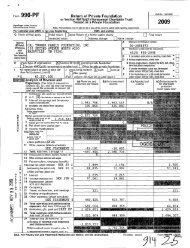

Form 990-PF (2009) Page 2 7 8 9 10a b c 11 12 13 14 15 16 End of year A11aChBd SChedLI1eS and BmOUn1S In the Beglnnlng of yeaf Balance Sheets description column should be for end-of-year amounts only (See instructions) (a) Book Value (b) Book Value (c) Fair Market Value 1 Cash - non-interest-bearing I I I I I I I , I I I I I I I II I 15, 227, 318 5, 531, 098 5,531,098 2 Savings and temporary cash investments I , , , I I , , II I 3 Accounts receivable P ---------------------- II Less" allowance for doubtful accounts P ----------- - II 4 Pledges receivable P ---------------------- - Less allowance for doubtful accounts P ----------- - 5 Gfenle feeelveble . . . . . . . . . . . . . . . . . . . .. . 6 Receivables due from officers, directors, trustees, and other 11 1a 19 zo 21 zz i23 24 25 26 27 28 29 30 31 disqualified persons (attach schedule) (see page 16 ofthe instructions) Other notes and loans reoeivable (attach schedule) V - - - - Less allowance for doubtful accounts P ----------- - lnventories for sale or use I I I I I I I I I I I I I I I II I Prepaid expenses and deferred charges , , , , , , , , , ,, , lnvestments - U S and state govemment obligations (attach schedule) , lnvestments - corporate stock (attach schedulefttachment 2 lnvestments - corporate bonds (attach schedule) , , , , , I, , lnvestments and equipment - land, buildings, basis . , . . . . . . . . . . . . . . ... Less accumulated depreciation p (attach schedule) - - - - - - - - - - - - - - - - -- lnvestments - mortgage loans I I I , , , , , I I , , I ,, , lnvestments - other (attach schedule) I I I I I I I I I I II I equipment Land, buildings, basis and . . , . . . - - - . . . . . . . .- Less accumulated depreciation 5 (attach schedule) ------------------ - Other assets (describe D-A-C2150-EPI LN-V55 2t1E-NI*I1*- ULC- - II ) Total assets (to be completed by all filers - see the instructions Also, see page 1, item l) , , , , , , , , , , ,, , Accounts payable and accrued expenses I I I I I I I I II I Grams Patfable . . . . . . . . . . . . . . . . . . . . .. . Defeffed feVeflUe . . . . . . . . . . . . . . . . . . . .. . Loans from officers, directors, trustees, and other disqualified persons I Mortgages and other notes payable (attach schedule) I I I I I Other liabilities (describe P ----------------- -- ) Total Ilabllltles (add lines 17 through 22) . . . . . . . . .. . Foundations that follow SFAS 117, check here DLI and complete lines 24 through 26 and lines 30 and 31. Unrestricted . . . . . . . . . . . . . . . . . . . . . . .. . Temporarily restricted . . . . . . . . . . . . . . . . . .. . Permanently restricted . . . . . . . . . . . . . . . . . .. . Foundations that do not follow SFAS 117, check here and complete lines 27 through 31. P lj Capital stock, trust principal, or current funds I I I I I I II I Paid-in orcapital surplus, or land, bldg,and equipment fund I I I I I Retained earnings, accumulated income, endowment, orother funds , , Total net assets or fund balances (see page 17 of the insifucvonsl . . . . . . . . . . . . . . . . . . . . . . .. . Total llabllltles and net assets/fund balances (see page 17 of the instructions) . . . . . . . . . . . . . . . . . . . .. . 40, 766, 790 54, 973,487 54, 973, 487 41, 650, 504 32,261, 169 32, 261, 169 218,389 453, 149 453,149 97, 863, 001 93,218, 903 93, 218, 903 97,863,001 93,218,903 97,863,001 93,218,903 97,963,001 93,218,903 Analysis of Changes in Net Assets or Fund Balances 1 Total net assets or fund balances at beginning of year - Part ll, column (a), line 30 (must agree with end-of-year figure reported on pnor years return) I I I I II I Enter amount from Part l, line 27a I I I I I I I I I I I I II I Other increases not included inline 2 (itemize) p UNREALIZED APPRECIATION (DisPREc1AT1oNl dannes1,2,and3 II IIII III IIII IIff"ffff """"""""""""""""""""""""""""" " JSA 9E1420 1 000 Decreases not included in line 2 (itemize) p --------------- - Total net assets or fund balances at end of year (line 4 minus line 5)- Part ll, column (Q), line 30 . . . . . 97, 863, 001 -7, 103, 251 2, 459, 153 93, 218, 903 93,218, 903 Form 990-PF (zoos)

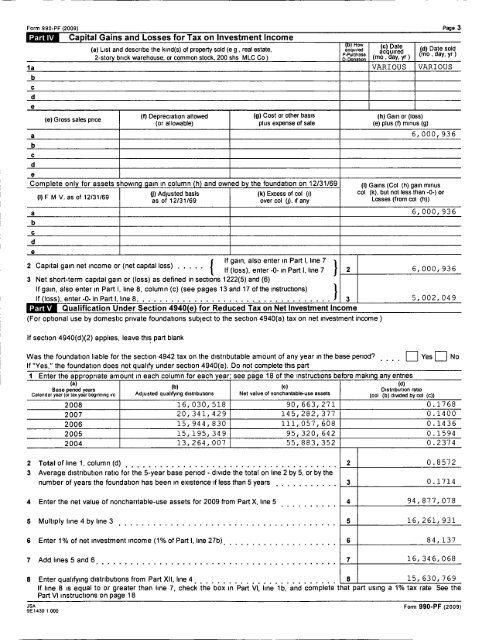

Form 990-PF (zoos) Page 3 Part IV Capital Gains and Losses for Tax on Investment <strong>Income</strong> IFTHOW ( ) Dale (a) List and describe the kind(s) of property sold (e g , real estate, acquired agqulred d) Date sold 2-sie ry brick e war ouse,o n r mm n co si k, zoo o oc sns ivii.c ) co Pf*"""?" (mo . day. vr I gm" " day" Yr) VARIOUS VARIOUS (t) Depreciation allowed (9) C051 Of Other DHSIS (9) Gross sales price (or allowable) plus expense of sale Complete only for assets showing gain in column (Q) and owned by the foundation on 12/31/69 (1) Adlusted basis (k) Excess of col (i) (I) F M V" as M12/31/69 as of 12/31/69 over col (1), if any (h) Gain or (loss) (e) plus (t) minus (g) 6, OOO, 936 (I) Gains (Col (h) gain minus col (k), but not less than -0-) or Losses (from col (h)) 6, 000, 936 If gain, also enter in Part I, line 7 2 Capital gain net income or (net capital loss) """"" ( lf(loss), enter-0- in Partl, line7 1 2 6,000, 936 3 Net short-term (al capital gain or (loss) as defined in sections 1222(5) and ldl (6) If gain, (loss), also enter in -0- Part in I, line Part 8, I, column line (c) 8 . (see . . . pages . . . . 13 . and . . . 17 . . ofthe . . . instructions) . . . . . . . . I. . . . . . .. . 3 5 I 002 , 04 9 Qualification Under Section 4940(e) for Reduced Tax on Net Investment <strong>Income</strong> (For optional use by domestic private foundations subject to the section 4940(a) tax on net investment <strong>Income</strong> ) If section 4940(d)(2) applies, leave this part blank Was the foundation liable for the section 4942 tax on the distributable amount of any year in the base period? I I I I EI Yes lj No If "Yes," Base the foundation does not enod (bi qualify under section 4940(e). ears (cl Do not complete Distrib this part t t 1 Enter the appropriate amount in each column for each yearg see page 18 of the instructions before making any entries Calendar year (gi tax yogi beginning in) Adjusted qualifying distnbutions Net value of nonchantable-use assets (col (D) dlwlaggnbriggl (6)) 2008 16, 030, 518 90, 663, 271 0.1768 2007 20,341,429 145,282,377 1400 2006 15,944,830 111,057,608 1436 2005 15, 195,349 95, 320, 642 1594 2004 13, 264, 007 55, 883, 352 0.2374 2 Total of line 1, column (d) 3 Average distribution ratio for the 5-year base period - divide the total on line 2 by 5, or by the number of years the foundation has been in existence if less than 5 years , 4 Enter the net value of noncharitable-use assets for 2009 from Part X, line 5 I I I I I I I II I 5 Multiply line 4 by line 3 I 6 Enter 1% of net investment income (1% of Part I, line 27b)I 7 Add lines5and6I I I I I . . . . - . . - - - - . . - . . -- . . . . . . . . . . . . . . . . .. . . . - . . . - - . . . . . - . - .. . 0.8572 0.1714 94, 877, 078 16, 261, 931 84, 137 16, 346, 068 8 Enter qualifying distributions from Part XII, line 4 I I I I I I I I I I I I I I I I I I I I I I II I 15, 630,769 If line 8 is equal to or greater than line 7, check the box in Part VI, line 1b, and complete that part using a 1% tax rate See the Part VI instructions on page 18 $224301 000 Form 990-PF (2009)

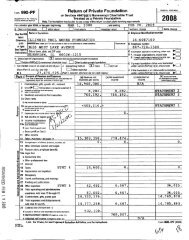

- Page 1: 1 l l ., Form Return or Section o

- Page 5 and 6: W b I c I 2 Form 990-PF (zoos) Pese

- Page 7 and 8: Form 990-PF (2009) Page 7 Part VIII

- Page 9 and 10: Form 990-PF (2009) Page 9 Part XIII

- Page 11 and 12: Form 990-PF (2009) Supplementary In

- Page 13 and 14: Form 990-PF (zoos) Page 13 Informat

- Page 15 and 16: Egg- i scneauies(Furmsao,990-Ez,or9

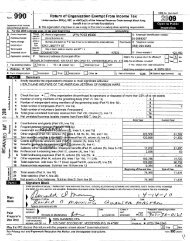

- Page 17: Northwestern Mutual Life Foundation

- Page 80 and 81:

Northwestern Mutual Life Foundation

- Page 82:

-, . , Please summarize the proposa

- Page 85 and 86:

7/1/2009 Check Register Number 2915

- Page 87 and 88:

7/1/2009 Check Register Number Paye

- Page 89 and 90:

7/1/2009 Check Register Number Paye

- Page 91 and 92:

7/1/2009 Check Register Number Paye

- Page 93 and 94:

7/1/2009 Check Register Number Paye

- Page 95 and 96:

Charitable Contributions FY 2010 xl

- Page 97 and 98:

7/14/2009 Check Register Number Pay

- Page 99 and 100:

8/20/2009 Check Register Number 296

- Page 101 and 102:

8/20/2009 Check Register Number 297

- Page 103 and 104:

8/20/2009 Check Register Number Pay

- Page 105 and 106:

8/20/2009 Check Register Number Pay

- Page 107 and 108:

8/20/2009 Check Register Number Pay

- Page 109 and 110:

Charitable Contributions FY 2010.xl

- Page 111 and 112:

10/19/2009 Check Register Number Pa

- Page 113 and 114:

10/19/2009 Check Register Number Pa

- Page 115 and 116:

10/19/2009 Check Register Number Pa

- Page 117 and 118:

Charitable Contributions FY 2010 xl

- Page 119 and 120:

NFO CHECKS WITHOUT CANCELLED CHECKS

- Page 121 and 122:

12/17/2009 Check Register Date Paid

- Page 123 and 124:

12/17/2009 Check Register Number Pa

- Page 125 and 126:

12/17/2009 Check Register Number 30

- Page 127 and 128:

12/16/2009 Check Register Number Pa

- Page 129 and 130:

Charitable Contributions FY 2010 xl

- Page 131 and 132:

1/20/2010 Check Register Number Pay

- Page 133 and 134:

2/19/2010 Check Register Number Pay

- Page 135 and 136:

2/19/2010 Check Register Number Pay

- Page 137 and 138:

2/19/2010 Check Register Number Pay

- Page 139 and 140:

2/19/2010 Check Register Number Pay

- Page 141 and 142:

2/19/2010 Check Register Number 313

- Page 143 and 144:

2/19/2010 Check Register Number Pay

- Page 145 and 146:

2/18/2010 Check Register Number Pay

- Page 147 and 148:

Charitable Contributions FY 2010.xI

- Page 149 and 150:

Charitable Contributions FY 2010 xl

- Page 151 and 152:

5/18/2010 Check Register Number Pay

- Page 153 and 154:

5/7/2010 Check Register Number Paye

- Page 155 and 156:

5/7/2010 Check Register Number Paye

- Page 157 and 158:

5/7/2010 Check Register Number Paye

- Page 159 and 160:

5/7/2010 Check Register Date Paid A

- Page 161 and 162:

5/7/2010 Check Register Number Paye

- Page 163 and 164:

5/7/2010 Check Register Number Paye

- Page 165 and 166:

5/7/2010 Check Register Number Paye

- Page 167 and 168:

NFO CHECKS WITHOUT CANCELLED CHECKS

- Page 169 and 170:

6/11/2010 Check Register Number Pay

- Page 171 and 172:

FY10ApriIMGCheckRegisterpd06 29 1O.

- Page 173 and 174:

FY1OAprilMGCheckRegisterpdO6 29 1O.

- Page 175 and 176:

FY10ApriIMGCheckRegisterpd06 29 10.

- Page 177 and 178:

FY10AprilMGCheckRegisterpdO6 29 1O.

- Page 179 and 180:

6/25/2010 Check Register FY10AprVHC