SCHWEIZ - Banco Mercantil

SCHWEIZ - Banco Mercantil

SCHWEIZ - Banco Mercantil

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Annual Report 2 0 0 8<br />

<strong>Mercantil</strong> Bank Schweiz<br />

a Subsidiary of <strong>Mercantil</strong> Servicios Financieros

Annual Report 2 0 0 8<br />

Contents<br />

Board of Directors and Management<br />

Board of Directors’ Report<br />

Report of the Group Auditors and Consolidated<br />

Financial Statements as of December 31, 2008<br />

Report of the Statutory Auditors and Parent Company<br />

Financial Statements as of December 31, 2008

Board of Directors<br />

Management<br />

Board of Directors and Management<br />

1) 2)<br />

Dr. Thomas E. Krayenbühl<br />

Chairman<br />

Dr. Kurt Sieger 1)<br />

Vice-Chairman<br />

Peter Huwyler 1)<br />

Director<br />

Gustavo A. Marturet<br />

Director<br />

J. Guillermo Villar<br />

Director<br />

Joaquín Fischer<br />

General Manager<br />

Brigitte Manns<br />

Vice-President Private Banking<br />

Sandra Righetti<br />

Vice-President Operations and IT<br />

Thomas Ita<br />

Vice-President Finance<br />

Internal Audit Internal Audit Department<br />

<strong>Mercantil</strong> Servicios Financieros<br />

External Auditors PricewaterhouseCoopers Ltd, Zurich<br />

Adress Talacker 42, P.O.Box 9758, CH-8036 Zurich<br />

Tel: + 41 - 433 444 555; Fax: + 41 - 433 444 550<br />

Swift: BAMR CH ZZ<br />

Website: www.mercantilsuiza.com<br />

1) These members of the Board fulfil the independence criteria stipulated in margins nos. 20-24 of FINMA circular 08/24.<br />

2) The Chairman of the Board is also member of the Audit Committee due to the limited number of independent members of the Board with<br />

accounting background.

Board of Directors’ Report<br />

During 2008, the global economy experienced a rapid downturn and financial<br />

institutions around the world felt its considerable impact. Although<br />

conditions were challenging, <strong>Mercantil</strong> Bank (Schweiz) AG faced this market<br />

situation proactively. Key initiatives were aimed at offsetting reduced<br />

interest margins and underwriting risks. While the financial results were<br />

somewhat affected, these assertive practices allowed the Bank to maintain<br />

a good asset quality in its credit and investment portfolio and continue to<br />

serve the credit needs of its customers.<br />

Private Banking business showed a positive trend due to increased volume<br />

in foreign exchange transactions and higher fee income. The Bank implemented<br />

a long-term strategy to increase the share of wallet of existing customers,<br />

to broaden the client base and to take advantage of opportunities<br />

that will emerge in an uncertain and changing market.<br />

Corporate Banking and Treasury activities were managed in response to<br />

the credit risk quality concerns by an unfavorable trend in interest margins.<br />

Loan loss reserves are adequate to cover potential deterioration of assets<br />

in an unpredictable market. The Bank increased the number of corporate<br />

and commercial clients, mainly for clearing services.<br />

Total consolidated assets decreased by CHF 26 million or approximately 7<br />

percent to CHF 356 million, in comparison with CHF 382 million in 2007.<br />

Capital at the Bank’s consolidated level is CHF 56.6 million or a leverage<br />

ratio of 15.9%, while for the parent company only, the ratio is 38%. The conservative<br />

financing approach of the Bank is the foundation that supports<br />

its solid reputation in the industry and its capacity to respond quickly to<br />

business opportunities.

The year 2009 will continue to be challenging for the world economy at<br />

large. Our prudent risk management practices will enable us to maintain<br />

a strong balance sheet and continue increasing our customer base. We remain<br />

confident that our human resources and operational infrastructure<br />

will allow us to continue serving the needs of our customers and show our<br />

appreciation for their trust in our financial institution.<br />

Zurich, March 12, 2009<br />

Dr. Thomas Krayenbühl, Chairman<br />

Dr. Kurt Sieger, Vice Chairman<br />

Peter Huwyler<br />

Gustavo A. Marturet<br />

J. Guillermo Villar

MERCANTIL BANK (<strong>SCHWEIZ</strong>) AG<br />

ZURICH<br />

Report of the Group Auditors<br />

to the General Meeting of Shareholders<br />

Consolidated Financial Statements 2008<br />

14 April 2009/00593800001/15/SMN/HEX<br />

With offices in Aarau, Basel, Berne, Chur, Geneva, Lausanne, Lugano, Lucerne, Neuchâtel, Sitten, St. Gallen, Thun, Winterthur, Zug and<br />

Zurich, PricewaterhouseCoopers AG is a provider of auditing services and tax, legal and business consultancy services.<br />

PricewaterhouseCoopers AG is a member of a global network of companies that are legally independent of one another; the network is<br />

represented in some 150 countries throughout the world.

Report of the group auditors<br />

to the general meeting of<br />

MERCANTIL BANK (<strong>SCHWEIZ</strong>) AG<br />

ZURICH<br />

Report of the statutory auditor on the consolidated financial statements<br />

PricewaterhouseCoopers AG<br />

Birchstrasse 160<br />

8050 Zürich<br />

Phone +41 58 792 44 00<br />

Fax +41 58 792 44 10<br />

www.pwc.ch<br />

As statutory auditor, we have audited the consolidated financial statements of MERCANTIL BANK<br />

(<strong>SCHWEIZ</strong>) AG, which comprise the balance sheet, income statement, statement of cash flows<br />

and notes, for the year ended 31 December 2008.<br />

Board of Directors’ Responsibility<br />

The Board of Directors is responsible for the preparation and fair presentation of the consolidated<br />

financial statements in accordance with accounting rules for banks and the requirements of Swiss<br />

law. This responsibility includes designing, implementing and maintaining an internal control<br />

system relevant to the preparation and fair presentation of consolidated financial statements that<br />

are free from material misstatement, whether due to fraud or error. The Board of Directors is further<br />

responsible for selecting and applying appropriate accounting policies and making accounting<br />

estimates that are reasonable in the circumstances.<br />

Auditor’s Responsibility<br />

Our responsibility is to express an opinion on these consolidated financial statements based on our<br />

audit. We conducted our audit in accordance with Swiss law and Swiss Auditing Standards. Those<br />

standards require that we plan and perform the audit to obtain reasonable assurance whether the<br />

consolidated financial statements are free from material misstatement.<br />

An audit involves performing procedures to obtain audit evidence about the amounts and<br />

disclosures in the consolidated financial statements. The procedures selected depend on the<br />

auditor’s judgment, including the assessment of the risks of material misstatement of the financial<br />

statements, whether due to fraud or error. In making those risk assessments, the auditor considers<br />

the internal control system relevant to the entity’s preparation and fair presentation of the<br />

consolidated financial statements in order to design audit procedures that are appropriate in the<br />

circumstances, but not for the purpose of expressing an opinion on the effectiveness of the entity’s<br />

internal control system. An audit also includes evaluating the appropriateness of the accounting<br />

policies used and the reasonableness of accounting estimates made, as well as evaluating the<br />

overall presentation of the consolidated financial statements. We believe that the audit evidence we<br />

have obtained is sufficient and appropriate to provide a basis for our audit opinion.

Opinion<br />

In our opinion, the consolidated financial statements for the year ended 31 December 2008 give a<br />

true and fair view of the financial position, the results of operations and the cash flows in<br />

accordance with accounting rules for banks and comply with Swiss law.<br />

Report on other legal requirements<br />

We confirm that we meet the legal requirements on licensing according to the Auditor Oversight Act<br />

(AOA) and independence (article 728 CO and article 11 AOA) and that there are no circumstances<br />

incompatible with our independence.<br />

In accordance with article 728a paragraph 1 item 3 CO and Swiss Auditing Standard 890, we<br />

confirm that an internal control system exists which has been designed for the preparation of<br />

consolidated financial statements according to the instructions of the Board of Directors.<br />

We recommend that the consolidated financial statements submitted to you be approved.<br />

PricewaterhouseCoopers AG<br />

Martin Schmidt Alex Henzi<br />

Audit expert<br />

Auditor in charge<br />

Zürich, 14 April 2009<br />

Enclosure:<br />

- Consolidated financial statements (balance sheet, income statement, cash flow statement and<br />

notes)

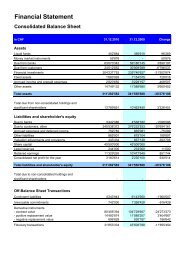

Financial Statement<br />

Consolidated Balance Sheet<br />

in CHF 31.12.2008 31.12.2007 Change<br />

Assets<br />

Liquid funds 224'893 379'212<br />

Money market instruments - 60'997'440<br />

Due from banks 220'810'539 222'373'187<br />

Due from customers 106'250'033 81'927'627<br />

Financial investments 13'620'067 3'776'106<br />

Fixed assets 1'777'082 2'067'545<br />

Accrued income and prepaid expenses 3'243'996 2'989'304<br />

Other assets 9'708'279 7'574'440<br />

Total assets 355'634'889 382'084'861<br />

Total due from non-consolidated holdings and shareholder 9'371'634 7'002'392<br />

Liabilities and shareholder's equity<br />

Due to banks 4'068'768 11'207'249<br />

Due to customers, other 289'802'997 307'478'353<br />

Accrued expenses and deferred income 2'005'041 3'103'977<br />

Other liabilities 920'653 864'160<br />

Valuation adjustments and provisions 2'270'294 2'961'167<br />

Share capital 45'500'000 45'500'000<br />

Legal reserves 230'000 200'000<br />

Retained earnings 10'169'026 8'970'698<br />

Consolidated net profit for the year 668'110 1'799'257<br />

Total liabilities and shareholder's equity 355'634'889 382'084'861<br />

-154'319<br />

-60'997'440<br />

-1'562'648<br />

24'322'406<br />

9'843'961<br />

-290'463<br />

254'692<br />

2'133'839<br />

-26'449'972<br />

2'369'242<br />

-7'138'481<br />

-17'675'356<br />

-1'098'936<br />

56'493<br />

-690'873<br />

-<br />

30'000<br />

1'198'328<br />

-1'131'147<br />

-26'449'972<br />

Total due to non-consolidated holdings and shareholder - - -<br />

Off-Balance Sheet Transactions<br />

Contingent liabilities 4'530'391 12'190'517 -7'660'126<br />

Irrevocable commitments 590'000 418'000 172'000<br />

Derivative instruments<br />

- contract value 64'646'580 73'978'266 -9'331'686<br />

- positive replacement value 9'706'578 7'574'162 2'132'416<br />

- negative replacement value 741'133 611'754 129'379<br />

Fiduciary transactions 85'912'858 55'834'480 30'078'378

Consolidated Income Statement<br />

in CHF 2008 2007 Change<br />

Ordinary operating income and expense<br />

Interest income<br />

Interest and discount income 15'551'462 19'618'436 -4'066'974<br />

Interest and dividend income on financial investments 589'718 466'475 123'243<br />

Interest expense -9'488'710 -12'473'674 2'984'964<br />

Net interest income 6'652'470 7'611'237 -958'767<br />

Income from commission and services<br />

Commission income on lending activities 246'192 331'564 -85'372<br />

Commission income on asset management 3'111'828 2'627'040 484'788<br />

Commission income on other services 427'689 229'811 197'878<br />

Commission expense -1'391'608 -1'221'697 -169'911<br />

Net commission income 2'394'101 1'966'718 427'383<br />

Income from trading operations 940'851 186'704 754'147<br />

Other ordinary income<br />

Results from sale of financial investments - - -<br />

Other ordinary income 2'120 3'248 -1'128<br />

Other ordinary expense -453'068 -371'767 -81'301<br />

Total other ordinary income -450'948 -368'519 -82'429<br />

Total operating income 9'536'474 9'396'140 140'334<br />

Operating expenses<br />

Personnel expenses -4'591'269 -4'154'724 -436'545<br />

Other operating expenses -3'419'727 -3'126'602 -293'125<br />

Total operating expenses -8'010'996 -7'281'326 -729'670<br />

Gross profit 1'525'478 2'114'814 -589'336<br />

Consolidated net income for the year<br />

Gross profit 1'525'478 2'114'814 -589'336<br />

Depreciation and write-offs of non-current assets -807'164 -535'856 -271'308<br />

Valuation adjustments, provisions and losses -618'794 -315'232 -303'562<br />

Subtotal 99'520 1'263'726 -1'164'206<br />

Extraordinary income 649'745 617'800 31'945<br />

Extraordinary expenses - - -<br />

Taxes -81'155 -82'269 1'114<br />

Consolidated net income for the year 668'110 1'799'257 -1'131'147

Consolidated statement of cash flows<br />

in CHF 2008 2007<br />

Source Application Balance Source Application Balance<br />

of funds of funds of funds of funds<br />

Consolidated net profit for the year 668'110 - 1'799'257 -<br />

Depreciation and write-offs of non-current assets 807'164 - 535'856 -<br />

Valuation adjustments and provisions - 542'050 - 448'172<br />

Consolidated translation adjustments - 570'929 - 808'619<br />

Accrued income and prepaid expenses - 254'692 70'618 -<br />

Accrued expenses and deferred income - 1'098'936 283'318 -<br />

Other assets - 2'133'839 - 3'959'322<br />

Other liabilities 56'493 - 682'891 -<br />

Net cash flows from operating results 1'531'767 4'749'269 3'217'502 3'371'940 5'216'113 1'844'173<br />

Share capital - - 12'000'000 -<br />

Capital increase costs - - - -<br />

Net cash flows from equity transactions - - - 12'000'000 - 12'000'000<br />

Fixed assets - 516'701 - 296'859<br />

Software - - - 814'895<br />

Net cash flows from investment activities - 516'701 516'701 - 1'111'754 1'111'754<br />

Due to customers, other - 1'151'610 - 3'302'382<br />

Money market instruments - - 1'418'750 -<br />

Due from banks 4'611'680 - - 4'611'680<br />

Due from customers 15'817'111 - 14'849'395 -<br />

Financial investments - 4'981'065 1'855'985 -<br />

Medium and long term operations (>1 year) 20'428'791 6'132'675 14'296'116 18'124'130 7'914'062 10'210'068<br />

Due to banks - 7'138'481 3'483'638 -<br />

Due to customers, other - 16'523'746 22'728'234 -<br />

Money market instruments 60'997'440 - 2'593'807 -<br />

Due from banks - 3'049'032 - 65'302'679<br />

Due from customers - 40'139'517 14'941'943 -<br />

Financial investments - 4'862'896 2'362'570 -<br />

Short term operations 60'997'440 71'713'672 10'716'232 46'110'192 65'302'679 19'192'487<br />

Net cash flows from banking operations 81'426'231 77'846'347 3'579'884 64'234'322 73'216'741 8'982'419<br />

Decrease / Increase in cash position 154'319 - - 61'654<br />

Change in liquid funds 154'319 - 154'319 - 61'654 61'654<br />

Total source of funds / application of funds 83'112'317 83'112'317 - 79'606'262 79'606'262 -

Notes to the consolidated financial statement<br />

1. Information on business activities and number of employees<br />

General information<br />

<strong>Mercantil</strong> Bank (Schweiz) AG, until January 27, 2000,<br />

operating under the name BMS Finanz AG, was<br />

incorporated in May 1988 in Zurich. Its activities in the<br />

areas of trade finance, private banking and fiduciary<br />

transactions are focused on Latin America and<br />

complemented by the banking activities of its wholly<br />

owned subsidiaries <strong>Mercantil</strong> Bank & Trust Ltd., Grand<br />

Cayman and MBS Advisory Services Ltd., British<br />

Virgin Island.<br />

It is intended to continue intensifying the expansion of<br />

the private banking activities for the clientele of the<br />

Grupo <strong>Mercantil</strong> Servicios Financieros (MSF). For this,<br />

the group continues to invest in its banking software<br />

and electronic banking facilities to support and<br />

enhance the range of services offered to its customers.<br />

It is also intended to continue developing the traditional<br />

trade finance activities between Europe, Asia and Latin<br />

America.<br />

Balance Sheet transactions<br />

Short-term financial investments with European banks<br />

and trade financing for Latin American banks as well<br />

as short-term lending to Latin American and US<br />

corporate borrowers, largely related to preliminary and<br />

supplementary trade financing, represent the major<br />

assets of the group. Investments in securities of Latin<br />

American and European borrowers complement the<br />

group’s balance sheet business. Exposures with<br />

maturities of over one year are entered but limited to<br />

the group’s net equity.<br />

Funding is obtained through customer deposits and<br />

also through credit lines from major European banks.<br />

Income from commissions and services<br />

Income from commissions and services results mainly<br />

from letter of credit transactions as well as from the<br />

issuance of guarantees, from custody fees, brokerage<br />

and other service fees related to fiduciary investments<br />

of private customers.<br />

Other activities<br />

For investment and also for liquidity purposes, the<br />

group maintains an investment portfolio consisting<br />

mainly of fixed income securities of Latin American and<br />

European borrowers.<br />

Risk Control<br />

The Board of Directors discussed during its meeting as<br />

of February 3, 2009 the relevant risks the Group is<br />

facing. Relevant risks are market, liquidity, credit,<br />

operational and other risks. The basis for the<br />

assessment of the risks was the business rationale<br />

and strategy of the business generating the risks, the<br />

risk appetite of the group and the nature of the risk, its<br />

magnitude of a potential misstatement and the<br />

likelihood of the risk occurring. Additionally, the<br />

predefined risk reducing measures and the internal<br />

controls (including financial reporting) were included in<br />

the evaluation.<br />

The Board of Directors took also into consideration the<br />

monitoring of internal controls, the correct treatment of<br />

the risk recognition and the valuation effects of<br />

relevant risks on the financial reporting.<br />

For detailed information regarding risk management<br />

we refer to the explanations below.<br />

Risk Management<br />

The analysis and control of risks is performed in close<br />

cooperation with the Risk Management Group of our<br />

parent company (MSF) in Caracas.<br />

Credit approval is based on requirements as to quality,<br />

collaterals, limits and credit authority as laid down in<br />

the internal risk policy. All credit risk positions,<br />

including those from derivative instruments, are limited<br />

and monitored continuously by a credit line system<br />

based on counterparty and country risk.<br />

Foreign exposures are entered into and monitored in<br />

compliance with the internal risk policy. The<br />

assessment procedure, except for exposures in<br />

industrialized countries (Category 1), where country<br />

risk is negligible, is based on the rating of the<br />

Interagency Country Exposure Committee (ICERC)<br />

and on the Group’s own internal rating system. The<br />

internal evaluation is based on economic trends and<br />

political and social developments and derived from<br />

various group-internal and external sources<br />

(Categories 2 – 6).

The risk provisioning requirements for country risk and<br />

counterparty risk are calculated independently on the<br />

basis of an internal rating process.<br />

Liquidity and interest rate risks are monitored and<br />

managed on a consolidated basis.<br />

Foreign exchange risks are to a large extent restricted<br />

by internal limits for open currency positions.<br />

Derivative financial instruments are used exclusively to<br />

hedge open foreign exchange positions and interest<br />

rate risks.<br />

When trading securities for customers, the group does<br />

not engage in open positions from which market risks<br />

could arise.<br />

All other operating risks, especially those related to the<br />

internal organization and information systems, are<br />

monitored through internal policies and directives.<br />

The Board of Directors and Senior Management are<br />

regularly informed of the risks related to asset value,<br />

financial position, liquidity, earnings and operations<br />

through a management information system.<br />

Outsourcing<br />

<strong>Mercantil</strong> Bank (Schweiz) AG has outsourced the<br />

operation of its banking system to PriBaSys AG in<br />

Zurich and the operation of SWIFT and SIC to Biveroni<br />

Batschelet Partners AG in Baden. These outsourcing<br />

arrangements were set up under detailed Service<br />

Level Agreements according to the regulations of the<br />

Swiss Financial Market Supervisory Authority (FINMA).<br />

All personnel of the service providers are placed under<br />

the group secrecy act, which safeguards the<br />

requirements of confidentiality.<br />

Personnel<br />

The group employed 31 persons including part-time<br />

employees. It also receives support from the head<br />

office and affiliates in areas such as internal audit, loan<br />

review, IT, and credit and country risk analysis.

2. Accounting and valuation principles<br />

General principles<br />

The Group’s accounting and valuation principles<br />

comply with the Swiss Code of Obligations, the Bank<br />

Law, and guidelines of the Swiss Financial Market<br />

Supervisory Authority (FINMA).<br />

Consolidation principles<br />

Besides the figures of <strong>Mercantil</strong> Bank (Schweiz) AG,<br />

the consolidated financial statements include the<br />

financial statements of <strong>Mercantil</strong> Bank and Trust Ltd,<br />

Grand Cayman and MBS Advisory Services Ltd.,<br />

British Virgin Islands which are fully consolidated.<br />

The capital is consolidated using the purchase method,<br />

i.e. at the time of acquisition.<br />

Upon elimination of intercompany transactions, the<br />

assets, liabilities, income and expenses of the<br />

subsidiaries are included in the relevant line items in<br />

the consolidated financial statements.<br />

Translation differences resulting from the consolidation<br />

are included in the line item “currency translation<br />

differences”, which is part of the capital resources.<br />

The consolidated financial statements reflect a true<br />

and fair view of the net assets as well as of profitability<br />

and the financial situation.<br />

Accounting and booking of transactions<br />

All transactions are recorded in the Group’s balance<br />

sheet on a trade date basis, except for forward<br />

transactions, which are reported from the trade date as<br />

off-balance sheet items and from the settlement date in<br />

the balance sheet. All transactions are valued from the<br />

trade date onward.<br />

Foreign currency translation<br />

Transactions in foreign currencies are translated at<br />

daily exchange rates. Foreign currency positions, with<br />

the exception of participations, are converted at the<br />

exchange rates prevailing at the year-end closing date.<br />

Resulting conversion profits and losses are included in<br />

the income statement. Participations are valued at the<br />

exchange rates prevailing at the time of the purchase.<br />

In the event of a decline in the value of such an<br />

investment, giving due account also to the fluctuation<br />

of exchange rates, a valuation adjustment is made.<br />

Assets and liabilities of group companies are<br />

translated using the exchange rate as at the balance<br />

sheet date, and income and expenses at the average<br />

exchange rate of the year. The difference arising from<br />

the use of different exchange rates is directly<br />

recognized in capital resources and disclosed as<br />

currency translation difference.<br />

The following exchange rates were used as at the<br />

balance sheet date (major currencies):<br />

2008 2007<br />

USD 1.0597 1.1248<br />

EUR 1.4880 1.6573<br />

The balance sheet of the subsidiaries carrying its<br />

books in USD was translated using the above<br />

mentioned exchange rate as at the balance sheet date,<br />

and the income statement was translated using the<br />

average rate for the year of 1.0822/USD (2007: 1.20).<br />

General valuation principles<br />

Each item reflected in the balance sheet is valued<br />

individually.<br />

Cash, Due from Money Market Instruments, Due<br />

from banks, Deposits<br />

They are stated at their nominal value, or at historical<br />

cost, less specific valuation adjustments for doubtful<br />

receivables. Money market instruments are adjusted<br />

for discounts. Unearned discounts on money market<br />

instruments are accrued over their life within the<br />

corresponding balance sheet item.<br />

Due from customers<br />

Doubtful receivables, i.e. loans for which it is unlikely<br />

that the customer will be able to comply with its future<br />

obligations, are valued individually and the impairment<br />

of value is covered by a specific provision. Off-balance<br />

sheet transactions, such as firm commitments,<br />

guarantees and derivative financial instruments are<br />

also included in this valuation. Loans are classified as<br />

impaired at the latest when a borrower is in arrears<br />

with payments of capital and/or interest for a period of<br />

over 90 days. Interests in arrears for a period of over<br />

90 days are considered overdue. Overdue interest and<br />

interest of which collection is considered at risk are not<br />

reflected as income but directly allocated to valuation<br />

adjustments and provisions. Loans are placed on a<br />

non-accrual status when the collectibility of their<br />

interest is considered doubtful to the extent that an<br />

accrual would be imprudent.

The amount of the impairment is measured by the<br />

difference between the book value of the loan and the<br />

estimated collectible amount, considering the<br />

counterparty risk and the net value from the execution<br />

of any collateral. If the process of execution is<br />

expected to take longer than a year, then a present<br />

value calculation is made of the expected cash flows to<br />

be generated from the execution process. Specific<br />

provisions are deducted directly from the<br />

corresponding asset item.<br />

Loans that are believed to be entirely or partially<br />

uncollectible or for which the group consents to their<br />

remission, are charged off against the provision for<br />

loan losses. Recoveries of previously charged-off<br />

amounts are directly credited to the provision for loan<br />

losses.<br />

A general provision for loan losses is made, based on<br />

set rates per credit rating category, to cover for not yet<br />

recognizable loan loss risks inherent in the credit<br />

portfolio.<br />

Doubtful receivables are classified again at full value if<br />

payments of outstanding capital and interest are<br />

resumed according to the contractual terms and also<br />

credit standing criteria are fulfilled.<br />

Financial investments<br />

Fixed income securities held as available for sale are<br />

valued at the lower of cost or market. The net balances<br />

of value adjustments are made through “Other<br />

Ordinary Income” or “Other Ordinary Expense”,<br />

respectively. Write-ups are recognized up to the<br />

acquisition costs, provided the market value which had<br />

fallen below the acquisition cost recovers again. Such<br />

value adjustment is recognized as described above.<br />

Debt securities acquired with the intention to hold them<br />

to maturity are recorded using the accrual method, i.e.<br />

premiums or discounts are accrued over their<br />

remaining life. Interest-related gains or losses from<br />

sale before maturity or prepayment are deferred and<br />

accrued over the remaining life, i.e., until the original<br />

maturity. Value reductions or subsequent increases,<br />

resulting from credit rating are treated as “available for<br />

sale” in the income statement.<br />

Buildings and participations acquired from the credit<br />

business earmarked for disposal are registered as<br />

financial investments and valued at the lower of cost or<br />

market, i.e. at the lower of acquisition cost or<br />

liquidation value.<br />

Other fixed assets / Software<br />

Other fixed assets and Software are stated at cost plus<br />

value-creating investments less depreciation computed<br />

on a straight line basis over their expected useful life –<br />

of 3 years for software, IT and communication<br />

systems, 5 years for furniture, and installations in new<br />

premises over the duration of the lease contract.<br />

Valuation adjustments and provisions<br />

Specific valuation adjustments and provisions are<br />

created for all recognizable risks both on and offbalance<br />

sheet. Valuation adjustments and provisions<br />

which are no longer required in the reporting period are<br />

reversed affecting income.<br />

Specific valuation adjustments and provisions are<br />

directly deducted from the corresponding asset item.<br />

General provisions for default risks as well as other<br />

risks are recorded under this balance sheet position.<br />

Employee benefit obligation<br />

The group maintains two defined contribution pension<br />

plans for its employees in Switzerland. The group<br />

bears the expenses of the pension plans of all its employees<br />

as well as their survivors in accordance with<br />

the Swiss social security law. The benefit obligations<br />

as well as the coverage capital are disincorporated into<br />

legally independent pension funds or foundations of<br />

insurance companies. The organization, management<br />

and financing of the pension plans conform to the legal<br />

regulations, to the articles of the funds as well as to<br />

current pension regulations.<br />

For each pension plan the group has to assess, according<br />

to Swiss GAAP FER 16, if a possible credit or<br />

debit balance of a plan can result in economical gains<br />

or losses. The financial statement of the pension fund<br />

provides the basis for the annual assessment.<br />

The group records its contributions as employer in<br />

“personnel expenses” in the same period in which the<br />

contributions are paid.<br />

Taxes<br />

Tax expenditure is calculated on basis of the actual<br />

profit of the individual group companies.<br />

Contingent liabilities, irrevocable commitments<br />

Contingent liabilities and irrevocable commitments are<br />

stated at their nominal value. Provisions for recognizeable<br />

risks are created and recorded under “valuation<br />

adjustments and provisions” on the liability side.<br />

Derivative financial instruments<br />

Derivative financial instruments are recorded at<br />

nominal value in the off-balance sheet.<br />

Gains or losses arising from hedge instruments are<br />

reflected in the same income item as that of the<br />

hedged underlying transaction.

3. Information on the Balance sheet<br />

3.1 Listing of collateral of loans and off-balance sheet transactions<br />

in CHF 1000 Type of collateral<br />

Total<br />

Loans<br />

Mortgage collateral<br />

Other<br />

collateral<br />

Without<br />

collateral<br />

Due from customers - 43'109 63'141 106'250<br />

Total loans 31.12.2008 - 43'109 63'141 106'250<br />

Previous year 20'240<br />

Off-balance sheet transactions<br />

29'940 31'748 81'928<br />

Contingent liabilities - 3'872 658 4'530<br />

Irrevocable commitments - - 590 590<br />

Total off-balance sheet transactions 31.12.2008 - 3'872 1'248 5'120<br />

Previous year - 11'830 779 12'609<br />

in CHF 1000 Gross<br />

outstanding<br />

Doubtful loans as per 31.12.2008 6'464<br />

Previous year 148<br />

3.2 Financial investments<br />

in CHF 1000<br />

Estimated<br />

recovery amount<br />

of collaterals<br />

Net<br />

outstanding<br />

Specific<br />

provision<br />

4'769 1'695 588<br />

- 148 148<br />

Book value Fair value<br />

31.12.2008 31.12.2007 31.12.2008 31.12.2007<br />

Debt securities 12'873 2'942 12'253 2'942<br />

- of which valued at accrual method 12'873 2'942 12'253 2'942<br />

- of which valued at lower of cost or market - - - -<br />

Shares 747 834 747 835<br />

Total financial investments 13'620 3'776 13'000 3'777<br />

3.3 Fixed assets<br />

in CHF 1000 Historical Accumula- Book value<br />

Fixed assets<br />

Other fixed assets 2'176 1'037<br />

Software 2'613 1'684<br />

Total fixed assets 4'789 2'721<br />

Cost ted depre- previous Invest- Disinvest- Depreciation/ Book Value<br />

ciation year ments ment Write-offs 31.12.2008<br />

1'139 50<br />

929 466<br />

2'068 516<br />

- 261 928<br />

- 546 849<br />

- 807 1'777<br />

Fire insurance value of other fixed assets 970<br />

2008

3.4 Other Assets and Other Liabilities<br />

in CHF 1000<br />

Other<br />

Assets<br />

Replacement value from derivative financial<br />

instruments<br />

Contracts as own trader<br />

- Trading position 335<br />

- Balance sheet structure management 9'372<br />

Total derivative financial instruments 9'707<br />

Other<br />

Liabilities<br />

Other<br />

Assets<br />

741<br />

572<br />

- 7'002<br />

741<br />

7'574<br />

Other<br />

Liabilities<br />

Indirect Taxes 1<br />

7<br />

- 45<br />

Sundry accounts - - - -<br />

Other assets and liabilities - 173<br />

- 207<br />

Total other assets and other liabilities 9'708<br />

3.5 Disclosure of liabilities to own pension plans<br />

31.12.2008 31.12.2007<br />

The group’s employees are entitled to a legally independent personnel pension fund with two different plans. One plan covers<br />

the obligatory benefits according to the Swiss pension fund law, while the second plan covers all the non-obligatory benefits.<br />

Both plans are defined contribution plans. As in the previous year, the group had no further obligations towards these pension<br />

plans and there were no reserves from employer’s contributions.<br />

The group’s employees are insured at a collective foundation for pension services in the scope of an affiliation agreement. The<br />

contracts cover all retirement, invalidity and death benefits. A possible shortage of the pension fund, causing a future liability for<br />

the group, is covered by existing reserves.<br />

3.6 Valuation adjustments and provisions, reserves for general banking risks<br />

in CHF 1000 Balance<br />

previous year<br />

Valuation adjustments and<br />

provisions for credit and<br />

country risks 3'109<br />

Specific<br />

usage<br />

-148<br />

Recoveries,<br />

doubtful interest,<br />

currency<br />

differences<br />

-103<br />

921<br />

New creation<br />

charged to<br />

income<br />

statement<br />

601<br />

7'574<br />

Reversals<br />

credited to<br />

income<br />

-601<br />

612<br />

-<br />

612<br />

864<br />

Balance<br />

current year<br />

Valuation adjustments and<br />

provisions for investments - - - - - -<br />

Other Provisions (operating loss) - - - - - -<br />

Total valuation adjustments and<br />

provisions 3'109<br />

less: set-offs with investments<br />

Total valuation adjustments and<br />

-148<br />

provisions as of balance sheet 2'961<br />

-148<br />

148<br />

-103<br />

10<br />

601<br />

-599<br />

-601<br />

2'858<br />

2'858<br />

-588<br />

2'270

3.7 Schedule of share capital and disclosure of shareholders<br />

in CHF 1000<br />

Capital structure<br />

Nominal<br />

amount<br />

Shareholder's equity 45'500<br />

Number of<br />

shares<br />

45'500<br />

Capital with<br />

dividend rights<br />

45'500<br />

Nominal<br />

amount<br />

45'500<br />

Number of<br />

shares<br />

45'500<br />

Capital with<br />

dividend rights<br />

Significant shareholders and shareholder groups<br />

with voting rights<br />

31.12.2008 31.12.2007<br />

Nominal Share in % Nominal Share in %<br />

Holding <strong>Mercantil</strong> Internacional, C.A., Caracas, Venezuela 45'500<br />

100% 45'500<br />

100%<br />

Shareholder of Holding <strong>Mercantil</strong> Internacional, C.A.:<br />

<strong>Mercantil</strong> Servicios Financieros, C.A., Caracas, Venezuela 45'500<br />

31.12.2008 31.12.2007<br />

100% 45'500<br />

<strong>Mercantil</strong> Servicios Financieros (MSF) is a financial holding registered on the Caracas Stock Exchange. The capital structure of MSF<br />

is comprised of A (58%) and B (42%) shares, with B shares having limited voting rights. Its shares are held primarily by Venezuelan<br />

investors. Approximately 39% of the B shares are owned through an American Depositary Receipt (ADR) program, therefore MSF does<br />

not have information who the holders of the ADR's are. Shareholders with ownership of over 5%, as known to MSF are:<br />

- Vadesa Group (4.1% A shares; 15.7% B shares); 9.0% participation<br />

- Gustavo J. Vollmer Group (11.1% A shares; 4.6% B shares); 8.4% participation<br />

- Travieso Sanchez Group (7.6% A shares; 3.4% B shares); 5.8% participation<br />

- Altamis B.V. (9.4% A shares; 0.3% B shares); 5.6% participation<br />

- Gustavo A. Marturet Group (8.3% A shares; 1.1% B shares); 5.2% participation<br />

45'500<br />

100%

3.8 Statement of changes in shareholder's equity<br />

in CHF 1000 31.12.2008 31.12.2007<br />

Shareholder's equity at beginning of current year<br />

Share capital 45'500 33'500<br />

Capital Reserves 200 169<br />

Retained earnings (incl. Currency translation differences) 8'971 7'374<br />

Consolidated net profit 1'799 2'437<br />

Total shareholder's equity at beginning of current year (before profit distribution) 56'470 43'480<br />

+ Capital increase - 12'000<br />

- Capital increase costs - -<br />

+ Consolidated net profit for the year 668 1'799<br />

+ Currency translation adjustments -571 -809<br />

Total shareholder's equity at end of current year (before profit distribution) 56'567 56'470<br />

Thereof:<br />

Share capital 45'500 45'500<br />

Capital Reserves 230 200<br />

Retained earnings (incl. currency translation differences) 10'169 8'971<br />

Consolidated net profit 668 1'799<br />

On the basis of the legal provision the capital reserves may not be distributed.

3.9 Maturity structure of current assets, financial investments and liabilities<br />

in CHF 1000<br />

Current assets and financial investments<br />

at sight redeemable<br />

by<br />

notice<br />

within<br />

3 months<br />

within<br />

3-12<br />

months<br />

within<br />

1-5 years<br />

after<br />

5 years<br />

Liquid funds 225 - - - - - 225<br />

Money market instruments - - - - - - -<br />

Due from Banks 46'994 42'854 89'953 41'010 - - 220'811<br />

Due from Customers 6'974 - 58'326 38'316 2'634 - 106'250<br />

Financial investments<br />

Total current assets and<br />

3 - 3'726 2'955 1'804 5'132 13'620<br />

financial investments 31.12.2008<br />

54'196 42'854 152'005 82'281 4'438 5'132 340'906<br />

Previous year 24'327 640<br />

Current liabilities<br />

209'118 110'351 21'845 3'172<br />

Total<br />

369'453<br />

Due to banks 168 - 3'901 - - - 4'069<br />

Due to customers, other 62'675 10'682<br />

Total current liabilities 31.12.2008 62'843 10'682<br />

Previous year 45'075 6'609<br />

Maturity<br />

152'834 63'504 108 - 289'803<br />

156'735 63'504 108 - 293'872<br />

205'684 60'057 1'260 - 318'685<br />

3.10 Disclosure of amounts due from and due to affiliated companies as well as<br />

loans and exposures to directors and senior executives<br />

in CHF 1000 31.12.2008 31.12.2007<br />

Due from affiliated companies 32'321<br />

Due to affiliated companies 175<br />

Loans to directors and senior executives 19<br />

Transactions with related parties<br />

Transactions with related parties such as securities transactions, international payments, placement of funds and deposits<br />

are made under conditions as they would apply with third parties.<br />

18'689<br />

127<br />

70

3.11 Balance sheet by domestic and foreign origin (by domicile)<br />

in CHF 1000<br />

Assets<br />

Domestic Foreign Domestic Foreign<br />

Liquid Funds 225 - 379 -<br />

Money market instruments - - 4'621 56'376<br />

Due from banks 23'406 197'405 12'875 209'498<br />

Due from customers 1'454 104'796 1'789 80'139<br />

Financial investments 1<br />

13'619 1 3'775<br />

Fixed assets 1'777 - 2'068 -<br />

Accrued income and prepaid expenses 929 2'315 696 2'294<br />

Other assets 250 9'458 571 7'003<br />

Total assets 28'042 327'593 23'000 359'085<br />

Liabilities<br />

31.12.2008 31.12.2007<br />

Due to banks - 4'069 4'851 6'356<br />

Due to customers, other 550 289'253 317 307'161<br />

Accrued expenses and deferred income 449 1'556 570 2'535<br />

Other liabilities 736 185 864 -<br />

Valuation adjustments and provisions 1'154 1'116 1'214 1'747<br />

Share capital 45'500 - 45'500 -<br />

Legal reserves 230 - 200 -<br />

Retained earnings (losses) 1'384 8'785 847 8'124<br />

Consolidated net profit (loss) for the year 42 626 573 1'226<br />

Total liabilities 50'045 305'590 54'936 327'149

3.12.1 Geographical analysis of assets (by domicile)<br />

in CHF 1000<br />

31.12.2008 31.12.2007<br />

Amount in % Amount in %<br />

Europe 102'940 28.9% 117'577 30.8%<br />

Switzerland 28'042 7.9% 23'002 6.0%<br />

Other west European countries 74'898 21.1% 94'575 24.8%<br />

North-America 41'328 11.6% 77'474 20.2%<br />

Latin-America 211'220 59.5% 181'411 47.5%<br />

Argentina 8'928 2.5% - 0.0%<br />

Bahamas - 0.0% 5'401 1.4%<br />

Brazil 44'961 12.6% 33'407 8.7%<br />

Cayman Islands 2'334 0.7% 2'409 0.6%<br />

Chile 7'736 2.2% 15'747 4.1%<br />

Colombia 5'284 1.5% 19'001 5.0%<br />

Costa Rica 20'611 5.8% 9'730 2.5%<br />

Dominican Republic 5'373 1.5% 5'624 1.5%<br />

Ecuador 1'060 0.3% 1'146 0.3%<br />

El Salvador 10'809 3.0% 7'255 1.9%<br />

Guatemala 14'806 4.2% 17'685 4.6%<br />

Mexico 19'903 5.6% 19'294 5.0%<br />

Panama 6'171 1.7% 8'184 2.1%<br />

Peru 31'719 8.9% 14'378 3.8%<br />

St. Lucia 22 0.0% - 0.0%<br />

Trinidad and Tobago 2'967 0.8% - 0.0%<br />

Venezuela 26'323 7.6% 16'940 4.6%<br />

Virgin Islands (British) 2'213 0.6% 1'470 0.4%<br />

Virgin Islands (USA) - 0.0% 3'740 1.0%<br />

Other 147 0.0% 5'623 1.5%<br />

Total assets 355'635 100.0% 382'085 100.0%

3.12.2 Breakdown of exposure by country of risk and by rating categories<br />

in CHF 1000<br />

31.12.2008 31.12.2007<br />

Amount in % Amount in %<br />

Category 1 168'186 46.6% 210'301 53.3%<br />

Austria - - 8'784 2.2%<br />

Belgium 2 - 3 -<br />

Canada - - 6'186 1.6%<br />

France - - 13'802 3.5%<br />

Germany 49'063 13.6% 33'406 8.5%<br />

Great Britain 4'811 1.3% 768 0.2%<br />

Italy 5'033 1.4% 9'198 2.3%<br />

Luxembourg 950 0.3% 13'099 3.3%<br />

Netherlands 4'769 1.3% - -<br />

Norway - - 5'622 1.4%<br />

Spain 26'873 7.4% 12'553 3.2%<br />

Sweden 1'491 0.4% 5'612 1.4%<br />

Switzerland 29'496 8.2% 33'189 8.4%<br />

USA 42'051 11.7% 58'988 15.0%<br />

Virgin Islands (British) 3'647 1.0% 9'091 2.3%<br />

Category 2 34'314 9.5% 42'919 10.9%<br />

Chile 7'736 2.1% 15'747 4.0%<br />

Mexico 23'611 6.6% 21'951 5.6%<br />

Russia - - 5'221 1.3%<br />

Trinidad and Tobago 2'967 0.8% - -<br />

Category 3 89'871 24.9% 82'053 20.7%<br />

Brazil 40'192 11.1% 47'356 12.0%<br />

Costa Rica 10'756 3.0% 9'730 2.5%<br />

Panama 6'992 1.9% 10'027 2.5%<br />

Peru 31'719 8.8% 14'369 3.6%<br />

South Africa 212 0.1% 571 0.1%<br />

Category 4 19'091 5.3% 26'256 6.7%<br />

Colombia 5'845 1.6% 19'001 4.9%<br />

El Salvador 13'246 3.7% 7'255 1.8%<br />

Category 5 and 6 49'293 13.7% 33'165 8.4%<br />

Cayman Islands 6'189 1.7% 112 -<br />

Dominican Republic 5'373 1.5% - -<br />

Guatemala 14'806 4.1% 17'675 4.5%<br />

Venezuela 22'925 6.4% 15'132 3.8%<br />

Others - - 246 0.1%<br />

Total 360'755 100.0% 394'694 100.0%

3.13 Balance sheet by currencies<br />

in CHF 1000<br />

Assets<br />

CHF EUR USD other<br />

Liquid Funds 167 32 26 -<br />

Money market instruments - - - -<br />

Due from banks 217 90'347 127'943 2'304<br />

Due from customers - 2'357 103'891 2<br />

Financial investments 1<br />

12'559 1'060 -<br />

Fixed assets 1'777 - - -<br />

Accrued income and prepaid expenses 262 624 2'358 -<br />

Other assets 15 253 9'440 -<br />

Total balance sheet effective assets 2'439 106'172 244'718 2'306<br />

Claims from transactions related to forex spot,<br />

forward and option transactions 48'935 16'071 11'268 262<br />

Total assets 51'374 122'243 255'986 2'568<br />

Liabilities<br />

Currencies<br />

Due to banks - 11 4'058 -<br />

Due to customers, other 875 111'764 174'923 2'241<br />

Accrued expenses and deferred income 384 833 788 -<br />

Other liabilities 180 315 426 -<br />

Valuation adjustments and provisions 1'154 - 1'116 -<br />

Share capital 45'500 - - -<br />

Legal reserves 230 - - -<br />

Retained earnings (losses) 1'384 1 8'784 -<br />

Consolidated net profit for the year 42 - 626 -<br />

Total balance sheet effective liabilities 49'749 112'924 190'721 2'241<br />

Claims from transactions related to forex spot,<br />

forward and option transactions 2'661 9'626 63'986 263<br />

Total liabilities 52'410 122'550 254'707 2'504<br />

Net position per currency -1'036 -307 1'279 64

4. Information on Off-Balance Sheet Transactions<br />

4.1 Analysis of contingent liabilities<br />

in CHF 1000 31.12.2008 31.12.2007 Change<br />

Guarantees to secure credits and similar 4'530<br />

12'191<br />

Guarantees for warranty and similar - - -<br />

Irrevocable commitments 590<br />

Total contingent liabilities 5'120<br />

4.2 Outstanding derivative instruments<br />

in CHF 1000 positive<br />

replacement value<br />

Foreign exchange<br />

Forward contracts with maturity under 1 year 9'707<br />

- thereof trading instruments 335<br />

- thereof hedging instruments 9'372<br />

Total 31.12.2008 9'707<br />

Previous year 7'574<br />

- thereof trading instruments 572<br />

- thereof hedging instruments 7'002<br />

4.3 Analysis of fiduciary transactions<br />

418<br />

12'609<br />

negative<br />

replacement value<br />

-7'661<br />

172<br />

-7'489<br />

Contract<br />

Volume<br />

741<br />

64'647<br />

741<br />

16'709<br />

- 47'938<br />

741<br />

64'647<br />

612<br />

73'978<br />

612<br />

26'040<br />

- 47'938<br />

in CHF 1000 31.12.2008 31.12.2007 Change<br />

Fiduciary placements with third party banks 21'886<br />

Fiduciary placements with affiliated banks 64'027<br />

Total fiduciary transactions 85'913<br />

14'483<br />

41'351<br />

55'834<br />

7'403<br />

22'676<br />

30'079

5. Information on the Income Statement<br />

5.1 Income from trading activities<br />

in CHF 1000 31.12.2008 31.12.2007 Change<br />

Foreign exchange 941 187 754<br />

Total trading income 941 187 754<br />

5.2 Personnel expenses<br />

in CHF 1000 31.12.2008 31.12.2007 Change<br />

Salaries and allowances 3'869 3'457 412<br />

Contributions to pension funds 278 263 15<br />

Social security contributions 327 307 20<br />

Other personnel expenses 117 128 -11<br />

Total personnel expenses 4'591 4'155 436<br />

5.3 Other operating expenses<br />

in CHF 1000 31.12.2008 31.12.2007 Change<br />

Expenses for premises 299 273 26<br />

Expenses for IT, machinery, furniture<br />

vehicles and other equipment 1'561 1'213 348<br />

Other operating expenses 1'560 1'641 -81<br />

Total other operating expenses 3'420 3'127 293<br />

5.4 Tax expenses<br />

Tax expenditure includes current income and annual capital tax and is calculated on the actual income<br />

(after offsetting potential tax losses) as well as on the actual taxable capital.<br />

5.5 Comments to extraordinary income and expenses, to significant reversals<br />

of general banking risks and of freed valuation adjustments and reserves<br />

The extraordinary income of TCHF 650 resulted from the following:<br />

- Reversal of general banking risk provision of TCHF 599.<br />

- Recovery of a written off position of TCHF 51.

6. Disclosure according to capital adequacy ordinance<br />

6.1 Information on eligible capital and capital requirements<br />

in CHF 1000 31.12.2008<br />

Eligible capital 56'567<br />

Total amount of eligible capital 56'567<br />

Credit risk 14'807<br />

Non-Counterparty risks 889<br />

Market risks 1'138<br />

Operational risks 1'311<br />

Value adjustments and provisions recognised as liabilities -136<br />

Total amount of capital requirements 18'009

MERCANTIL BANK (<strong>SCHWEIZ</strong>) AG<br />

ZURICH<br />

Report of the Statutory Auditors<br />

to the General Meeting of<br />

Shareholders for the year 2008<br />

14 April 2009/00593800001/12/SMN/HEX<br />

With offices in Aarau, Basel, Berne, Chur, Geneva, Lausanne, Lugano, Lucerne, Neuchâtel, Sitten, St. Gallen, Thun, Winterthur, Zug and<br />

Zurich, PricewaterhouseCoopers AG is a provider of auditing services and tax, legal and business consultancy services.<br />

PricewaterhouseCoopers AG is a member of a global network of companies that are legally independent of one another; the network is<br />

represented in some 150 countries throughout the world.

Report of the statutory auditors<br />

to the general meeting of<br />

MERCANTIL BANK (<strong>SCHWEIZ</strong>) AG<br />

ZURICH<br />

Report of the statutory auditor on the financial statements<br />

PricewaterhouseCoopers AG<br />

Birchstrasse 160<br />

8050 Zürich<br />

Phone +41 58 792 44 00<br />

Fax +41 58 792 44 10<br />

www.pwc.ch<br />

As statutory auditor, we have audited the financial statements of MERCANTIL BANK (<strong>SCHWEIZ</strong>)<br />

AG, which comprise the balance sheet, income statement and notes, for the year ended<br />

31 December 2008.<br />

Board of Directors’ Responsibility<br />

The Board of Directors is responsible for the preparation of the financial statements in accordance<br />

with the requirements of Swiss law and the company’s articles of incorporation. This responsibility<br />

includes designing, implementing and maintaining an internal control system relevant to the<br />

preparation of financial statements that are free from material misstatement, whether due to fraud<br />

or error. The Board of Directors is further responsible for selecting and applying appropriate<br />

accounting policies and making accounting estimates that are reasonable in the circumstances.<br />

Auditor’s Responsibility<br />

Our responsibility is to express an opinion on these financial statements based on our audit. We<br />

conducted our audit in accordance with Swiss law and Swiss Auditing Standards. Those standards<br />

require that we plan and perform the audit to obtain reasonable assurance whether the financial<br />

statements are free from material misstatement.<br />

An audit involves performing procedures to obtain audit evidence about the amounts and<br />

disclosures in the financial statements. The procedures selected depend on the auditor’s judgment,<br />

including the assessment of the risks of material misstatement of the financial statements, whether<br />

due to fraud or error. In making those risk assessments, the auditor considers the internal control<br />

system relevant to the entity’s preparation of the financial statements in order to design audit<br />

procedures that are appropriate in the circumstances, but not for the purpose of expressing an<br />

opinion on the effectiveness of the entity’s internal control system. An audit also includes<br />

evaluating the appropriateness of the accounting policies used and the reasonableness of<br />

accounting estimates made, as well as evaluating the overall presentation of the financial<br />

statements. We believe that the audit evidence we have obtained is sufficient and appropriate to<br />

provide a basis for our audit opinion.<br />

Opinion<br />

In our opinion, the financial statements for the year ended 31 December 2008 comply with Swiss<br />

law and the company’s articles of incorporation.

Report on other legal requirements<br />

We confirm that we meet the legal requirements on licensing according to the Auditor Oversight Act<br />

(AOA) and independence (article 728 CO and article 11 AOA) and that there are no circumstances<br />

incompatible with our independence.<br />

In accordance with article 728a paragraph 1 item 3 CO and Swiss Auditing Standard 890, we<br />

confirm that an internal control system exists which has been designed for the preparation of<br />

financial statements according to the instructions of the Board of Directors.<br />

We further confirm that the proposed appropriation of available earnings complies with Swiss law<br />

and the company’s articles of incorporation. We recommend that the financial statements<br />

submitted to you be approved.<br />

PricewaterhouseCoopers AG<br />

Martin Schmidt Alex Henzi<br />

Audit expert<br />

Auditor in charge<br />

Zürich, 14 April 2009<br />

Enclosures:<br />

- Financial statements (balance sheet, income statement and notes)<br />

- Proposed appropriation of the available earnings

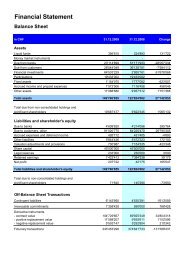

Financial Statement<br />

Balance Sheet<br />

in CHF 31.12.2008 31.12.2007 Change<br />

Assets<br />

Liquid funds 224'893 379'212 -154'319<br />

Money market instruments - 4'809'323 -4'809'323<br />

Due from banks 51'171'933 25'457'295 25'714'638<br />

Due from customers 36'138'161 50'056'593 -13'918'432<br />

Financial investments 2'855'161 833'531 2'021'630<br />

Participations 19'433'002 19'433'002 -<br />

Fixed assets 1'777'082 2'067'545 -290'463<br />

Accrued income and prepaid expenses 1'116'458 847'599 268'859<br />

Other assets 9'937'312 7'574'440 2'362'872<br />

Total assets 122'654'002 111'458'540 11'195'462<br />

Total due from non-consolidated holdings and shareholder 9'622'345 7'210'236 2'412'109<br />

Liabilities and shareholder's equity<br />

Due to banks 4'214'056 12'135'652 -7'921'596<br />

Due to customers, other 64'225'470 45'923'025 18'302'445<br />

Accrued expenses and deferred income 431'405 569'739 -138'334<br />

Other liabilities 5'472'323 4'501'634 970'689<br />

Valuation adjustments and provisions 1'154'335 1'214'252 -59'917<br />

Share capital 45'500'000 45'500'000 -<br />

Legal reserves 230'000 200'000 30'000<br />

Retained earnings 1'384'238 841'175 543'063<br />

Net profit 42'175 573'063 -530'888<br />

Total liabilities and shareholder's equity 122'654'002 111'458'540 11'195'462<br />

Total due to non-consolidated holdings and shareholder 145'290 928'406 -783'116<br />

Off-Balance Sheet Transactions<br />

Contingent liabilities 4'530'391 12'190'517 -7'660'126<br />

Irrevocable commitments 590'000 418'000 172'000<br />

Derivative instruments<br />

- contract value 69'925'349 73'978'266 -4'052'917<br />

- positive replacement value 9'935'611 7'574'162 2'361'449<br />

- negative replacement value 5'292'804 4'249'228 1'043'576<br />

Fiduciary transactions 374'841'733 355'682'698 19'159'035

Income Statement<br />

in CHF 2008 2007 Change<br />

Ordinary operating income and expense<br />

Interest income<br />

Interest and discount income 4'136'134 5'118'312 -982'178<br />

Interest and dividend income on financial investments 250'967 149'515 101'452<br />

Interest expense -686'832 -873'031 186'199<br />

Net interest income 3'700'269 4'394'796 -694'527<br />

Income from commission and services<br />

Commission income on lending activities 246'192 331'564 -85'372<br />

Commission income on asset management 2'024'473 1'686'688 337'785<br />

Commission income on other services 999'075 756'860 242'215<br />

Commission expense -132'273 -96'351 -35'922<br />

Net commission income 3'137'467 2'678'761 458'706<br />

Income from trading operations 843'759 197'625 646'134<br />

Other ordinary income<br />

Participation income 633'960 568'400 65'560<br />

Other ordinary income 2'120 1'818 302<br />

Other ordinary expense -195'578 - -195'578<br />

Total other ordinary income 440'502 570'218 -129'716<br />

Total operating income 8'121'997 7'841'400 280'597<br />

Operating expenses<br />

Personnel expenses -4'591'269 -4'154'724 -436'545<br />

Other operating expenses -2'631'187 -2'503'898 -127'289<br />

Total operating expenses -7'222'456 -6'658'622 -563'834<br />

Gross profit 899'541 1'182'778 -283'237<br />

Net income for the year<br />

Gross profit 899'541 1'182'778 -283'237<br />

Depreciation and write-offs of non-current assets -807'164 -535'856 -271'308<br />

Valuation adjustments, provisions and losses -77'692 -9'390 -68'302<br />

Subtotal 14'685 637'532 -622'847<br />

Extraordinary income 108'645 17'800 90'845<br />

Extraordinary expenses - - -<br />

Taxes -81'155 -82'269 1'114<br />

Net income for the year 42'175 573'063 -530'888<br />

Distribution of profit<br />

Net profit for the year 42'175 573'063 -530'888<br />

Retained profit brought forward 1'384'238 841'175 543'063<br />

Balance sheet profit 1'426'413 1'414'238 12'175<br />

Allocation of profit<br />

Allocation to legal reserves -3'000 -30'000 27'000<br />

Retained profit brought forward 1'423'413 1'384'238 39'175

Notes to the parent financial statement<br />

1. Information on business activities and number of employees<br />

General information<br />

<strong>Mercantil</strong> Bank (Schweiz) AG, until January 27, 2000,<br />

operating under the name BMS Finanz AG, was<br />

incorporated in May 1988 in Zurich. Its activities in<br />

the areas of trade finance, private banking and<br />

fiduciary transactions are focused on Latin America<br />

and complemented by the banking activities of its<br />

wholly owned subsidiaries <strong>Mercantil</strong> Bank & Trust<br />

Ltd., Grand Cayman and MBS Advisory Services<br />

Ltd., British Virgin Island.<br />

It is intended to continue intensifying the expansion<br />

of the private banking activities for the clientele of the<br />

Grupo <strong>Mercantil</strong> Servicios Financieros (MSF). For<br />

this, the bank continues to invest in its banking<br />

software and electronic banking facilities to support<br />

and enhance the range of services offered to its<br />

customers. It is also intended to continue developing<br />

the traditional trade finance activities between<br />

Europe, Asia and Latin America.<br />

Balance Sheet transactions<br />

Short-term financial investments with European<br />

banks and trade financing for Latin American banks<br />

as well as short-term lending to Latin American and<br />

US corporate borrowers, largely related to<br />

preliminary and supplementary trade financing,<br />

represent the major assets of the bank. Investments<br />

in securities of Latin American and European<br />

borrowers complement the bank’s balance sheet<br />

business. Exposures with maturities of over one year<br />

are entered but limited to the bank’s net equity.<br />

Funding is obtained through customer deposits and<br />

also through credit lines from major European banks.<br />

Income from commissions and services<br />

Income from commissions and services results<br />

mainly from letter of credit transactions as well as<br />

from the issuance of guarantees, from custody fees,<br />

brokerage and other service fees related to fiduciary<br />

investments of private customers.<br />

Other activities<br />

For investment and also for liquidity purposes,<br />

<strong>Mercantil</strong> Bank (Schweiz) AG maintains an investment<br />

portfolio consisting mainly of fixed income<br />

securities of Latin American and European<br />

borrowers.<br />

Risk Assessment<br />

The Board of Directors discussed during its meeting<br />

as of February 3, 2009 the relevant risks the bank is<br />

facing. Relevant risks are market, liquidity, credit,<br />

operational and other risks. The basis for the<br />

assessment of the risks was the business rational<br />

and strategy of the business generating the risks, the<br />

risk appetite of the bank and the nature of the risk, its<br />

magnitude of a potential misstatement and the<br />

likelihood of the risk occurring. Additionally, the<br />

predefined risk reducing measures and the internal<br />

controls (including financial reporting) were included<br />

in the evaluation.<br />

The Board of Directors took also into consideration<br />

the monitoring of internal controls, the correct<br />

treatment of the risk recognition and the valuation<br />

effects of relevant risks on the financial reporting.<br />

For detailed information regarding risk management<br />

we refer to the explanations below.<br />

Risk Management<br />

The analysis and control of risks is performed in<br />

close cooperation with the Risk Management Group<br />

of our parent company (MSF) in Caracas.<br />

Credit approval is based on requirements as to<br />

quality, collaterals, limits and credit authority as laid<br />

down in the internal risk policy. All credit risk positions,<br />

including those from derivative instruments,<br />

are limited and monitored continuously by a credit<br />

line system based on counterparty and country risk.<br />

Foreign exposures are entered into and monitored in<br />

compliance with the internal risk policy. The assessment<br />

procedure, except for exposures in industrialized<br />

countries (Category 1), where country risk is<br />

negligible, is based on the rating of the Interagency<br />

Country Exposure Committee (ICERC) and on the<br />

Group’s own internal rating system. The internal evaluation<br />

is based on economic trends and political and<br />

social developments and derived from various groupinternal<br />

and external sources (Categories 2 – 6).

The risk provisioning requirements for country risk<br />

and counterparty risk are calculated independently<br />

on the basis of an internal rating process.<br />

Liquidity and interest rate risks are monitored and<br />

managed on a consolidated basis.<br />

Foreign exchange risks are to a large extent restricted<br />

by internal limits for open currency positions.<br />

Derivative financial instruments are used exclusively<br />

to hedge open foreign exchange positions and<br />

interest rate risks.<br />

When trading securities for customers, <strong>Mercantil</strong><br />

Bank (Schweiz) AG does not engage in open<br />

positions from which market risks could arise.<br />

All other operating risks, especially those related to<br />

the internal organization and information systems,<br />

are monitored through internal policies and<br />

directives.<br />

The Board of Directors and Senior Management are<br />

regularly informed of the risks related to asset value,<br />

financial position, liquidity, earnings and operations<br />

through a management information system.<br />

Outsourcing<br />

<strong>Mercantil</strong> Bank (Schweiz) AG has outsourced the<br />

operation of its banking system to PriBaSys AG in<br />

Zurich and the operation of SWIFT and SIC to<br />

Biveroni Batschelet Partners AG in Baden. These<br />

outsourcing arrangements were set up under detailed<br />

Service Level Agreements according to the<br />

regulations of the Swiss Financial Market<br />

Supervisory Authority (FINMA). All personnel of the<br />

service providers are placed under the bank secrecy<br />

act, which safeguards the requirements of<br />

confidentiality.<br />

Personnel<br />

<strong>Mercantil</strong> Bank (Schweiz) AG employed 31 persons<br />

including part-time employees. It also receives<br />

support from the head office and affiliates in areas<br />

such as internal audit, loan review, IT, and credit and<br />

country risk analysis.

2. Accounting and valuation principles<br />

General principles<br />

The Bank’s accounting and valuation principles<br />

comply with the Swiss Code of Obligations, the Bank<br />

Law, and guidelines of the Swiss Financial Market<br />

Supervisory Authority (FINMA).<br />

Accounting and booking of transactions<br />

All transactions are recorded in the balance sheet on<br />

a trade date basis, except for forward transactions,<br />

which are reported from the trade date as off-balance<br />

sheet items and from the settlement date in the<br />

balance sheet. All transactions are valued from the<br />

trade date onward.<br />

Foreign currency translation<br />

Transactions in foreign currencies are translated at<br />

daily exchange rates. Foreign currency positions,<br />

with the exception of participations, are converted at<br />

the exchange rates prevailing at the year-end closing<br />

date. Resulting conversion profits and losses are<br />

included in the income statement. Participations are<br />

valued at the exchange rates prevailing at the time of<br />

the purchase. In the event of a decline in the value of<br />

such an investment, giving due account also to the<br />

fluctuation of exchange rates, a valuation adjustment<br />

is made.<br />

The following exchange rates were used as at the<br />

balance sheet date (major currencies):<br />

2008 2007<br />

USD 1.0597 1.1248<br />

EUR 1.4880 1.6573<br />

General valuation principles<br />

Each item reflected in the balance sheet is valued<br />

individually.<br />

Cash, Due from Money Market Instruments, Due<br />

from banks, Deposits<br />

They are stated at their nominal value, or at historical<br />

cost, less specific valuation adjustments for doubtful<br />

receivables. Money market instruments are adjusted<br />

for discounts. Unearned discounts on money market<br />

instruments are accrued over their life within the<br />

corresponding balance sheet item.<br />

Due from customers<br />

Doubtful receivables, i.e. loans for which it is unlikely<br />

that the customer will be able to comply with its future<br />

obligations, are valued individually and the impairment<br />

of value is covered by a specific provision.<br />

Off-balance sheet transactions, such as firm<br />

commitments, guaranties and derivative financial<br />

instruments are also included in this valuation. Loans<br />

are classified as impaired at the latest when a<br />

borrower is in arrears with payments of capital and/or<br />

interest for a period of over 90 days. Interests in<br />

arrears for a period of over 90 days are considered<br />

overdue. Overdue interest and interest of which<br />

collection is considered at risk are not reflected as<br />

income but directly allocated to valuation adjustments<br />

and provisions. Loans are placed on a non-accrual<br />

status when the collectibility of their interest is<br />

considered doubtful to the extent that an accrual<br />

would be imprudent.<br />

The amount of the impairment is measured by the<br />

difference between the book value of the loan and<br />

the estimated collectible amount, considering the<br />

counterparty risk and the net value from the<br />

execution of any collateral. If the process of<br />

execution is expected to take longer than a year,<br />

then a present value calculation is made of the<br />

expected cash flows to be generated from the<br />

execution process. Specific provisions are deducted<br />

directly from the corresponding asset item.<br />

Loans that are believed to be entirely or partially<br />

uncollectible or for which the bank consents to their<br />

remission, are charged off against the provision for<br />

loan losses. Recoveries of previously charged-off<br />

amounts are directly credited to the provision for loan<br />

losses.<br />

A general provision for loan losses is made, based<br />

on set rates per credit rating category, to cover for<br />

not yet recognizable loan loss risks inherent in the<br />

credit portfolio.<br />

Doubtful receivables are classified again at full value<br />

if payments of outstanding capital and interest are<br />

resumed according to the contractual terms and also<br />

credit standing criteria are fulfilled.

Financial investments<br />

Fixed income securities held as available for sale are<br />

valued at the lower of cost or market. The net<br />

balances of value adjustments are made through<br />

“Other Ordinary Income” or “Other Ordinary<br />

Expense”, respectively. Write-ups are recognized up<br />

to the acquisition costs, provided the market value<br />

which had fallen below the acquisition cost recovers<br />

again. Such value adjustment is recognized as<br />

described above.<br />

Debt securities acquired with the intention to hold<br />

them to maturity are recorded using the accrual<br />

method, i.e. premiums or discounts are accrued over<br />

their remaining life. Interest-related gains or losses<br />

from sale before maturity or prepayment are deferred<br />

and accrued over the remaining life, i.e., until the<br />

original maturity. Value reductions or subsequent<br />

increases, resulting from credit rating are treated as<br />

“available for sale” in the income statement .<br />

Buildings and participations acquired from the credit<br />

business earmarked for disposal are registered as<br />

financial investments and valued at the lower of cost<br />

or market, i.e. at the lower of acquisition cost or<br />

liquidation value.<br />

Investments in subsidiaries<br />

The investments in subsidiaries are reflected at<br />

historical cost in Swiss Francs.<br />

Other fixed assets / Software<br />

Other fixed assets and Software are stated at cost<br />

plus value-creating investments less depreciation<br />

computed on a straight line basis over their expected<br />

useful life – of 3 years for software, IT and<br />

communication systems, 5 years for furniture, and<br />

installations in new premises over the duration of the<br />

lease contract.<br />

Valuation adjustments and provisions<br />

Specific valuation adjustments and provisions are<br />

created for all recognizable risks both on and offbalance<br />

sheet. Valuation adjustments and provisions<br />

which are no longer required in the reporting period<br />

are reversed affecting income.<br />

Specific valuation adjustments and provisions are<br />

directly deducted from the corresponding asset item.<br />

General provisions for default risks as well as other<br />

risks are recorded under this balance sheet position.<br />

Employee benefit obligation<br />

<strong>Mercantil</strong> Bank (Schweiz) AG maintains two defined<br />

contribution pension plans for its employees in<br />

Switzerland. The bank bears the expenses of the<br />

pension plans of all its employees as well as their<br />

survivors in accordance with the Swiss social security<br />

law. The benefit obligations as well as the coverage<br />

capital are disincorporated into legally independent<br />