BusinessDay 22 Aug 2018

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Wednesday <strong>22</strong> <strong>Aug</strong>ust <strong>2018</strong><br />

gas<br />

Brief<br />

Egypt:<br />

Egypt to export gas starting<br />

January, says minister<br />

Egypt’s petroleum<br />

minister, Tarek El<br />

Molla, said that<br />

the country would<br />

begin exporting natural<br />

gas in January 2019 adding<br />

that the country would halt<br />

gas imports in October this<br />

year.<br />

“It will be the beginning<br />

of gas self-sufficiency, and<br />

we will begin exporting the<br />

surplus in January 2019,”<br />

he said. He gave no further<br />

details.<br />

Egypt aims to be a regional<br />

hub for the trade of<br />

liquefied natural gas (LNG)<br />

after a string of major discoveries<br />

in recent years including<br />

the giant Zohr offshore<br />

gas field which holds<br />

an estimated 30 trillion cubic<br />

feet of gas.<br />

Egypt is one of the biggest<br />

energy markets in the<br />

Africa with a relatively extensive<br />

energy infrastructure,<br />

especially for natural<br />

gas. In 2015, Egypt became<br />

a net gas importer after being<br />

a key North African gas<br />

exporter for a period of ten<br />

years. This unfortunate, but<br />

not unexpected, situation<br />

was the result of a decline<br />

in Egypt’s indigenous natu-<br />

ral gas production combined<br />

with a rapidly rising<br />

domestic gas demand<br />

driven mainly by large energy<br />

price subsidies. Major<br />

changes are presently taking<br />

place on the gas supply<br />

side which are significantly<br />

impacting on the country’s<br />

natural gas balance and the<br />

economy in general.<br />

Given the dominant<br />

position of natural gas in<br />

Egypt’s energy scene, the<br />

government needed to take<br />

urgent and drastic action to<br />

unlock Egypt’s gas supply<br />

potential.<br />

In 2013/2014, it started<br />

implementing a more favourable<br />

upstream development<br />

policy to reverse<br />

the country’s declining gas<br />

supply profile. New policy<br />

measures helped bring<br />

about the discovery of the<br />

Zohr field in 2015 and its<br />

fast-track development,<br />

and other gas discoveries<br />

(West Nile Delta, Greater<br />

Nooros, and Atoll) were<br />

made in recent years. Future<br />

supplies from all the<br />

newly discovered fields are<br />

expected to produce the<br />

equivalent of Egypt’s present<br />

natural gas output.<br />

C002D5556<br />

BUSINESS DAY<br />

03<br />

WEST AFRICA<br />

ENERGY intelligence<br />

NLNG Train 7 to increase FDI in Nigeria<br />

The Managing<br />

Director and<br />

Chief Executive<br />

Officer of<br />

Nigeria LNG<br />

Limited (NLNG), Tony Attah,<br />

said NLNG’s planned<br />

Train 7 Project, which will<br />

increase production output<br />

of its plant from <strong>22</strong> Million<br />

Tonnes Per Annum<br />

(MTPA) to 30 MTPA, will<br />

lift Foreign Direct Investment<br />

(FDI) in the country.<br />

He said this during the visit<br />

of the Honourable Minister<br />

of Finance, Kemi Adeosun,<br />

to the NLNG’s plant<br />

complex on Bonny Island,<br />

Rivers State.<br />

Briefing the Minister<br />

on NLNG’s operations and<br />

business, Attah said NLNG<br />

will be seeking an estimation<br />

of $7 billion from the<br />

global international markets<br />

to cover the construction<br />

of Train 7) (and investment<br />

in the upstream<br />

gas sector in Nigeria that<br />

will ensure the sustainability<br />

of feedgas supply to its<br />

existing trains (Trains 1 to<br />

6) and the new Train 7.<br />

“We are committed to<br />

our expansion goals of<br />

building an additional production<br />

train to our plant.<br />

We believe this will ensure<br />

our country becomes<br />

a country that has been<br />

able to unleash its gas po-<br />

tentials and one that is in<br />

a transitional state from<br />

an oil-based economy to<br />

a gas-based economy. We<br />

also hope that Train 7 will<br />

change the country’s revenue<br />

and foreign investment<br />

profile.”<br />

He remarked that only<br />

recently, NLNG commemorated<br />

the repayment of a<br />

$5.45 billion Shareholder<br />

loan. The consolidated<br />

loan contributed towards<br />

funding the Base Project,<br />

Expansion Project, NLNG<br />

Plus Project and Train<br />

6. The final repayment,<br />

which is a milestone for<br />

NLNG and Nigeria, sends<br />

a strong message to the<br />

world that Nigeria is ready<br />

for more foreign investments.<br />

He added that the economic<br />

impact of increased<br />

LNG production output<br />

will be significant, stating<br />

that since the start of<br />

our operations 19 years<br />

ago, NLNG has generated<br />

more than $90 billion in<br />

revenue and has paid over<br />

$16 billion dividends to the<br />

Global LNG:<br />

Prices edge up as focus switches to winter storage<br />

Asian liquefied<br />

natural gas (LNG)<br />

spot prices edged<br />

higher as attention<br />

shifted to cargoes for<br />

winter storage, though few<br />

shipments changed hands.<br />

LNG cargo prices for<br />

delivery in October LNG-<br />

AS were about $11.10 per<br />

million British thermal<br />

units (Btu), up from $11.<br />

September cargoes were<br />

still being sold, with prices<br />

assessed at $10.20 to<br />

$10.30 per mmBtu, up 20-<br />

30 cents.<br />

A prolonged heatwave<br />

through large areas of China<br />

and in Japan over the<br />

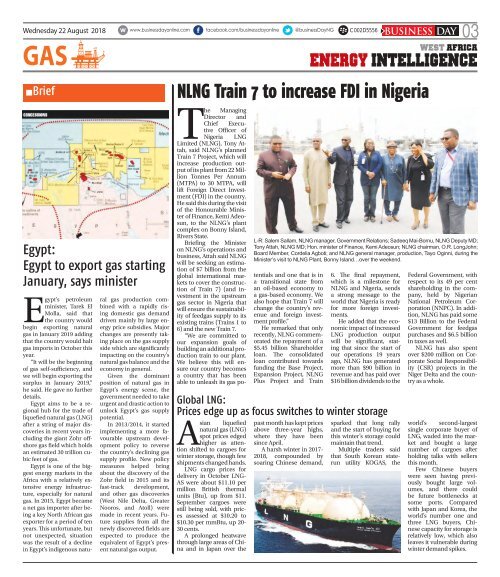

L-R: Salem Sallam, NLNG manager, Government Relations; Sadeeq Mai-Bornu, NLNG Deputy MD;<br />

Tony Attah, NLNG MD; Hon. minister of Finance, Kemi Adeosun; NLNG chairman, O.R. LongJohn;<br />

Board Member, Cordelia Agboti; and NLNG general manager, production, Tayo Oginni, during the<br />

Minister’s visit to NLNG Plant, Bonny Island…over the weekend.<br />

past month has kept prices<br />

above three-year highs,<br />

where they have been<br />

since April.<br />

A harsh winter in 2017-<br />

<strong>2018</strong>, compounded by<br />

soaring Chinese demand,<br />

sparked that long rally<br />

and the start of buying for<br />

this winter’s storage could<br />

maintain that trend.<br />

Multiple traders said<br />

that South Korean staterun<br />

utility KOGAS, the<br />

Federal Government, with<br />

respect to its 49 per cent<br />

shareholding in the company,<br />

held by Nigerian<br />

National Petroleum Corporation<br />

(NNPC). In addition,<br />

NLNG has paid some<br />

$13 Billion to the Federal<br />

Government for feedgas<br />

purchases and $6.5 billion<br />

in taxes as well.<br />

NLNG has also spent<br />

over $200 million on Corporate<br />

Social Responsibility<br />

(CSR) projects in the<br />

Niger Delta and the country<br />

as a whole.<br />

world’s second-largest<br />

single corporate buyer of<br />

LNG, waded into the market<br />

and bought a large<br />

number of cargoes after<br />

holding talks with sellers<br />

this month.<br />

Few Chinese buyers<br />

were seen having previously<br />

bought large volumes,<br />

and there could<br />

be future bottlenecks at<br />

some ports. Compared<br />

with Japan and Korea, the<br />

world’s number one and<br />

three LNG buyers, Chinese<br />

capacity for storage is<br />

relatively low, which also<br />

leaves it vulnerable during<br />

winter demand spikes.