May-June-issue

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

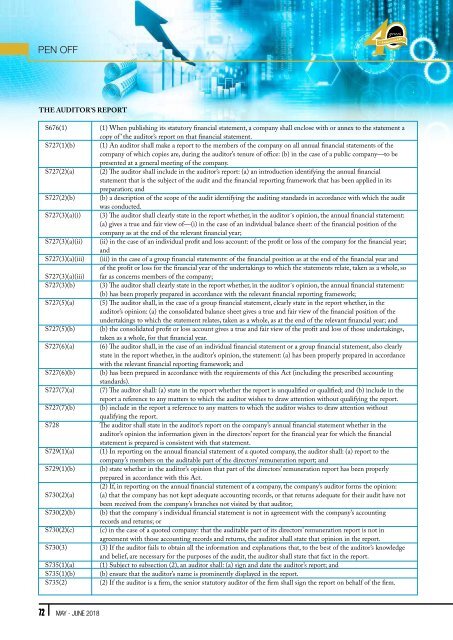

pEN OFF<br />

THE AUDITOR’S REPORT<br />

S676(1)<br />

S727(1)(b)<br />

S727(2)(a)<br />

S727(2)(b)<br />

S727(3)(a)(i)<br />

S727(3)(a)(ii)<br />

S727(3)(a)(iii)<br />

S727(3)(a)(iii)<br />

S727(3)(b)<br />

S727(5)(a)<br />

S727(5)(b)<br />

S727(6)(a)<br />

S727(6)(b)<br />

S727(7)(a)<br />

S727(7)(b)<br />

S728<br />

S729(1)(a)<br />

S729(1)(b)<br />

S730(2)(a)<br />

S730(2)(b)<br />

S730(2)(c)<br />

S730(3)<br />

S735(1)(a)<br />

S735(1)(b)<br />

S735(2)<br />

(1) When publishing its statutory financial statement, a company shall enclose with or annex to the statement a<br />

copy of ’ the auditor’s report on that financial statement.<br />

(1) An auditor shall make a report to the members of the company on all annual financial statements of the<br />

company of which copies are, during the auditor’s tenure of office: (b) in the case of a public company—to be<br />

presented at a general meeting of the company.<br />

(2) The auditor shall include in the auditor’s report: (a) an introduction identifying the annual financial<br />

statement that is the subject of the audit and the financial reporting framework that has been applied in its<br />

preparation; and<br />

(b) a description of the scope of the audit identifying the auditing standards in accordance with which the audit<br />

was conducted.<br />

(3) The auditor shall clearly state in the report whether, in the auditor´s opinion, the annual financial statement:<br />

(a) gives a true and fair view of—(i) in the case of an individual balance sheet: of the financial position of the<br />

company as at the end of the relevant financial year;<br />

(ii) in the case of an individual profit and loss account: of the profit or loss of the company for the financial year;<br />

and<br />

(iii) in the case of a group financial statements: of the financial position as at the end of the financial year and<br />

of the profit or loss for the financial year of the undertakings to which the statements relate, taken as a whole, so<br />

far as concerns members of the company;<br />

(3) The auditor shall clearly state in the report whether, in the auditor´s opinion, the annual financial statement:<br />

(b) has been properly prepared in accordance with the relevant financial reporting framework;<br />

(5) The auditor shall, in the case of a group financial statement, clearly state in the report whether, in the<br />

auditor’s opinion: (a) the consolidated balance sheet gives a true and fair view of the financial position of the<br />

undertakings to which the statement relates, taken as a whole, as at the end of the relevant financial year; and<br />

(b) the consolidated profit or loss account gives a true and fair view of the profit and loss of those undertakings,<br />

taken as a whole, for that financial year.<br />

(6) The auditor shall, in the case of an individual financial statement or a group financial statement, also clearly<br />

state in the report whether, in the auditor’s opinion, the statement: (a) has been properly prepared in accordance<br />

with the relevant financial reporting framework; and<br />

(b) has been prepared in accordance with the requirements of this Act (including the prescribed accounting<br />

standards).<br />

(7) The auditor shall: (a) state in the report whether the report is unqualified or qualified; and (b) include in the<br />

report a reference to any matters to which the auditor wishes to draw attention without qualifying the report.<br />

(b) include in the report a reference to any matters to which the auditor wishes to draw attention without<br />

qualifying the report.<br />

The auditor shall state in the auditor’s report on the company’s annual financial statement whether in the<br />

auditor’s opinion the information given in the directors’ report for the financial year for which the financial<br />

statement is prepared is consistent with that statement.<br />

(1) In reporting on the annual financial statement of a quoted company, the auditor shall: (a) report to the<br />

company’s members on the auditable part of the directors’ remuneration report; and<br />

(b) state whether in the auditor’s opinion that part of the directors’ remuneration report has been properly<br />

prepared in accordance with this Act.<br />

(2) If, in reporting on the annual financial statement of a company, the company’s auditor forms the opinion:<br />

(a) that the company has not kept adequate accounting records, or that returns adequate for their audit have not<br />

been received from the company’s branches not visited by that auditor;<br />

(b) that the company´s individual financial statement is not in agreement with the company’s accounting<br />

records and returns; or<br />

(c) in the case of a quoted company: that the auditable part of its directors’ remuneration report is not in<br />

agreement with those accounting records and returns, the auditor shall state that opinion in the report.<br />

(3) If the auditor fails to obtain all the information and explanations that, to the best of the auditor’s knowledge<br />

and belief, are necessary for the purposes of the audit, the auditor shall state that fact in the report.<br />

(1) Subject to subsection (2), an auditor shall: (a) sign and date the auditor’s report; and<br />

(b) ensure that the auditor’s name is prominently displayed in the report.<br />

(2) If the auditor is a firm, the senior statutory auditor of the firm shall sign the report on behalf of the firm.<br />

72 MAY - JUNE 2018