Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

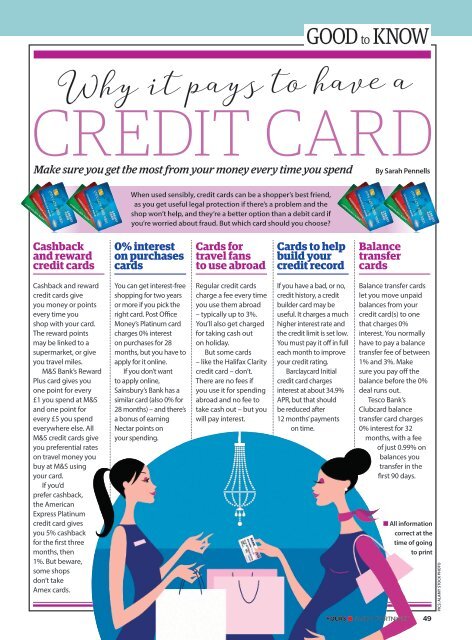

good to know<br />

Why it pays to have a<br />

credit card<br />

Make sure you get the most from your money every time you spend <br />

By Sarah Pennells<br />

When used sensibly, credit cards can be a shopper’s best friend,<br />

as you get useful legal protection if there’s a problem and the<br />

shop won’t help, and they’re a better option than a debit card if<br />

you’re worried about fraud. But which card should you choose?<br />

Cashback<br />

and reward<br />

credit cards<br />

0% interest<br />

on purchases<br />

cards<br />

Cards for<br />

travel fans<br />

to use abroad<br />

Cards to help<br />

build your<br />

credit record<br />

Balance<br />

transfer<br />

cards<br />

Cashback and reward<br />

credit cards give<br />

you money or points<br />

every time you<br />

shop with your card.<br />

The reward points<br />

may be linked to a<br />

supermarket, or give<br />

you travel miles.<br />

M&S Bank’s Reward<br />

Plus card gives you<br />

one point for every<br />

£1 you spend at M&S<br />

and one point for<br />

every £5 you spend<br />

everywhere else. All<br />

M&S credit cards give<br />

you preferential rates<br />

on travel money you<br />

buy at M&S using<br />

your card.<br />

If you’d<br />

prefer cashback,<br />

the American<br />

Express Platinum<br />

credit card gives<br />

you 5% cashback<br />

for the first three<br />

months, then<br />

1%. But beware,<br />

some shops<br />

don’t take<br />

Amex cards.<br />

You can get interest-free<br />

shopping for two years<br />

or more if you pick the<br />

right card. Post Office<br />

Money’s Platinum card<br />

charges 0% interest<br />

on purchases for 28<br />

months, but you have to<br />

apply for it online.<br />

If you don’t want<br />

to apply online,<br />

Sainsbury’s Bank has a<br />

similar card (also 0% for<br />

28 months) – and there’s<br />

a bonus of earning<br />

Nectar points on<br />

your spending.<br />

Regular credit cards<br />

charge a fee every time<br />

you use them abroad<br />

– typically up to 3%.<br />

You’ll also get charged<br />

for taking cash out<br />

on holiday.<br />

But some cards<br />

– like the Halifax Clarity<br />

credit card – don’t.<br />

There are no fees if<br />

you use it for spending<br />

abroad and no fee to<br />

take cash out – but you<br />

will pay interest.<br />

If you have a bad, or no,<br />

credit history, a credit<br />

builder card may be<br />

useful. It charges a much<br />

higher interest rate and<br />

the credit limit is set low.<br />

You must pay it off in full<br />

each month to improve<br />

your credit rating.<br />

Barclaycard Initial<br />

credit card charges<br />

interest at about 34.9%<br />

APR, but that should<br />

be reduced after<br />

12 months’ payments<br />

on time.<br />

Balance transfer cards<br />

let you move unpaid<br />

balances from your<br />

credit card(s) to one<br />

that charges 0%<br />

interest. You normally<br />

have to pay a balance<br />

transfer fee of between<br />

1% and 3%. Make<br />

sure you pay off the<br />

balance before the 0%<br />

deal runs out.<br />

Tesco Bank’s<br />

Clubcard balance<br />

transfer card charges<br />

0% interest for 32<br />

months, with a fee<br />

of just 0.99% on<br />

balances you<br />

transfer in the<br />

first 90 days.<br />

n All information<br />

correct at the<br />

time of going<br />

to print<br />

pics: alamy stock photo<br />

YOURS n EVERY FORTNIGHT<br />

49