May-June-issue

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Financial Reporting and Assurance<br />

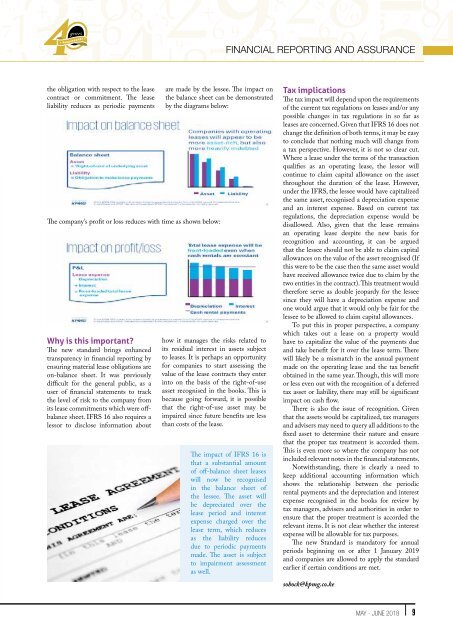

the obligation with respect to the lease<br />

contract or commitment. The lease<br />

liability reduces as periodic payments<br />

are made by the lessee. The impact on<br />

the balance sheet can be demonstrated<br />

by the diagrams below:<br />

The company’s profit or loss reduces with time as shown below:<br />

Why is this important?<br />

The new standard brings enhanced<br />

transparency in financial reporting by<br />

ensuring material lease obligations are<br />

on-balance sheet. It was previously<br />

difficult for the general public, as a<br />

user of financial statements to track<br />

the level of risk to the company from<br />

its lease commitments which were offbalance<br />

sheet. IFRS 16 also requires a<br />

lessor to disclose information about<br />

how it manages the risks related to<br />

its residual interest in assets subject<br />

to leases. It is perhaps an opportunity<br />

for companies to start assessing the<br />

value of the lease contracts they enter<br />

into on the basis of the right-of-use<br />

asset recognised in the books. This is<br />

because going forward, it is possible<br />

that the right-of-use asset may be<br />

impaired since future benefits are less<br />

than costs of the lease.<br />

The impact of IFRS 16 is<br />

that a substantial amount<br />

of off-balance sheet leases<br />

will now be recognised<br />

in the balance sheet of<br />

the lessee. The asset will<br />

be depreciated over the<br />

lease period and interest<br />

expense charged over the<br />

lease term, which reduces<br />

as the liability reduces<br />

due to periodic payments<br />

made. The asset is subject<br />

to impairment assessment<br />

as well.<br />

Tax implications<br />

The tax impact will depend upon the requirements<br />

of the current tax regulations on leases and/or any<br />

possible changes in tax regulations in so far as<br />

leases are concerned. Given that IFRS 16 does not<br />

change the definition of both terms, it may be easy<br />

to conclude that nothing much will change from<br />

a tax perspective. However, it is not so clear cut.<br />

Where a lease under the terms of the transaction<br />

qualifies as an operating lease, the lessor will<br />

continue to claim capital allowance on the asset<br />

throughout the duration of the lease. However,<br />

under the IFRS, the lessee would have capitalized<br />

the same asset, recognised a depreciation expense<br />

and an interest expense. Based on current tax<br />

regulations, the depreciation expense would be<br />

disallowed. Also, given that the lease remains<br />

an operating lease despite the new basis for<br />

recognition and accounting, it can be argued<br />

that the lessee should not be able to claim capital<br />

allowances on the value of the asset recognised (If<br />

this were to be the case then the same asset would<br />

have received allowance twice due to claim by the<br />

two entities in the contract). This treatment would<br />

therefore serve as double jeopardy for the lessee<br />

since they will have a depreciation expense and<br />

one would argue that it would only be fair for the<br />

lessee to be allowed to claim capital allowances.<br />

To put this in proper perspective, a company<br />

which takes out a lease on a property would<br />

have to capitalize the value of the payments due<br />

and take benefit for it over the lease term. There<br />

will likely be a mismatch in the annual payment<br />

made on the operating lease and the tax benefit<br />

obtained in the same year. Though, this will more<br />

or less even out with the recognition of a deferred<br />

tax asset or liability, there may still be significant<br />

impact on cash flow.<br />

There is also the <strong>issue</strong> of recognition. Given<br />

that the assets would be capitalized, tax managers<br />

and advisers may need to query all additions to the<br />

fixed asset to determine their nature and ensure<br />

that the proper tax treatment is accorded them.<br />

This is even more so where the company has not<br />

included relevant notes in the financial statements.<br />

Notwithstanding, there is clearly a need to<br />

keep additional accounting information which<br />

shows the relationship between the periodic<br />

rental payments and the depreciation and interest<br />

expense recognised in the books for review by<br />

tax managers, advisers and authorities in order to<br />

ensure that the proper treatment is accorded the<br />

relevant items. It is not clear whether the interest<br />

expense will be allowable for tax purposes.<br />

The new Standard is mandatory for annual<br />

periods beginning on or after 1 January 2019<br />

and companies are allowed to apply the standard<br />

earlier if certain conditions are met.<br />

sobock@kpmg.co.ke<br />

MAY - JUNE 2018 9