MBR ISSUE 44

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

EXECUTIVE LIFESTYLE<br />

Malta Business Review<br />

Blockchain in Action in Corporate Banking<br />

by Alenka Grealish<br />

“And they’re off” is the most succinct way to describe the status of<br />

blockchain-based initiatives in commercial banking. The race to scale<br />

production is on and will be a marathon, not a sprint.<br />

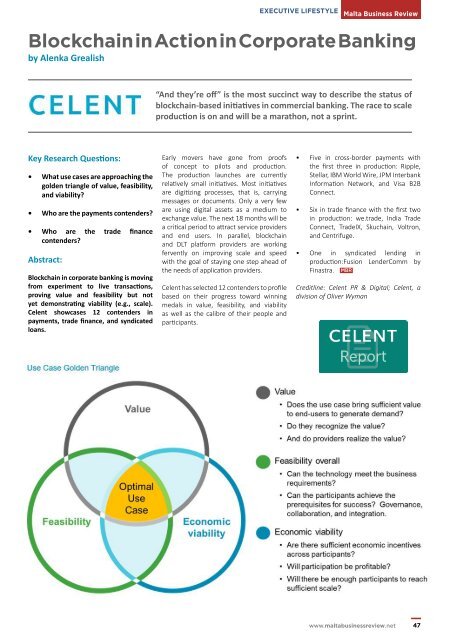

Key Research Questions:<br />

• What use cases are approaching the<br />

golden triangle of value, feasibility,<br />

and viability?<br />

• Who are the payments contenders?<br />

• Who are the trade finance<br />

contenders?<br />

Abstract:<br />

Blockchain in corporate banking is moving<br />

from experiment to live transactions,<br />

proving value and feasibility but not<br />

yet demonstrating viability (e.g., scale).<br />

Celent showcases 12 contenders in<br />

payments, trade finance, and syndicated<br />

loans.<br />

Early movers have gone from proofs<br />

of concept to pilots and production.<br />

The production launches are currently<br />

relatively small initiatives. Most initiatives<br />

are digitizing processes, that is, carrying<br />

messages or documents. Only a very few<br />

are using digital assets as a medium to<br />

exchange value. The next 18 months will be<br />

a critical period to attract service providers<br />

and end users. In parallel, blockchain<br />

and DLT platform providers are working<br />

fervently on improving scale and speed<br />

with the goal of staying one step ahead of<br />

the needs of application providers.<br />

Celent has selected 12 contenders to profile<br />

based on their progress toward winning<br />

medals in value, feasibility, and viability<br />

as well as the calibre of their people and<br />

participants.<br />

• Five in cross-border payments with<br />

the first three in production: Ripple,<br />

Stellar, IBM World Wire, JPM Interbank<br />

Information Network, and Visa B2B<br />

Connect.<br />

• Six in trade finance with the first two<br />

in production: we.trade, India Trade<br />

Connect, TradeIX, Skuchain, Voltron,<br />

and Centrifuge.<br />

• One in syndicated lending in<br />

production:Fusion LenderComm by<br />

Finastra. <strong>MBR</strong><br />

Creditline: Celent PR & Digital; Celent, a<br />

division of Oliver Wyman<br />

www.maltabusinessreview.net<br />

47