Income m difi - Charity Blossom

Income m difi - Charity Blossom

Income m difi - Charity Blossom

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

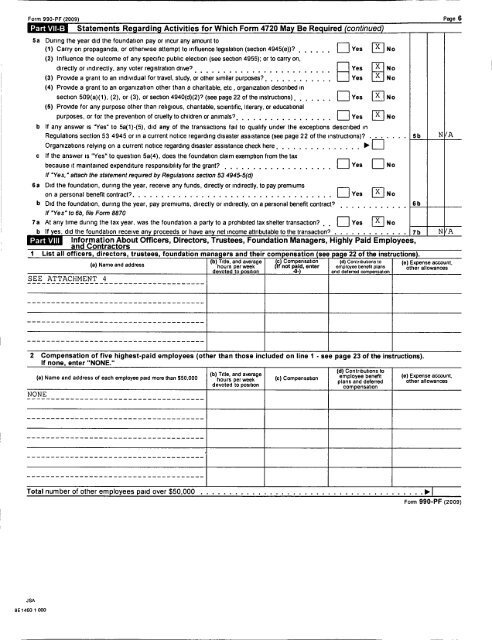

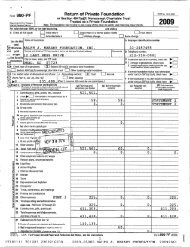

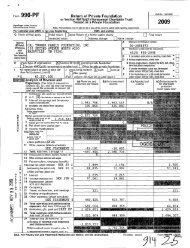

Form 990-PF (2009) Page 6<br />

Statements Regarding Activities for Which Form 4720 May Be Required (continued)<br />

5a During the year did the foundation pay or incur any amount to D<br />

(1) Carry on propaganda, or otherwise attempt to influence legislation (section 4945(e))? I I I II I CI Yes X<br />

(2) Influence the outcome of any specific public election (see section 4955), or to carry on, *<br />

(3) directly Provide a or grant indirectly, to an individual any voter for registration travel, study, drive? or I other I I I similar I I I I I purposes? I I I I I I I I I I I I I II I I E I II Yes I Yes -7-4. L<br />

(4) Provide a grant to an organization other than a charitable, etc , organization described in 1<br />

section 509(a)(1), (2), or (3), or section 4940(d)(2)"7 (see page 22 of the instructions) I I I I II I Cl Yes -X-I<br />

(5) Provide for any purpose other than religious, charitable, scientific, literary. or educational <br />

purposes, or for the prevention of cruelty to children or animals? I I I I I I I I I I I I I I II I lj Yes L<br />

b If any answer is "Yes" to 5a(1)-(5), did any of the transactions fail to qualify under the exceptions described in<br />

Regulations section 53 4945 or in a current notice regarding disaster assistance (see page 22 ofthe instructions)? . . . . . . . 5b N /A<br />

Organizations relying on a current notice regarding disaster assistance check here , , I I I I I I I I I I II I P -c<br />

lf the answer is "Yes" to question 5a(4), does the foundation claim exemption from the tax<br />

because it maintained expenditure responsibility for the grant? I , I I I I I I I I I I I I I I ,, , lj YES<br />

If "Yes, " attach the statement required by Regulations section 53 4945-5(d)<br />

6a Did the foundation, during the year, receive any funds, directly or indirectly, to pay premiums 2<br />

on a personal benent contract? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .. . tj Yes L<br />

b Did the foundation, during the year, pay premiums, directly or indirectly, on a personal benefit contract? I I I I I<br />

lf "Yes" to 6b, tile Form 8870<br />

I 7a At any time during the tax year, was the foundation a party to a prohibited tax shelter transaction? I I lj Yes X<br />

l b If yes, did the foundation receive any-proceeds or have any net income attributable to the transaction? . . . . . . .. . , 75 N/A<br />

Part viii information<br />

and Contractors<br />

About Officers, Directors, Trustees, Foundation Managers, Highly Paid Employees,<br />

1 List all officers, directors, trustees, foundation managers and their compensation (see page 22 of the instructions).<br />

b Ttl , d c Compensation (d)c i bt t g<br />

(3) Name and Hddfess ( )hdu?s aprer 3lYeeerl?ge ((If)not paid, enter em I iagilegelziwiaons P UV (B) P Expense th Ilaccaun<br />

"<br />

devoted to position -0-) and deferred compensation 0 er 8 owances<br />

55ELfUYE%E@@@YE.4 ................... -<br />

2 Compensation of five highest-paid employees (other than those included on line 1 - see page 23 of the instructions).<br />

If none, enter "NONE."<br />

(d) Contributions to<br />

(a) Name and address of each employee paid more than $50,000 how-g pe,-week (c) Compensation plan s an P erred yd def other allowances<br />

99?? ............................... -,<br />

(bl We and ave"-296 em io ee benem lvl Expense account.<br />

devoted to position Compensauon<br />

Total number of other employees paid over $50,000 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .. . . . . . ...vI<br />

JSA<br />

9E1460 1 000<br />

. ll<br />

Form 990-PF (zoos)