MBR_ISSUE 43_LOWRES

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Malta Business Review<br />

PLATFORM BANKING<br />

PLATFORM BANKING IN THE US:<br />

Positioning to Be at the Center - By Alenka Grealish<br />

How can a bank position itself to be at the center of customer engagement and avoid being squeezed out<br />

by nimble incumbents, digital giants, and fintechs?<br />

KEY RESEARCH QUESTIONS<br />

1 2 3<br />

What is a platform<br />

banking strategy?<br />

What will the<br />

pursuit of a platform<br />

banking strategy<br />

bring in the US?<br />

What could the<br />

platform banking end<br />

game look like?<br />

ABSTRACT<br />

Platform banking as<br />

a business model will<br />

become a force in the<br />

US that will dramatically<br />

change the competitive<br />

landscape. Given the<br />

unique characteristics<br />

of banking, banks will<br />

not follow the platform<br />

strategy playbook of the<br />

digital giants like Apple<br />

and Facebook. Instead,<br />

they will develop and<br />

adopt hybridized versions.<br />

There has been much buzz in Europe about<br />

open banking ever since open application<br />

program interfaces (APIs) were mandated.<br />

What of the US, where there is no mandate?<br />

Are there market and/or other forces which<br />

will drive banks toward a platform strategy,<br />

one broader than open APIs? The resounding<br />

answer is yes.<br />

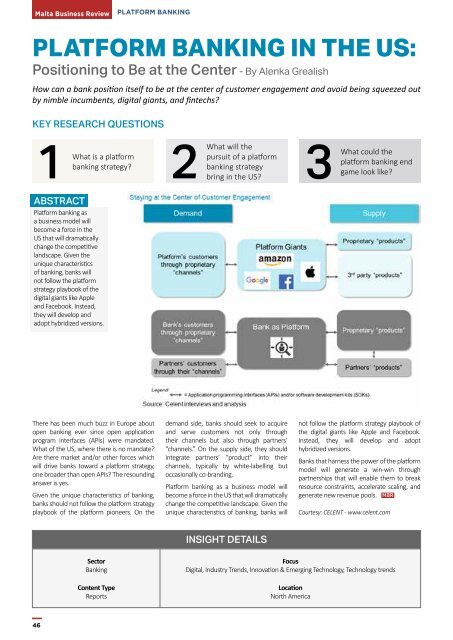

Given the unique characteristics of banking,<br />

banks should not follow the platform strategy<br />

playbook of the platform pioneers. On the<br />

demand side, banks should seek to acquire<br />

and serve customers not only through<br />

their channels but also through partners’<br />

“channels.” On the supply side, they should<br />

integrate partners’ “product” into their<br />

channels, typically by white-labelling but<br />

occasionally co-branding.<br />

Platform banking as a business model will<br />

become a force in the US that will dramatically<br />

change the competitive landscape. Given the<br />

unique characteristics of banking, banks will<br />

not follow the platform strategy playbook of<br />

the digital giants like Apple and Facebook.<br />

Instead, they will develop and adopt<br />

hybridized versions.<br />

Banks that harness the power of the platform<br />

model will generate a win-win through<br />

partnerships that will enable them to break<br />

resource constraints, accelerate scaling, and<br />

generate new revenue pools. <strong>MBR</strong><br />

Courtesy: CELENT - www.celent.com<br />

INSIGHT DETAILS<br />

Sector<br />

Banking<br />

Content Type<br />

Reports<br />

Focus<br />

Digital, Industry Trends, Innovation & Emerging Technology, Technology trends<br />

Location<br />

North America<br />

46