. It also includes assistance in selecting appropriate<br />

drug therapies.<br />

<strong>Health</strong>e Eating <strong>Health</strong>y eating and managing weight are essential to maintaining good health. Through <strong>Health</strong>e<br />

You, <strong>Advocate</strong> provides affordable and convenient arrangements with a number of weight loss<br />

and management companies, including Jenny Craig ® , NutriSystems ® and Seattle Sutton ® .<br />

<strong>Health</strong>e Path<br />

<strong>Health</strong>e Trends<br />

To promote daily exercise—even in inclement weather—<strong>Advocate</strong> has created indoor walking<br />

paths at a variety of sites. It’s an easy, convenient way to stretch your legs. All you need to do is<br />

get up from your desk and follow the posted pathway signs.<br />

Special interest articles offering informative tips and guidelines on a number of health care<br />

issues, including age- and gender-recommended screening tests, managing chronic pain, sticking<br />

with a healthy diet (even when eating “on-the-run”) and family fitness.<br />

5

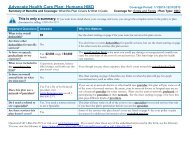

<strong>PPO</strong>/<strong>DRP</strong> At-A-Glance<br />

Feature How the <strong>PPO</strong>/<strong>DRP</strong> Works<br />

When Coverage Begins If you are eligible, coverage for you and your eligible dependents can<br />

begin on the day after you complete 30 days of employment with<br />

<strong>Advocate</strong> or one of its affiliated companies.<br />

Cost of Coverage You and <strong>Advocate</strong> share the cost of coverage. Your contributions—<br />

which are based on your length of service as an <strong>Advocate</strong> associate<br />

and , if you are a full-time associate, your annual pay—are deducted<br />

from your pay on a pre-tax basis.<br />

Choice of <strong>Medical</strong> Providers You can choose any licensed health care provider. (You will generally<br />

receive a higher level of benefits if you use a participating provider.)<br />

Annual Deductible3 Single<br />

Associate + Child(ren)<br />

Associate + Spouse/Domestic Partner/<br />

Civil Union or Family<br />

Annual Out-of-Pocket Coinsurance Limit4 Individual<br />

Family<br />

Lifetime Benefit Maximum for Infertility<br />

Treatment (not including pharmacy)<br />

In-Network<br />

$1,600<br />

$2,600<br />

$3,200<br />

$2,000<br />

$4,000<br />

Out-of-Network<br />

$3,200<br />

$5,200<br />

$6,400<br />

$5,000<br />

$10,000<br />

$50,000 $50,000<br />

1 When you receive services from <strong>Advocate</strong> facilities, <strong>Advocate</strong> will waive 10% of the cost of covered services; you will be responsible for 10%.<br />

You must still satisfy the annual deductible before benefits begin—except for preventive care.<br />

2 When you receive medically necessary care from nonparticipating providers, the <strong>PPO</strong>/<strong>DRP</strong> will pay 60% of eligible costs (based on reasonable<br />

and customary charges, according to the applicable reimbursement schedule). You must satisfy a higher annual deductible before benefits<br />

begin and pay higher coinsurance for all services.<br />

3 There are no cost-sharing requirements (e.g., coinsurance, deductibles, and copayments) for preventive care services provided by a<br />

participating provider.<br />

4 Annual out-of-pocket coinsurance limit does not include deductibles, ER copayments, penalties that result from no pre-approval (when<br />

required), and amounts above the maximum allowance when services are received in-network (or the reasonable and customary charge when<br />

services are received out-of-network). Eligible expenses incurred out-of-network apply to the in-network deductible and out-of-pocket limit and<br />

vice versa. No deductible, co-payment or coinsurance aaplies to preventive care services provided by participating providers.<br />

6

Services In-Network Out-of-Network<br />

Preventive <strong>Care</strong> Services 1<br />

Routine care for child(ren)<br />

– exam<br />

– lab test/x-ray<br />

– immunization<br />

– flu/pneumonia injection<br />

– Human Papillomavirus<br />

(HPV) vaccination<br />

Routine care for adult(s)<br />

– exam<br />

– lab test/x-ray<br />

– immunization<br />

– flu/pneumonia injection<br />

– Human Papillomavirus<br />

(HPV) vaccination<br />

– Shingles vaccination<br />

– mammogram<br />

– Pap smear<br />

– colonoscopy,<br />

proctosigmoidoscopy<br />

and sigmoidoscopy<br />

screenings<br />

– Prostate Specific<br />

Antigen (PSA) testing<br />

– bone density scan<br />

<strong>Plan</strong> pays 100% of covered expenses—<br />

with no deductible<br />

Considered routine regardless of<br />

diagnosis submitted<br />

For child(ren) age 9 and older<br />

<strong>Plan</strong> pays 100% of covered expenses with<br />

no deductible (limit one exam per year)<br />

Considered routine regardless of<br />

diagnosis submitted<br />

For adult age 26 and younger<br />

For adult age 60 and older<br />

One per calendar year for women<br />

When performed as hospital outpatient<br />

or in an ambulatory surgical center<br />

or clinic; includes related services; if<br />

performed as part of surgical treatment<br />

(e.g., polyp removal, biopsies, etc.)<br />

general illness benefits will apply<br />

<strong>Plan</strong> pays 60% of reasonable and<br />

customary charges<br />

Considered routine regardless of<br />

diagnosis submitted<br />

For child(ren) age 9 and older<br />

<strong>Plan</strong> pays 60% of reasonable and customary<br />

charges (limit one exam per year)<br />

Considered routine regardless of<br />

diagnosis submitted<br />

For adult age 26 and younger<br />

For adult age 60 and older<br />

One per calendar year for women<br />

When performed as hospital outpatient<br />

or in an ambulatory surgical center<br />

or clinic; includes related services; if<br />

performed as part of surgical treatment<br />

(e.g., polyp removal, biopsies, etc.)<br />

general illness benefits will apply<br />

1 To the extent the service is considered a “preventive care service” and is provided by a participating provider, it must be provided without any<br />

cost-sharing requirements according to federal law. In other words, no deductible, copayments or coinsurance will apply to such service when<br />

provided by a participating provider.<br />

7

Type of Services In-Network Out-of-Network<br />

Hospital and Surgery Centers<br />

Inpatient care2,3 Outpatient surgery2 Outpatient non-surgical care2 Emergency Room<br />

Facility charges2 Physician charges<br />

Physician Services<br />

Pediatric care<br />

Office visit for treatment of<br />

illness or injury<br />

Diagnostic lab test and x-rays<br />

In-office allergy treatment and<br />

materials<br />

Casts, splints, crutches, braces<br />

and prosthetic devices<br />

Hearing and vision exams due to<br />

illness or injury<br />

Outpatient surgery<br />

Infertility<br />

Inpatient care<br />

After you pay the deductible, <strong>Plan</strong> pays<br />

80% of covered expenses<br />

After you pay the deductible<br />

and a $200 copayment per visit<br />

(copayment waived if admitted to<br />

hospital), <strong>Plan</strong> pays 80% of covered<br />

expenses<br />

After you pay the deductible,<br />

<strong>Plan</strong> pays 80% of covered expenses<br />

After you pay the deductible, <strong>Plan</strong> pays<br />

80% of covered expenses<br />

After you pay the deductible, <strong>Plan</strong> pays<br />

60% of reasonable and customary<br />

charges<br />

After you pay the deductible<br />

and a $200 copayment per visit<br />

(copayment waived if admitted<br />

to hospital), <strong>Plan</strong> pays 80% of<br />

reasonable and customary charges<br />

After you pay the deductible and a<br />

$200 copayment per visit, <strong>Plan</strong> pays<br />

60% of reasonable and customary<br />

charges (if treatment is for a nonemergency)<br />

After you pay the deductible,<br />

the <strong>Plan</strong> pays 80% of reasonable and<br />

customary charges<br />

After you pay the deductible,<br />

the <strong>Plan</strong> pays 60% of reasonable and<br />

customary charges (if treatment is<br />

for a non-emergency)<br />

After you pay the deductible, <strong>Plan</strong> pays<br />

60% of reasonable and customary<br />

charges<br />

$50,000 lifetime maximum benefit<br />

2 When you receive services from an <strong>Advocate</strong> facility—<strong>Advocate</strong> will waive 10% of your portion of the coinsurance amount; you will be<br />

responsible for 10%. You must still satisfy the annual deductible before benefits begin—except for preventive care.<br />

3 <strong>Care</strong> must be pre-certified; the number to call to initiate the pre-certification process is on the back of your coverage ID card.<br />

8

Type of Services In-Network Out-of-Network<br />

Other <strong>Medical</strong> Services<br />

Home health care2,3 Skilled nursing facility3 Durable medical equipment<br />

Chiropractic care<br />

Physical, Occupational and<br />

Speech Therapy<br />

Behavioral <strong>Health</strong> <strong>Care</strong><br />

Behavioral illness—inpatient4 and outpatient<br />

Alcoholism and chemical<br />

dependency—inpatient and<br />

outpatient<br />

After you pay the deductible, <strong>Plan</strong><br />

pays 80% of covered expenses,<br />

unless noted:<br />

Spinal manipulations limited to 20 per year<br />

After you pay the deductible, <strong>Plan</strong><br />

pays 80% of covered expenses.<br />

After you pay the deductible, <strong>Plan</strong> pays<br />

60% of reasonable and customary<br />

charges, unless noted:<br />

After you pay the deductible,<br />

<strong>Plan</strong> pays 60% of reasonable and<br />

customary charges<br />

Limited to 60 visits per calendar year for all therapy services<br />

After you pay the deductible, <strong>Plan</strong> pays<br />

80% of covered expenses<br />

After you pay the deductible, <strong>Plan</strong> pays<br />

80% of covered expenses<br />

After you pay the deductible,<br />

<strong>Plan</strong> pays 60% of reasonable and<br />

customary charges<br />

After you pay the deductible,<br />

<strong>Plan</strong> pays 60% of reasonable and<br />

customary charges<br />

Prescription Drugs <strong>Benefits</strong> provided through CVS/<strong>Care</strong>mark. <strong>Plan</strong> pays 100% of covered<br />

prescription drugs after you pay a copayment based on whether the drug you<br />

select is:<br />

Value generics<br />

Generic<br />

Preferred brand-name<br />

Non-preferred brand-name<br />

For more information, see Prescription <strong>Benefits</strong>, page 29.<br />

Eyeglasses and Contact Lenses Not covered<br />

Not covered<br />

2 When you receive services from an <strong>Advocate</strong> facility—<strong>Advocate</strong> will waive 10% of your portion of the coinsurance amount; you will be responsible<br />

for 10%. You must still satisfy the annual deductible before benefits begin—except for preventive care.<br />

3 <strong>Care</strong> must be pre-certified the number to call to initiate the pre-certification process is on the back of your coverage ID card.<br />

4 Inpatient care must be pre-certified; the number to call to initiate the pre-certification process for behavioral health services is on the back of<br />

your coverage ID card.<br />

9

The Basics<br />

Eligibility<br />

To be eligible to participate in the <strong>Plan</strong>, you must<br />

be employed by <strong>Advocate</strong> or one of its affiliated<br />

companies that participates in the <strong>Plan</strong> (an<br />

“<strong>Advocate</strong> Company”) as a:<br />

Full-time associate—who works at least 40<br />

hours per work week (or who works 36 hours<br />

per week and is classified as an “E9” or<br />

“N9” associate),<br />

Part-time A associate—who works at least 32<br />

(but less than 40) hours per work week, or<br />

Part-time B associate—who works at least 20<br />

(but less than 32) hours per work week.<br />

You must also have completed 30 days of<br />

employment with <strong>Advocate</strong> or one of its<br />

affiliated companies to be eligible to participate.<br />

Satisfying these requirements means that<br />

you are a “benefits-eligible” associate or in a<br />

“benefits-eligible” position or status as referred<br />

to throughout this summary.<br />

You can purchase medical coverage for eligible<br />

family members, including:<br />

Your lawful spouse<br />

Your domestic partner or civil union partner<br />

Note: For more information about the eligibility<br />

of a civil union or domestic partner for<br />

coverage under the <strong>Plan</strong>, refer to the Partner<br />

<strong>Benefits</strong> Information Guide online at<br />

www.advocatebenefits.com (go to <strong>Benefits</strong><br />

Information > Partner <strong>Benefits</strong>).<br />

Your children up to age 26. Note: Children<br />

include your:<br />

– Natural children,<br />

– Stepchildren,<br />

– Adopted children (including children<br />

placed with you for adoption),<br />

– Foster children, and<br />

– Any children for whom you have<br />

legal guardianship.<br />

10<br />

Note: You cannot be covered under any of<br />

the <strong>Advocate</strong> medical plan options as both an<br />

associate and a dependent. If both parents are<br />

benefits-eligible associates, only one parent can<br />

cover the children as dependents. You or your<br />

dependents may not elect to be covered under<br />

more than one <strong>Advocate</strong> medical plan option.<br />

Are my married children eligible for inclusion<br />

under my <strong>Advocate</strong> medical coverage?<br />

Yes, your married children are eligible for<br />

coverage up to age 26. However, your child’s<br />

spouse is not eligible to participate.<br />

Enrollment<br />

To enroll initially or to change your<br />

existing coverage after a transfer to<br />

benefits-eligible status, you must log on to<br />

www.advocatebenefits.com. You will receive a<br />

system-generated <strong>Benefits</strong> Enrollment Guide,<br />

which will specify your designated enrollment<br />

period, as well as provide you with a Personal<br />

Identification Number (PIN) to access the<br />

<strong>Advocate</strong> <strong>Benefits</strong> Service Center benefits<br />

enrollment system.<br />

<strong>Advocate</strong> reserves the right to periodically audit<br />

the eligibility process and request documentation<br />

from <strong>Plan</strong> participants to verify eligibility for<br />

the <strong>Plan</strong> or the payment of benefits under the<br />

<strong>Plan</strong>. Associates found to be involved in acts of<br />

dishonesty are subject to disciplinary action, up<br />

to and including termination of employment.<br />

Important! You should review your enrollment<br />

materials carefully to ensure you are aware of<br />

your designated enrollment period. If you do not<br />

enroll during your designated enrollment period,<br />

you will not be able to enroll for coverage until<br />

the next annual enrollment period—unless you<br />

have a qualified work, family or eligible life status<br />

change (see Work, Family or Eligible Life Status<br />

Change, page 14).

Incapacitated Dependents<br />

A child will remain eligible for coverage under the<br />

<strong>Plan</strong> beyond the date coverage would otherwise<br />

be lost if the child is:<br />

Unmarried<br />

Mentally or physically incapacitated, and<br />

Dependent upon you for support<br />

and maintenance.<br />

<strong>Advocate</strong> will request proof of the child’s<br />

incapacity after he or she reaches the <strong>Plan</strong>’s<br />

eligibility age limit. This proof of incapacitation<br />

must be provided within 45 days of the child’s<br />

loss of eligibility. In addition, <strong>Advocate</strong> may have<br />

the dependent examined by a physician to verify<br />

the incapacity.<br />

Cost<br />

You and <strong>Advocate</strong> share the cost of the medical<br />

coverage you choose. Your cost for this coverage<br />

will automatically be deducted from your pay<br />

each pay period on a pre-tax basis. This means<br />

that your cost for coverage is not subject to<br />

federal, state and Social Security taxes because<br />

the cost is deducted from your pay before income<br />

and Social Security taxes are calculated. This<br />

reduces your taxable income and, in turn, the<br />

taxes you pay. The resulting tax savings reduces<br />

your out-of-pocket cost for coverage.<br />

The amount you pay toward the cost of your<br />

<strong>Advocate</strong> medical coverage each pay period will<br />

depend on four things:<br />

Your associate classification<br />

The level of coverage you choose—Single,<br />

Associate + Child(ren), Associate + Spouse/<br />

Partner, or Family,<br />

Your years of benefits-eligible service, and<br />

Your annual pay (if you are a full-time associate).<br />

For more information, see the appropriate<br />

Associate Contributions rate sheet available<br />

at www.advocatebenefits.com (go to<br />

<strong>Benefits</strong> Information > <strong>Medical</strong> <strong>Benefits</strong> ><br />

Associate Contributions).<br />

11<br />

If you enroll a domestic partner or civil union<br />

partner under your coverage, your contributions<br />

for the cost of coverage for you and your other<br />

eligible dependents are taken on a pre-tax basis,<br />

but—in accordance with federal tax laws—your<br />

contributions for the coverage of your domestic<br />

partner or civil union partner are taken from your<br />

pay on an after-tax basis, and you will have an<br />

additional amount added to your taxable income<br />

that is equal to the amount <strong>Advocate</strong> pays for<br />

your domestic partner’s or civil union partner’s<br />

coverage. For additional information, please<br />

review the Partner Information Guide.<br />

How do I access information about my<br />

<strong>Advocate</strong> <strong>Benefits</strong>?<br />

You can access benefits information online<br />

at www.advocatebenefits.com from your<br />

worksite through an <strong>Advocate</strong>-networked<br />

personal computer or kiosk or by calling<br />

the <strong>Advocate</strong> <strong>Benefits</strong> Service Center at<br />

800.775.4784.<br />

When Coverage Begins<br />

Coverage for You<br />

Your coverage under the <strong>Plan</strong> can begin on the<br />

day after you complete 30 days of employment<br />

with <strong>Advocate</strong> or one of its affiliated companies<br />

and are in a benefits-eligible position with an<br />

<strong>Advocate</strong> Company—as long as you enroll for<br />

coverage. during your designated enrollment<br />

period. If you do not elect coverage within that<br />

period, you will receive a notice confirming your<br />

non-election of coverage. If you subsequently<br />

want to enroll for coverage and do so within<br />

60 days of your hire date or, if later, the date<br />

you transfer into a benefits-eligible status, your<br />

coverage will begin retroactive to your original<br />

eligibility date.<br />

If you do not enroll within 60 days of your hire<br />

or the date you transfer into benefits-eligible<br />

status, you will have to wait until the next annual<br />

enrollment period to enroll or until you have<br />

a qualified work, family or eligible life status<br />

change (see Work, Family or Eligible Life Status<br />

Change, page 14).

How do I enroll for coverage?<br />

Once you are eligible, you will receive an<br />

enrollment workbook that provides you<br />

with a Personal Identification Number (PIN).<br />

To enroll initially you must go online at<br />

www.advocatebenefits.com or by calling<br />

the <strong>Advocate</strong> <strong>Benefits</strong> Service Center at<br />

800.775.4784.<br />

Once your coverage under the <strong>PPO</strong>/<strong>DRP</strong> begins,<br />

it will continue for the balance of the current<br />

calendar year as long as you remain eligible<br />

and continue to pay the contributions required<br />

for this coverage.<br />

Coverage for Your Eligible Family Members<br />

Coverage for your eligible family members will<br />

begin on the same date as your coverage or, if<br />

later, the date they become eligibile for coverage,<br />

provided you enroll them. If you do not enroll<br />

your eligible family members for coverage within<br />

30 days after they first become eligible, you will<br />

not be able to enroll your eligible family members<br />

for coverage until the next annual enrollment<br />

period or you have a qualified work, family or<br />

eligible life status change (see Work, Family or<br />

Eligible Life Status Change, page 14).<br />

Once a family member’s coverage begins, it will<br />

continue for the balance of the current calendar<br />

year as long as your family member remains<br />

eligible and you continue to pay the contributions<br />

required for this coverage.<br />

12<br />

Making Changes<br />

You may change your medical coverage election<br />

during any annual enrollment period. Changes<br />

made during an annual enrollment period take<br />

effect on the next January 1.<br />

You also may change your medical coverage<br />

election when a qualified work, family or eligible<br />

life status change occurs (see Work, Family or<br />

Eligible Life Status Change, page 14).<br />

This type of coverage election change—which<br />

must be consistent with the status change—must<br />

be made online at www.advocatebenefits.com<br />

or by phone at 800.775.4784 within 30 days of<br />

the date the status change occurs. If you request<br />

the change:<br />

Within the first 30 days—the change will take<br />

effect retroactive to the date the qualified work,<br />

family or eligible life status change occurred;<br />

Within the 31st to 90th days—coverage will<br />

begin on the date your request is received by<br />

the <strong>Advocate</strong> <strong>Benefits</strong> Service Center.<br />

However, coverage for a newborn child, a newly<br />

adopted child or a child who is placed with you<br />

for adoption will take effect on the date of the<br />

birth, adoption or placement for adoption—as<br />

long as you request the change within 90 days of<br />

that date.<br />

Note: In the event of a qualified work, family<br />

or eligible life status change that relates to<br />

your employment with an <strong>Advocate</strong> Company<br />

(e.g., your associate classification changes<br />

from Part-Time A to Full-Time), you will be<br />

sent—automatically—a packet providing<br />

information and instructions regarding your<br />

coverage change opportunity.

You may be able to enroll yourself and/or your<br />

eligible family members for <strong>PPO</strong>/<strong>DRP</strong> coverage<br />

during the plan year, even if you had chosen<br />

to waive coverage during annual enrollment<br />

because you had other medical coverage, if you<br />

lose that other coverage during the year. To take<br />

advantage of this special enrollment opportunity,<br />

you and your eligible family members:<br />

Must have been covered under another group<br />

health care plan or health insurance coverage<br />

at the time you were eligible for coverage<br />

under the <strong>Plan</strong>, and<br />

Must lose the other coverage because<br />

continuation coverage ended, you or your<br />

dependents are no longer eligible under that<br />

coverage, you lose coverage as the result of a<br />

spouse’s (or domestic partner’s or civil union<br />

partner’s) loss of employment, or the other<br />

employer stops paying contributions<br />

for coverage.<br />

This type of special enrollment must be made<br />

online at www.advcoatebenefits.com or by<br />

calling the <strong>Advocate</strong> <strong>Benefits</strong> Service Center at<br />

800.775.4784 within 90 days of the date you or<br />

your eligible family members lose coverage.<br />

If you enroll:<br />

Within the first 30 days—coverage will begin<br />

retroactive to the date you or your dependents<br />

lost coverage;<br />

Within the 31st to 90th days—coverage will<br />

begin on the date you complete this special<br />

enrollment.<br />

13<br />

Generally, if you do not request a coverage<br />

change within 90 days of a status change, you<br />

will have to wait until the next annual enrollment<br />

period to change your coverage election.<br />

Changes in coverage to drop a family member<br />

as a result of a divorce or losing their eligible<br />

status may be made retrospectively at any time,<br />

but you will not be refunded any premiums<br />

paid to cover such individuals during any period<br />

of non-coverage unless you request the<br />

coverage change within 30 days of the date of<br />

the status change.<br />

You will need to provide copies of supporting<br />

documents for certain types of qualified work,<br />

family or eligible life status changes or special<br />

enrollment events (for example, if you get<br />

married, you will need to provide a copy of<br />

your marriage certificate). You will be notified<br />

if documentation supporting your coverage<br />

election change or special enrollment is required.<br />

If you do not provide the required documentation<br />

within 45 days of the date you request a coverage<br />

election change or complete a special enrollment,<br />

your coverage elections will go back to what<br />

they were before you requested the change<br />

or completed the special enrollment, and you<br />

will not be able to make a change until the next<br />

annual enrollment period (unless you have<br />

another qualified work, family or eligible life<br />

status change). You will be responsible for any<br />

premiums for non-covered individuals.<br />

Additional information about qualified work,<br />

family or eligible life status changes is available<br />

online at www.advocatebenefits.com (go to<br />

<strong>Benefits</strong> Information > Status Change) or<br />

by calling the <strong>Advocate</strong> <strong>Benefits</strong> Service Center<br />

at 800.775.4784.

Work, Family or Eligible Life Status Changes<br />

You have a qualified work, family or eligible life<br />

status change if:<br />

You marry or you meet the criteria to add a<br />

domestic partner or civil union partner (see<br />

definition in the Partner Information Guide)<br />

You have a newborn, you adopt a child (under<br />

age 26) or a child (under age 26) is placed with<br />

you for adoption<br />

You have a court order requiring coverage<br />

of a child (under age 26) under an <strong>Advocate</strong><br />

health plan<br />

You divorce or legally separate from your<br />

spouse, have your marriage annulled or end a<br />

domestic partnership or civil union partnership<br />

Your child becomes eligible or is no longer<br />

eligible for coverage<br />

You or your dependents lose coverage under<br />

another employer’s plan<br />

You, your spouse’s (or domestic partner’s or<br />

civil union partner’s) or child’s employment<br />

status changes and loses eligibility for his or<br />

her group coverage<br />

You, your spouse (or domestic partner or<br />

civil union partner) or child start or change<br />

employment status and become eligible for<br />

coverage under the <strong>Plan</strong><br />

Your spouse (or domestic partner or civil union<br />

partner) or child dies<br />

You or a dependent loses coverage under<br />

Medicaid or SCHIP, or becomes eligible for<br />

a state premium assistance subsidy from<br />

Medicaid or SCHIP 1<br />

You, your spouse (or domestic partner or civil<br />

union partner) or child becomes entitled to or<br />

loses eligibility for Medicare<br />

You or your spouse’s (or domestic partner’s or<br />

civil union partner’s) benefit coverage or cost of<br />

coverage under the <strong>Plan</strong> changes significantly,<br />

You or your spouse (or domestic partner or<br />

civil union partner) go on an unpaid leave of<br />

absence, or<br />

You, your spouse (or domestic partner or civil<br />

union partner) or your child change place<br />

of residence that results in a gain or loss of<br />

eligibility for coverage.<br />

1 You may request coverage due to this status change<br />

within 60 days after the event.<br />

14<br />

Rehire Policy<br />

If you terminate employment with an <strong>Advocate</strong><br />

Company or reduce your hours of work to a nonbenefits<br />

eligible status and then at least 30 days<br />

later become benefits-eligible or return to work<br />

with an <strong>Advocate</strong> Company, you will be treated<br />

as a new hire for purposes of participation in<br />

the <strong>Plan</strong>. There will be a 30-day waiting period<br />

before benefits can become effective, and you<br />

must call the <strong>Advocate</strong> <strong>Benefits</strong> Service Center at<br />

800.775.4784 in order to elect medical coverage<br />

under this <strong>PPO</strong>/<strong>DRP</strong> option or any other medical<br />

plan option. If you are rehired or become<br />

benefits-eligible in less than 30 days after your<br />

termination of employment or loss of benefitseligible<br />

status, you will be re-enrolled in the <strong>PPO</strong>/<br />

<strong>DRP</strong> coverage option as was in place immediately<br />

before your termination of employment or loss<br />

of benefits-eligible status. If you are rehired<br />

by an <strong>Advocate</strong> Company within 12 months of<br />

your termination of employment with and while<br />

receiving severance benefits from an <strong>Advocate</strong><br />

Company, your participation in the <strong>Plan</strong> will<br />

be reinstated with the same benefit elections<br />

as those in effect immediately prior to your<br />

termination of employment.

<strong>PPO</strong>/<strong>DRP</strong> <strong>Benefits</strong><br />

The <strong>PPO</strong>/<strong>DRP</strong> coverage allows you to decide at<br />

any time whether to use participating providers,<br />

specialists or hospitals (that is, you choose to<br />

receive care “in-network”) or nonparticipating<br />

providers, specialists and hospitals (that is, you<br />

choose to receive care “out-of-network”). If you<br />

choose:<br />

Participating providers, specialists and<br />

hospitals—you receive a higher level of<br />

benefits and reduce your out-of-pocket costs,<br />

and there are no claim forms to file.<br />

Nonparticipating providers, specialists and<br />

hospitals—in general, plan benefits will be<br />

lower, you will pay more toward the cost of<br />

the covered services that you and your eligible<br />

family members receive, and there are claim<br />

forms to file.<br />

Whenever you require medical services, you<br />

should call the <strong>PPO</strong>/<strong>DRP</strong> administrator at the<br />

number shown on your coverage ID card to make<br />

sure your provider is still in the network.<br />

Choosing a Provider<br />

The <strong>PPO</strong>/<strong>DRP</strong> provider network is a group of<br />

physicians, hospitals and other providers who<br />

have contracted to deliver their services at<br />

a discount.<br />

To find a participating provider, first check<br />

with your physician—he or she may already be<br />

participating in the <strong>PPO</strong>/<strong>DRP</strong> provider network.<br />

For complete and up-to-date information<br />

regarding participating physicians and hospitals<br />

in your location, go to <strong>Advocate</strong> <strong>Benefits</strong><br />

Service Center—www.advocatebenefits.com<br />

(go to <strong>Benefits</strong> Information > <strong>Medical</strong> <strong>Benefits</strong> ><br />

Physician Search.)<br />

15<br />

Important! Be aware that physicians and<br />

facilities listed in the provider directory<br />

or on the web page are subject to<br />

change. The most complete and up-todate<br />

information regarding participating<br />

physicians and facilities is available by<br />

calling the <strong>PPO</strong>/<strong>DRP</strong> administrator at the<br />

number shown on your coverage ID card.<br />

Always check directly with your provider<br />

of choice—at each visit or point of<br />

contact—to confirm that your physician is<br />

currently participating in the network.<br />

Coverage Amounts<br />

Deductibles<br />

The deductible is the amount of covered medical<br />

expenses you pay each year toward the cost of<br />

covered medical services before benefits begin<br />

(see <strong>PPO</strong>/<strong>DRP</strong> At-A-Glance, page 6).<br />

If you have associate + child(ren), associate +<br />

spouse/domestic partner/civil union partner or<br />

family coverage, the deductible may be satisfied<br />

by covered expenses incurred by one or a<br />

combination of two or more family members.

Coinsurance<br />

Once you meet the annual deductible, your <strong>PPO</strong>/<br />

<strong>DRP</strong> coverage will pay a certain percentage<br />

of eligible charges toward the cost of covered<br />

services. This percentage—the coinsurance<br />

amount—is:<br />

80% of the cost of most services received from<br />

a participating provider. (When you receive<br />

services from an <strong>Advocate</strong> facility, <strong>Advocate</strong><br />

will waive 10% of the cost of the covered<br />

services; you will be responsible for the<br />

remaining 10%.)<br />

60% of the reasonable and customary<br />

charge for most services received from a<br />

nonparticipating provider.<br />

Coinsurance does not apply to any preventive<br />

care services (as determined by federal law) that<br />

are provided by a participating provider.<br />

Note: Each visit to an emergency room is subject<br />

to a copayment as shown in the At-A-Glance<br />

(which does not apply against the deductible);<br />

however, this copayment will be waived if you<br />

are subsequently admitted to the hospital.<br />

Also, you will be responsible for any expenses<br />

greater than the reasonable and customary<br />

charge for services you receive from a<br />

nonparticipating provider).<br />

16<br />

Annual Out-of-Pocket Coinsurance Limit<br />

When you or your eligible dependents have<br />

expenses for covered services that meet the<br />

annual out-of-pocket coinsurance limit, all further<br />

eligible expenses will be 100% paid for the rest of<br />

the year, except for copayments and non-covered<br />

charges (see <strong>PPO</strong>/<strong>DRP</strong> At-A-Glance, page 6). For<br />

services provided by a nonparticipating provider,<br />

you will be responsible for any charges that are in<br />

excess of the maximum allowance.<br />

Expenses for covered services will not apply<br />

toward your annual out-of-pocket limit if they:<br />

Apply against any deductibles or copayments<br />

Are for any penalties that result from failure<br />

to have services pre-certified when precertification<br />

is required<br />

Are in excess of the rmaximum allowance<br />

charge—for out-of-network services<br />

Are for services, supplies and treatments not<br />

covered by your plan, or<br />

Exceed the eligible charge.<br />

Expenses for services that are not covered under<br />

the <strong>PPO</strong>/<strong>DRP</strong> also do not apply to your out-ofpocket<br />

limit (see Services That Are Not Covered,<br />

page 28).

<strong>Medical</strong>ly Necessary Services<br />

A procedure or supply is considered medically<br />

necessary if it is determined to be:<br />

Appropriate and consistent with the patient’s<br />

symptoms and could not have been omitted<br />

without adversely affecting the patient’s<br />

condition or the quality of the care rendered<br />

Supplied or performed in accordance with<br />

current U.S. standards of medical practice<br />

Not primarily for the convenience of the<br />

patient or the patient’s family or health care<br />

provider, and<br />

An appropriate supply or level of service that<br />

can be safely provided.<br />

The term “medically necessary” is usually used<br />

to determine whether a medical or insurance plan<br />

covers a procedure.<br />

Important! The fact that a physician<br />

prescribes, orders, recommends or approves<br />

a procedure or supply does not make the<br />

procedure or supply medically necessary.<br />

Your <strong>PPO</strong>/<strong>DRP</strong> coverage will not pay the<br />

cost of any procedure or supply that is not<br />

medically necessary.<br />

How do I obtain pre-certification—and<br />

the maximum benefits available under<br />

my coverage?<br />

To obtain pre-certification—and the<br />

maximum benefits available under the plan—<br />

you or your physician must call the <strong>PPO</strong>/<strong>DRP</strong><br />

administrator at the number shown on your<br />

coverage ID card. The number is also on your<br />

ID card. Note: Inpatient services for treatment<br />

of behavioral health disorders—behavioral<br />

illness and substance abuse—also are subject<br />

to pre-certification, but this pre-certification<br />

must be provided through the Behavioral<br />

<strong>Health</strong> Certification unit. The number is on the<br />

back of your ID card.<br />

17<br />

<strong>Health</strong> <strong>Care</strong> Management Program<br />

To make sure that services are provided in<br />

the most effective and cost-efficient manner<br />

possible, your <strong>PPO</strong>/<strong>DRP</strong> coverage includes the<br />

<strong>Health</strong> <strong>Care</strong> Management Program. The <strong>PPO</strong>/<br />

<strong>DRP</strong> administrator must review and pre-certify<br />

certain covered services before these services<br />

are provided. In some cases, however, services<br />

may be reviewed for medical necessity, proper<br />

length of stay or appropriateness while—or even<br />

after—you receive them.<br />

To ensure full payment of benefits,<br />

pre-certification is required for:<br />

All hospital admissions<br />

Home health care services, and<br />

Admissions to a skilled nursing facility.<br />

Important! If you have care that is medically<br />

necessary but is not pre-certified, you will pay<br />

out of your own pocket 50% of the maximum<br />

allowance for these services up-front. The<br />

proper benefit percentage will then be applied<br />

to the remaining 50% of the cost. You may<br />

be required to pay the entire cost of services<br />

you receive if certification is denied or if it is<br />

later determined that the services were not<br />

medically necessary.

How to Use the Case Management Program Review<br />

When you or your physician contacts the <strong>PPO</strong>/<br />

<strong>DRP</strong> administrator regarding a hospital admission<br />

or other service, you should provide:<br />

The name of the attending and/or admitting<br />

physician and his or her phone number<br />

The name of the hospital/location where the<br />

admission/service has been scheduled<br />

The scheduled admission/service date, and<br />

A preliminary diagnosis or reason for the<br />

admission/service.The <strong>PPO</strong>/<strong>DRP</strong> administrator<br />

will:<br />

Review the medical information provided and<br />

may follow up with your provider, and<br />

Determine whether the prescribed services or<br />

hospitalization is medically necessary.<br />

If the applicable health care services are not<br />

considered medically necessary, some days or<br />

the entire hospitalization will be denied. The<br />

claims administrator will notify you, the hospital<br />

and your physician of the decision and specify<br />

the date(s) for which benefits will not be paid.<br />

18<br />

What services does the <strong>PPO</strong>/<strong>DRP</strong> cover?<br />

For information about covered services<br />

and services that are not covered, you<br />

can call the <strong>PPO</strong>/<strong>DRP</strong> administrator at<br />

the number shown on your coverage ID<br />

card. A listing of services that are covered<br />

by the <strong>PPO</strong>/<strong>DRP</strong> is provided in Covered<br />

Services starting on page 19.<br />

Services Requiring Case Management Program Review<br />

Decisions about your course of treatment or<br />

whether you receive particular health services<br />

are between you and your physician. The claims<br />

administrator simply determines whether a<br />

proposed admission, continued hospitalization or<br />

other health care service is covered under your<br />

<strong>PPO</strong>/<strong>DRP</strong> coverage.<br />

Preadmission Review<br />

If your physician recommends a hospital<br />

admission for any reason—or admission to<br />

a skilled nursing facility or a program of<br />

home health care services—you must call<br />

the claims administrator in order to receive<br />

maximum benefits.

You must call to schedule a non-urgent<br />

admission at least 15 days in advance of your<br />

planned admission date. Preadmission review is<br />

not a guarantee of benefits. You must be a <strong>PPO</strong>/<br />

<strong>DRP</strong> participant at the time services are provided,<br />

and the prescribed services must be covered by<br />

your <strong>PPO</strong>/<strong>DRP</strong> coverage.<br />

Emergency Admission Review<br />

In an emergency, you or someone on your behalf<br />

must call the <strong>PPO</strong>/<strong>DRP</strong> administrator within 48<br />

hours or the next business day after the admission.<br />

You will not receive maximum benefits if the call is<br />

made later than the specified time period. Again,<br />

emergency admission review is not a guarantee of<br />

benefits. However, no pre-authorization is required<br />

for emergency room services.<br />

What happens if I decide to have medical<br />

services performed that the plan does<br />

not approve?<br />

Keep in mind that the <strong>PPO</strong>/<strong>DRP</strong> does not<br />

cover any services that are not medically<br />

necessary—and will not pay any related<br />

charges you incur. The fact that your<br />

physician may prescribe or recommend<br />

a particular service does not mean it is<br />

medically necessary or covered by your<br />

<strong>PPO</strong>/<strong>DRP</strong> coverage.<br />

Case Management<br />

Case Management service may be provided by<br />

the claims administrator. Participation in case<br />

management is voluntary.<br />

After Case Management has evaluated your case,<br />

you may be assigned a case manager. If your<br />

condition requires continued hospital care or care<br />

in another health care facility, the case manager<br />

may recommend an alternative treatment plan.<br />

The case manager will monitor your case for the<br />

duration of your condition. Alternative benefits will<br />

be covered as long as the <strong>PPO</strong>/<strong>DRP</strong> determines<br />

that the alternative services are medically<br />

necessary and cost-effective. Total payments<br />

for alternative services will not exceed the total<br />

benefit for which you would otherwise be entitled.<br />

19<br />

Covered Services<br />

The <strong>PPO</strong>/<strong>DRP</strong> covers the following expenses for<br />

hospital and other medical services and supplies<br />

for the treatment of an injury or disease. Only<br />

medically necessary treatments, services or<br />

supplies are covered.<br />

With the <strong>PPO</strong>/<strong>DRP</strong>, services are covered at<br />

the highest level of benefits when you use<br />

participating providers (see <strong>PPO</strong>/<strong>DRP</strong> At-A-<br />

Glance, page 6). In general, the plan pays 80%<br />

of negotiated charges for services received from<br />

participating providers and 60% of the reasonable<br />

and customary cost of services received from<br />

nonparticipating providers.<br />

Coverage for <strong>Advocate</strong> Hospital Services<br />

When you have the opportunity to use an<br />

<strong>Advocate</strong> hospital, <strong>Advocate</strong> will waive 10%<br />

of the cost of covered services; you will<br />

be responsible for 10%. This waiver will NOT<br />

apply to:<br />

Emergency room copayments or deductibles<br />

The charges of non-<strong>Advocate</strong> facilities—even<br />

if <strong>Advocate</strong> does not provide the service you<br />

need or if an <strong>Advocate</strong> facility is busy (“on bypass”)<br />

at the time the service is provided, and<br />

Charges for physician visits.<br />

Note: This waiver does not apply to the charges<br />

of an outside lab facility.

Ambulance Service<br />

The <strong>PPO</strong>/<strong>DRP</strong> covers the cost of ambulance<br />

services for ground transportation for you or a<br />

covered family member from the place where an<br />

injury or serious medical accident occurs to the<br />

nearest hospital where appropriate treatment can<br />

be given.<br />

Non-emergency ambulance services are covered<br />

only if required to transport you or a covered<br />

family member to or from a hospital or between<br />

hospitals for required treatment, but only if the<br />

ambulance service is medically necessary.<br />

Note: Air ambulance services are covered only if<br />

approved by the <strong>PPO</strong>/<strong>DRP</strong> administrator.<br />

Behavioral <strong>Health</strong> <strong>Care</strong><br />

The <strong>PPO</strong>/<strong>DRP</strong> covers hospital treatment for<br />

behavioral illness and substance abuse services;<br />

however, inpatient services must be pre-certified;<br />

to initiate the pre-certification process, call the<br />

number shown on your coverage ID card.<br />

Important! If you have inpatient behavioral<br />

health care services that are medically<br />

necessary but not pre-certified, you will pay<br />

50% of the cost of these services up-front<br />

(out of your own pocket) based on either<br />

the negotiated rate or actual cost of the<br />

service, as appropriate; the proper benefit<br />

percentage—depending on whether you see<br />

a participating or nonparticipating provider—<br />

will then be applied to the remaining<br />

50% of the cost. You may be required to<br />

pay the entire cost of services you have<br />

received if certification is denied or if it is<br />

later determined that the services were not<br />

medically necessary.<br />

While it is not necessary to pre-certify outpatient<br />

behavioral health services, you may contact the<br />

behavioral health certification unit for assistance<br />

in selecting a provider.<br />

20<br />

Behavioral Illness and Substance Abuse Treatment<br />

The <strong>PPO</strong>/<strong>DRP</strong> pays benefits for care to treat a<br />

behavioral illness or substance abuse. This type<br />

of care includes inpatient hospital confinement,<br />

psychotherapy, group therapy and psychological<br />

testing and—for treatment of a behavioral<br />

illness—electro-convulsive therapy or convulsive<br />

drug therapy and family counseling. <strong>Care</strong> must<br />

be provided by a physician, psychologist, clinical<br />

social worker or clinical professional counselor.<br />

<strong>Benefits</strong> are available if you:<br />

Are an inpatient in a hospital, skilled<br />

nursing facility or behavioral health/substance<br />

abuse facility<br />

Are a patient in a partial hospitalization<br />

treatment program or coordinated home care<br />

program, or<br />

Receive individual or group outpatient<br />

behavioral disorder/substance abuse treatment<br />

services from a physician, psychologist or<br />

clinical social worker.<br />

What is considered a behavioral illness?<br />

A behavioral illness is a disease that is<br />

commonly understood to be a mental<br />

disorder whether or not it has a physiological<br />

or organic basis. Treatment is generally<br />

provided by or under the direction of a<br />

behavioral disorder professional.

Chiropractic <strong>Care</strong><br />

The <strong>Plan</strong> will pay the cost of chiropractic<br />

care, including initial consultation, x-rays<br />

and treatment (but not maintenance care).<br />

Spinal manipulation charges are limited to 20<br />

manipulations per calendar year.<br />

Diagnostic Services and Supplies<br />

The <strong>PPO</strong>/<strong>DRP</strong> pays benefits toward the cost of<br />

diagnostic laboratory, pathology, ultrasound,<br />

nuclear medicine, magnetic imaging and x-ray<br />

services. Covered services include preadmission<br />

and diagnostic services performed within seven<br />

days prior to the start of an inpatient hospital<br />

stay, as long as these services are related to the<br />

condition necessitating the hospitalization.<br />

Note: <strong>Benefits</strong> will not be paid if the same<br />

diagnostic tests are performed again after you<br />

or your covered family member have entered<br />

the hospital. <strong>Benefits</strong> for diagnostic services and<br />

supplies will not be provided if you postpone or<br />

cancel an associated surgery.<br />

Durable <strong>Medical</strong> Equipment<br />

You can receive benefits for the rental or<br />

purchase of durable medical equipment<br />

prescribed by a physician and required for<br />

therapeutic use. The equipment must be<br />

primarily used to serve a medical purpose.<br />

<strong>Benefits</strong> will be paid based on the usual charge<br />

for the equipment which meets the patient’s<br />

needs. <strong>Benefits</strong> will be provided for the purchase<br />

of a piece of equipment if it is less expensive<br />

than renting. In addition, repair or replacement of<br />

purchased medically necessary durable medical<br />

equipment will be covered if required due to<br />

normal use or the growth of a child.<br />

Examples of durable medical equipment include:<br />

Internal cardiac valves<br />

Internal pacemakers<br />

Mandibular reconstruction devices not used<br />

primarily to support dental prosthesis<br />

Bone screws<br />

Wheelchairs<br />

Hospital beds, and<br />

Ventilators.<br />

21<br />

Emergency <strong>Care</strong><br />

Under the <strong>PPO</strong>/<strong>DRP</strong>, you are covered for the initial<br />

treatment of an injury or medical condition that is<br />

severe and life threatening. Emergency accident<br />

and medical care must begin within 72 hours of<br />

the injury or onset of the emergency condition.<br />

Your injury or medical condition is considered an<br />

emergency if it could:<br />

Place your life in jeopardy<br />

Cause other serious medical consequences<br />

Cause serious impairment to bodily functions, or<br />

Cause serious dysfunction of any organ or<br />

body part.<br />

You will also be subject to a copayment for<br />

emergency services as shown in the<br />

At-A-Glance, but this copayment will be waived<br />

if you are admitted.<br />

Extended <strong>Care</strong> Facility<br />

Extended care facility services are covered if all<br />

of the following criteria are met:<br />

<strong>Care</strong> is pre-certified before you receive it<br />

You were first confined to a hospital for three<br />

consecutive days<br />

Your physician recommends extended<br />

care confinement for convalescence from a<br />

condition that caused that hospital stay or a<br />

related condition<br />

The extended care confinement begins within<br />

14 days after discharge from the hospital<br />

You are under a physician’s continuous care, and<br />

Your physician certifies that you must have<br />

nursing care 24 hours a day.<br />

Extended care facility benefits will be paid for<br />

charges for:<br />

Room and board in a semiprivate room, and<br />

Other services, supplies and treatment ordered<br />

by your physician and furnished by the<br />

extended care facility for inpatient care.

Home <strong>Health</strong> <strong>Care</strong><br />

Home health care services are designed to<br />

enable you or a covered family member to<br />

receive treatment for an illness or injury in your<br />

home, rather than in a hospital or an extended<br />

care facility.<br />

To receive home health care benefits you must be<br />

homebound and require skilled nursing services<br />

on an intermittent basis. Home health care<br />

benefits will be paid if:<br />

<strong>Care</strong> is pre-certified before you receive it<br />

You are homebound (unable to leave home<br />

without assistance and requiring supportive<br />

devices or special transportation), and<br />

You require skilled nursing services on an<br />

intermittent basis under the direction of your<br />

physician.<br />

Covered home health care expenses include<br />

charges for:<br />

Part-time or intermittent care by an R.N., L.P.N.<br />

or L.V.N.<br />

Physical, respiratory, occupational or<br />

speech therapy<br />

Part-time or intermittent home health<br />

aide services for you or a covered family<br />

member who is receiving covered nursing<br />

or therapy services<br />

<strong>Medical</strong> social service consultations, and<br />

Nutritional guidance by a registered dietitian and<br />

nutritional supplements such as diet substitutes<br />

administered intravenously or through<br />

hyperalimentation (if medically necessary).<br />

22<br />

Home health care benefits will not be paid toward<br />

the cost of:<br />

Homemaker services<br />

Maintenance therapy<br />

Dialysis treatment<br />

Food or home delivered meals<br />

Prescription or non-prescription drugs<br />

or biologicals<br />

Rental or purchase of durable medical equipment<br />

Services or supplies that are not part of the<br />

home health care plan<br />

Services of a person who usually lives with<br />

you or is a member of your family<br />

Services of a social worker, or<br />

Transportation services.<br />

Hospice <strong>Care</strong><br />

Hospice care is specialized voluntary care for<br />

terminally ill patients who have a life expectancy<br />

of six months or less. Hospice care is designed<br />

to treat the unique physical and mental distress<br />

of terminal illness by addressing as many of the<br />

patient’s and family’s physical and emotional<br />

needs as possible.<br />

You or your covered dependent’s physician must<br />

submit documentation that:<br />

The illness is a terminal illness, and<br />

The covered person has a life expectancy of six<br />

months or less.<br />

The patient’s physician must approve his or her<br />

enrollment in the hospice program.

The <strong>PPO</strong>/<strong>DRP</strong> pays benefits if hospice care<br />

services are received from an approved provider<br />

either in your home (under a home health care<br />

program), as an outpatient, or as an inpatient<br />

in a hospital or skilled nursing facility. Services<br />

covered under the hospice care program include:<br />

Room and board in a hospice facility<br />

Services, supplies and treatment provided by a<br />

hospice in a home setting<br />

Physician services and/or nursing care by a<br />

R.N., L.P.N. or L.V.N.<br />

Physical therapy, occupational therapy,<br />

speech therapy or respiratory therapy<br />

Nutrition services<br />

Counseling services provided through a hospice<br />

Coordinated home care<br />

<strong>Medical</strong> dressings and supplies<br />

Medication, and<br />

Pain management services.<br />

Services not covered under the hospice care<br />

program include:<br />

Home delivered meals<br />

Homemaker services<br />

Respite care, and<br />

Transportation, including, but not limited to,<br />

ambulance transportation.<br />

Hospital <strong>Benefits</strong><br />

Inpatient Hospital Services<br />

The <strong>PPO</strong>/<strong>DRP</strong> covers the following<br />

inpatient services:<br />

Semiprivate room and board charges (private<br />

room charges are not covered unless a private<br />

room is medically necessary, or the facility has<br />

only private rooms)<br />

Intensive care unit services<br />

Admission fees and other fees charged by<br />

the hospital for rendering services, supplies<br />

and treatments<br />

Use of operating, treatment and delivery rooms<br />

Anesthesia and anesthesia supplies<br />

and administration<br />

<strong>Medical</strong> and surgical dressings, casts and splints<br />

Blood transfusions<br />

Drugs and medicines<br />

X-ray and diagnostic laboratory procedures<br />

and services<br />

23<br />

Oxygen and other gas therapy<br />

Therapy services, and<br />

Miscellaneous hospital services and supplies<br />

during confinement.<br />

Important! Inpatient hospital admissions are<br />

subject to pre-certification.<br />

Outpatient <strong>Care</strong><br />

The <strong>PPO</strong>/<strong>DRP</strong> covers the following outpatient<br />

services:<br />

Preadmission testing<br />

Surgery<br />

Diagnostic services<br />

Radiation therapy<br />

Chemotherapy<br />

Shock therapy, and<br />

Renal dialysis treatments if received in a<br />

hospital, dialysis facility, or in your home under<br />

the supervision of a hospital or dialysis facility.<br />

Human Organ Transplants<br />

Organ transplants are subject to pre-certification.<br />

<strong>Benefits</strong> for organ transplants are subject to<br />

following claims administrator guidelines.<br />

<strong>Benefits</strong> will be provided only for the following<br />

transplant procedures:<br />

Kidney<br />

Bone marrow<br />

Heart valve<br />

Heart<br />

Lung<br />

Heart/lung<br />

Liver<br />

Pancreas, or<br />

Pancreas/kidney human organ or<br />

tissue transplants.

<strong>Benefits</strong> are available to both the recipient and<br />

donor of a covered transplant as follows:<br />

If both the donor and the recipient have<br />

coverage—Each person will have their benefits<br />

paid by their own program.<br />

If you or your covered dependent is the<br />

recipient, and the donor does not have<br />

coverage from any other source—The benefits<br />

described in this summary will be provided for<br />

both you and the donor. Payments made for<br />

the donor will be charged against the benefits<br />

you or your dependent receives.<br />

If you or your covered dependent is the donor,<br />

and coverage for the recipient is not available<br />

from any other source—The benefits described<br />

in this summary will be provided for you or<br />

your dependent. The recipient will not receive<br />

benefits under this plan.<br />

<strong>Benefits</strong> are not paid for:<br />

Investigational drugs, or<br />

Travel time and related expenses required by a<br />

physician or other provider.<br />

Infertility Treatment<br />

<strong>Benefits</strong> for covered services related to the<br />

treatment of infertility are paid the same as for<br />

any other condition, up to a lifetime maximum<br />

of $50,000. Infertility refers to the inability to<br />

conceive a child after one year of unprotected<br />

sexual intercourse or the inability to sustain a<br />

successful pregnancy.<br />

Covered services include:<br />

In vitro fertilization<br />

Uterine embryo lavage<br />